Islamic banks see rise in gross default loan

Bangladesh's Islamic banks recorded an increase in their gross non-performing loan (GNPL) and unclassified rescheduled loan (URSDL) ratio in 2023 from a year ago, reflecting a deterioration of asset quality.

The Shariah-based banks' GNPL rose to 4.8 percent of total investments in 2023 from 4.1 percent a year ago.

Similarly, the URSDL grew 3.4 percentage points to 14.7 percent in the last calendar year in comparison with the previous year, according to the Financial Stability Report 2023 published by the Bangladesh Bank (BB) today.

The ratio of unclassified rescheduled loans in the overall banking sector was 14.5 percent in 2023, which was lower than that of the Islamic banks.

The BB said the asset quality indicators of the Islamic banks, measured by GNPL and NNPL (net NPL) ratios, indicated their better performance compared to the banking industry in both 2022 and 2023.

It said GNPL and NNPL ratios reached 4.8 percent and negative 0.1 percent respectively at the end of December 2023.

However, the GNPL and URSDL ratios of the Islamic banks deteriorated in 2023 compared to those of 2022, the BB report said.

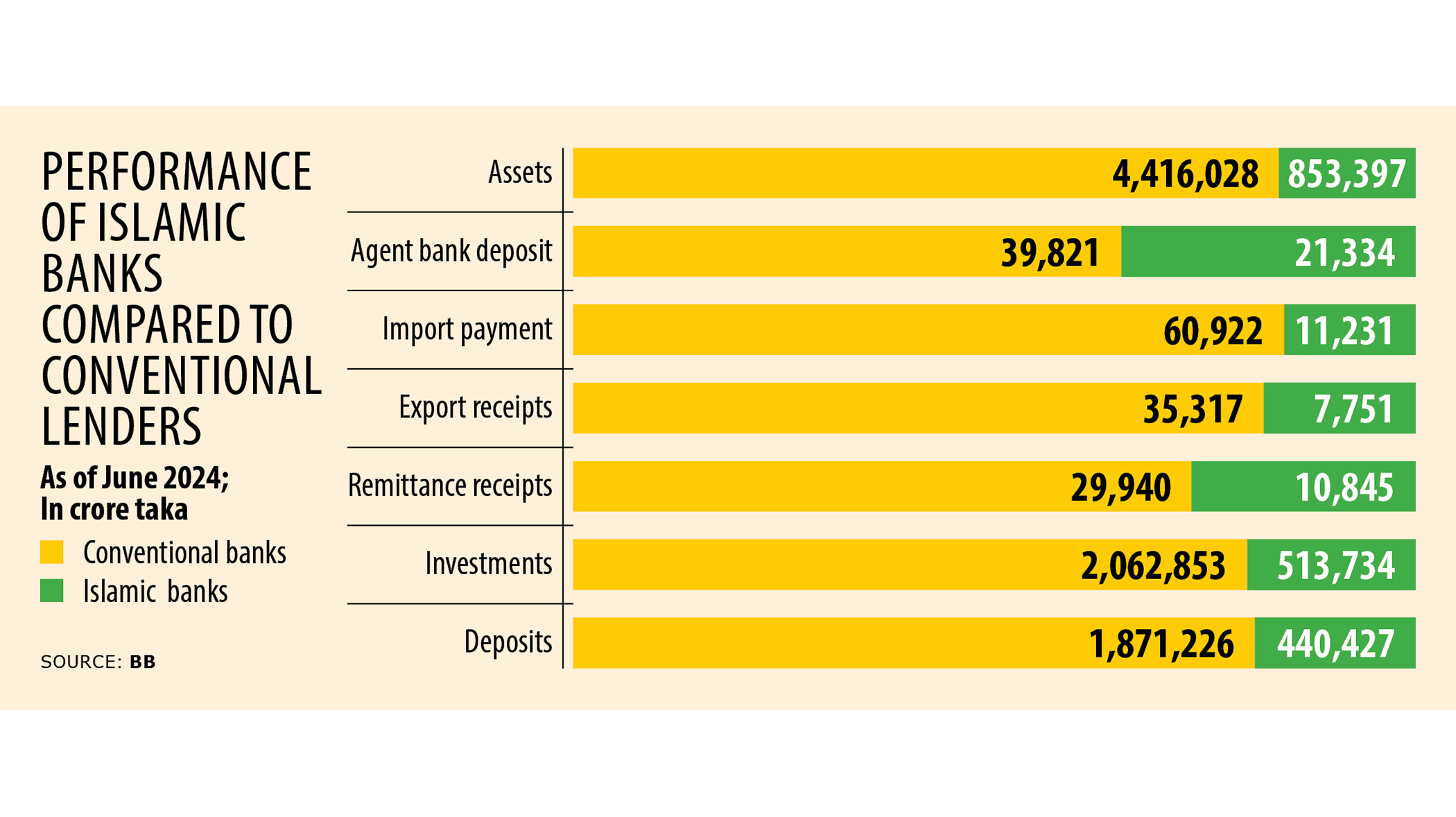

The central bank said Islamic banks in Bangladesh, as a whole, demonstrated better performance in terms of total deposit growth in 2023.

"However, the banks recorded lower growth in total assets, investments (advances), and shareholders' equity," it added.

The BB report said the performance of Islamic banks improved marginally in terms of efficiency indicators in 2023 from the previous year.

"This improvement was mainly attributable to the improvement in return on assets (ROA) and net non-interest income (NNII)."

On the contrary, asset quality, growth, capital adequacy, and liquidity indicators of the Islamic banks declined somewhat at the end of December 2023.

"The increase in nonperforming and rescheduled investment ratios largely led to the deterioration of asset quality while the growth indicator declined due to slower growth of assets, investments, and equity of the Islamic banks during 2023."

The latest Financial Stability Report said except deposits, aggregate investments namely loans and advances, shareholders' equity, and assets of Islamic banks posted a slower growth in 2023 from the previous year.

"As a result, the market share of Islamic banks declined in terms of total investment, assets, and deposits compared to those of the previous year."

For example, the share of Islamic banks in terms of total asset deposits in the banking sector dropped to 21.7 percent of total deposits in 2023 from 22.6 percent a year ago.

Islamic banks' share in total investments or loans fell to 25.9 percent at the end of 2023 from 26.3 percent, the data shows.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments