International firms to be hired to recover laundered money

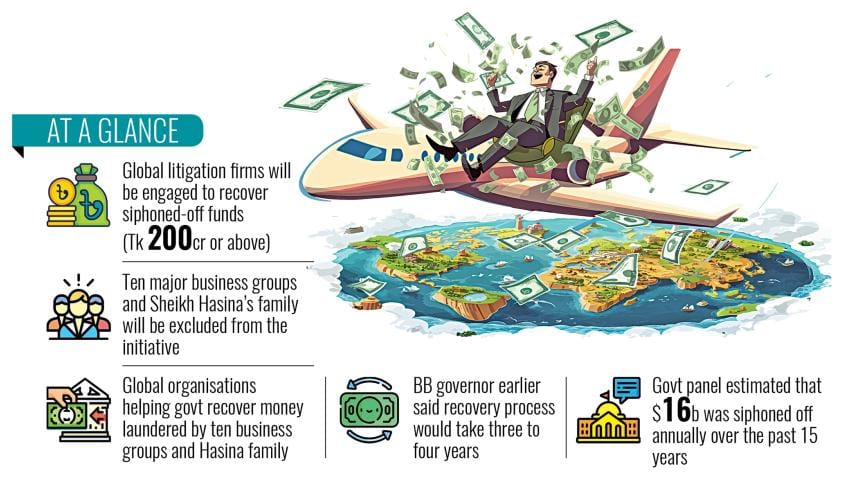

The Bangladesh Financial Intelligence Unit (BFIU) is set to appoint international litigation firms to recover loans worth Tk 200 crore and above that have been laundered abroad from 19 commercial banks.

A meeting between BFIU and managing directors of the banks made the decision on January 30, according to the meeting minutes.

The meeting document shows that the anti-money laundering agency will initially compile a cluster of cases involving Tk 200 crore or more each.

The litigation firms, which are law firms that handle legal disputes, will then assess the cases based on the likelihood of successful recovery.

The firms will receive a certain percentage of the recovered funds as compensation for their services. The process will not require financial involvement from the Bangladesh Bank or any other bank, according to the minutes.

The meeting, presided over by Bangladesh Bank Governor Ahsan H Mansur, included the chief executives or managing directors of Sonali Bank, Janata Bank, Agrani Bank, Rupali Bank, BASIC Bank, Islami Bank, First Security Islami Bank, Social Islami Bank, IFIC Bank, Global Islami Bank, Bangladesh Commerce Bank, United Commercial Bank, City Bank, National Bank, One Bank, Al-Arafah Islami Bank, Bank Asia, Union Bank, and Dhaka Bank.

The BFIU will conduct meetings with other commercial banks in due course.

On February 4, the BFIU directed those 19 banks to submit a list of cases where there is suspicion of Tk 200 crore or more being siphoned off. Banks were also advised to inform the BFIU immediately if any new cases of this nature arise.

Per the meeting minutes, since cases will be filed against individuals or groups with the assistance of litigation firms, it will be essential to coordinate information from all banks.

This means banks must provide necessary documents and evidence to strengthen legal proceedings, especially as litigation firms will only accept cases after verifying all submitted documentation.

Bangladesh Bank Governor Ahsan H Mansur instructed all banks to collect and securely preserve relevant documents and evidence. He also mentioned that banks may follow their own regulations and legal procedures to recover embezzled funds within the country.

However, 10 major business groups and the family members of ousted Prime Minister Sheikh Hasina will be excluded from this initiative, with a separate decision taken previously regarding their cases.

On January 6, the Financial Institutions Division directed the BFIU to form investigation teams comprising members of the Anti-Corruption Commission (ACC), the National Board of Revenue (NBR) and the Criminal Investigation Department (CID) to probe alleged money laundering and financial misconduct in those 11 cases.

The business groups under investigation are S Alam Group, Beximco Group, Summit Group, Bashundhara Group, Gemcon Group, Orion Group, Nabil Group, Nassa Group, Sikder Group and Aramit Group, which is owned by the family of former land minister Saifuzzaman Chowdhury.

International organisations such as the UK-based International Anti-Corruption Coordination Centre, the Stolen Asset Recovery Initiative (StAR), the U.S. Department of Justice, and the International Centre for Asset Recovery are assisting in the recovery of misappropriated funds in these 11 priority cases, as per the meeting minutes.

At a recent press conference, the Bangladesh Bank governor stated that the legal process to recover laundered funds could take three to four years, mentioning that the global standard for such recoveries typically ranges from four to five years.

"Our short-term goal is to identify and attach foreign-held assets within one year. We have also launched major initiatives for asset recovery," Mansur said.

In its white paper on the state of the Bangladesh economy, a government panel estimated that an average of $16 billion had been illicitly siphoned off from the country each year over the past 15 years.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments