Investors cheer as stocks soar

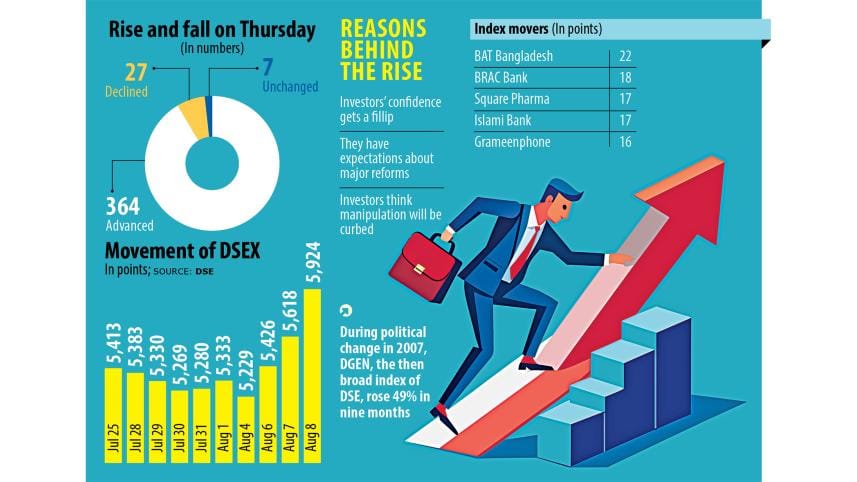

Share prices rallied for a third consecutive session yesterday, with the key index of Dhaka Stock Exchange (DSE) registering a 5.44 percent spike, the highest jump in four and a half years.

With yesterday's jump, the DSEX added 13 percent, or 695 points, in just three days after the fall of Sheikh Hasina's government on August 5 in the face of a mass uprising.

"This rally is a reflection of the investors' upbeat mood," said Mir Ariful Islam, managing director and CEO of Sandhani Asset Management Limited.

"When there is a regime change, expectations run high that the new government will make some structural changes for the benefit of the market," he said.

The three-day gain coincided with the arrival of Nobel laureate Professor Muhammad Yunus, who was later sworn in as the chief of an interim government, ending a three-day power vacuum in what can be considered an unusual development.

Investors said they were happy since shares of healthy companies rose rather than that of companies with poor financials and business prospects, reflecting a lack of presence of manipulators.

This shows that institutional investors, who had been on the sidelines for many years, are now injecting funds into stocks.

Turnover at the DSE, which indicates the volume of shares traded, shot up 107 percent to Tk 1,606 crore yesterday.

"Investors are hopeful, so they are entering the market with fresh funds. They were unhappy year after year seeing the ailing stocks. Now, they are happy to see the dynamism," Islam said.

"I hope the market will remain good as the interim government has been formed with some economists who are being vocal for reforms in the financial sector," he said.

"The reform is necessary and this will send out a good message to institutional investors and foreign investors too," he added.

Yesterday, the DSES index, which represents Shariah-compliant companies, increased by 55 points, or 4.57 percent, to 1,274 points.

Similarly, the DS30 index comprising blue-chip stocks surged by 110 points, or 5.46 percent, to 2,132 points.

British American Tobacco Bangladesh made the biggest contribution with 22 points followed by BRAC Bank with 18 points, Square Pharmaceuticals with 17 points and Islami Bank with 16.7 points, according to LankaBangla Securities.

"Most share prices had reached their lowest due to the lack of investor confidence. So, the recent rise is not ensuring profits for many yet," said Md Sajedul Islam, a former vice president of the DSE Brokers Association of Bangladesh.

"Now, investors are coming to the market only because they regained some confidence, and they think they will not incur loss for manipulation," he added.

Citing how turnover grew even though banking activities were not fully operational and banks were not allowed to withdraw more than Tk 1 lakh, Islam said this indicates that investors injected hefty funds.

"This shows that if investors have confidence and think there will be profit, funds will come to the market. So, it proves that the market only needs confidence. No other support is needed if confidence can be boosted," he said.

"Actually, support is needed for the sick but none wants to invest in a sick market," he added.

Against this backdrop, Islam said the regulator should undertake reform measures in line with the government's overall reform initiative to retain investor confidence.

Shares of companies listed with Chittagong Stock Exchange (CSE) also rose yesterday as the Caspi, the broad index of the port city bourse, increased by 861 points, or 5.40 percent, to 16,799 points.

The market movement was driven by positive changes in the market capitalisation of bank, financial institutions, and food and allied scrips amid negative changes in the market cap of travel and leisure, paper and printing, and jute scrips, Shanta Securities said in its daily market review.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments