Mercantile Bank redirects focus to SME, retail lending

Mercantile Bank PLC used to emphasise corporate lending but now the private commercial lender plans to redirect the focus in order to bring the unbanked people under the financial system by providing more loans to small and medium enterprises, retail and agriculture, said its top executive.

"We extend credit facilities to those who are interested in business but don't have money," said Md Quamrul Islam Chowdhury, managing director and chief executive officer of Mercantile Bank, in an interview with The Daily Star recently.

"Providing banking services to marginalised communities and ensuring smart banking through technological excellence will be our priority."

A group of visionary entrepreneurs set out in 1999 to contribute to the economy of Bangladesh in a sustainable way. Mercantile Bank was set up on June 2 of the same year as part of their vision.

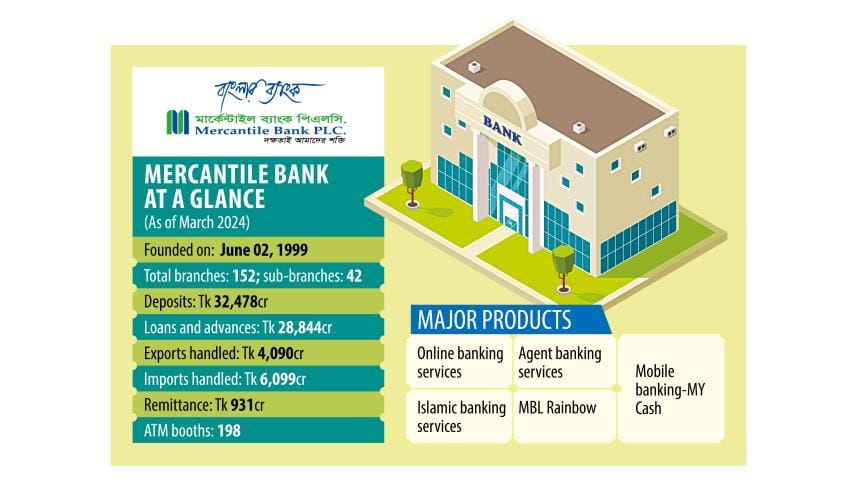

Today, the bank is delivering personalised, technology-driven services through its extensive network, which includes 152 branches, 42 sub-branches, 198 automated teller machines, and 187 agent banking outlets.

Despite facing multiple obstacles, the bank has grown sustainably year on year over the decades and delivered consistent financial performance.

Assets grew 5.19 percent to Tk 40,217 crore at the end of December. In March, deposits totalled Tk 32,478 crore, and loans and advances amounted to Tk 28,844 crore.

"Since its inception, the bank has created a credible brand impression and achieved customers' trust and loyalty," he said.

Chowdhury, who obtained master's degree in marketing from the University of Dhaka, started his banking career at National Bank in 1983 and later joined National Credit and Commerce Bank.

He joined Mercantile Bank in 2001. In the years since he served as the head of the Agrabad branch of Chattogram, the zonal head of the Chattogram region, and chief of the main branch.

Chowdhury was appointed as the managing director in February 2019.

He said from the beginning, the bank has adopted modern technologies to provide quick services to customers.

Mercantile Bank has introduced online, SMS and internet banking and is offering round-the-clock services through ATM booths and contact centres. It has implemented "TEMENOS T24", a world-class technology platform, which ensures real-time integrated banking software.

"We are committed to placing cutting-edge technology at the forefront of delivery channels and operations," the CEO said.

"We will continue our endeavours to strengthen our position in the banking sector by improving the skills of the workforce and striking a balance between risks and profits."

According to Chowdhury, the bank was able to reduce bad loans last year through cash recovery, rescheduling, legal procedures and alternative dispute resolution (ADR).

At the end of 2023, the bank had outstanding loans of Tk 28,341 crore. Of the sum, Tk 1,248 crore defaulted, central bank data showed.

"Thanks to our prudent risk management practice, we contained the non-performing loan ratio to 6.08 percent in December from 7.9 percent a year ago," Chowdhury said.

When asked about compliance and profitability, the noted banker said that the overall financial sector is struggling because of rising default loans, the shortfall in provisions and capital, shrinking profitability, operating inefficiency and weak governance.

He welcomed the central bank initiative aimed at introducing the market-driven interest rate and the flexible exchange rate.

In order to foster financial inclusion and support economic empowerment, the bank in 2016 established the financial inclusion department under the Agriculture Credit Division. The department aims to improve the living standards of marginalised individuals and include them in the formal financial system.

In accordance with the Bangladesh Bank's guidelines, it provides credit facilities through two refinance schemes: a Tk 500 crore scheme for 10/50/100-Taka account holders and a Tk 3,000 crore scheme for Covid-19-affected low-income professionals, farmers, and small business owners.

"We have put in place a network to reach unbanked and under-banked sections of society," Chowdhury said.

The bank is also providing services through three subsidiaries, two offshore banking units, internet banking and mobile banking.

"We remain hopeful of growing our business despite the current uncertain environment," he said. "As the crisis gradually recedes, there will be a greater ease of doing business, and we will forge ahead riding on that."

The private commercial bank received the 23rd ICAB National Award, the Elite Quality Recognition Award-2021 by JP Morgan, and many other recognitions for its unwavering commitment towards customer service, CSR activities and good governance.

"This testifies to our commitment to promoting transparency," Chowdhury added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments