Interest payments, subsidies soak up almost half of budget

Interest payments and subsidies have absorbed nearly half of Bangladesh's total budget expenditure in the first seven months of the current fiscal year, underscoring growing fiscal stress and raising concerns over public finances.

Between July and January, total government expenditure stood at Tk 246,583 crore, with Tk 118,046 crore -- roughly 48 percent -- channelled into interest servicing and subsidy payments, according to a January report from the finance ministry.

"This problem is structural," said Professor Mustafizur Rahman, a distinguished fellow at the local think tank Centre for Policy Dialogue (CPD).

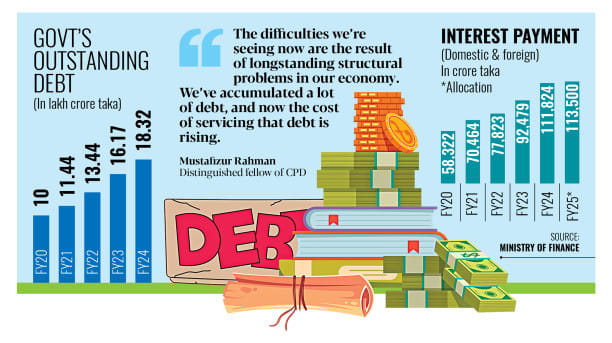

"The difficulties we're seeing now are the result of longstanding structural problems in our economy. We've accumulated a lot of debt, and now the cost of servicing that debt is rising," he said.

Interest payments alone rose 27 percent year-on-year to Tk 75,902 crore in the July-January period.

Although the 2024-25 budget earmarked Tk 113,500 crore for servicing domestic and foreign loans, finance officials now say the figure may need to be revised upward due to rising yields on treasury bills and bonds, higher foreign interest rates, and continued depreciation of the local currency taka.

"At times, we've had overcapitalisation, and because of that, we've had to incur even more debt," Rahman said. "That's why debt servicing costs are increasing now."

Rahman stressed the need for greater prudence in fresh borrowing. "But we can't escape the debt that's already accumulated -- we have to carry that burden. It will have to be managed by future generations," he said.

BALLOONING SUBSIDIES

Subsidies also surged 53 percent year-on-year, reaching Tk 42,144 crore in the first seven months of FY25.

For the full fiscal year, the government had allocated Tk 88,000 crore for subsidies, but that figure is also expected to overshoot initial projections.

In the power sector alone, subsidy allocations are likely to rise from Tk 40,000 crore to as much as Tk 62,000 crore in the revised estimate. Fertiliser and gas subsidies are also set to climb.

"In the case of subsidies, we've had persistent problems with inclusion and exclusion. There hasn't been any meaningful reform or restructuring," said Rahman.

"What we're seeing now in these high percentages is the direct result of that," he added.

Donor agencies have long urged Dhaka to rationalise subsidies, particularly in the electricity sector. But finance ministry officials say reductions have proven difficult due to mounting arrears and sector-specific liabilities.

"Looking ahead, we can act," said Rahman. "For subsidies, we can undertake reforms and restructuring, apply sunset clauses, and take steps to reduce them," said Rahman.

The pressure on the budget has been compounded by a sharp rise in public debt. In fiscal year 2023-24, government debt grew by 13.3 percent year-on-year to Tk 18.3 lakh crore, equivalent to 36.3 percent of the country's gross domestic product.

As a result, rising interest payments are steadily eroding the government's capacity to invest in other areas.

Despite the expanding size of the national budget, set at Tk 797,000 crore for the current fiscal year, revenue mobilisation has remained flat.

The resulting mismatch has left the government increasingly reliant on domestic and external borrowing to meet its obligations, deepening the strain on fiscal space.

PRESSURE ON BUDGET

Development spending is already under pressure. Spending under the Annual Development Programme (ADP) fell to Tk 48,701 crore in the July-January period, compared with Tk 52,488 crore a year earlier.

Development expenditure under the revenue budget also dropped to Tk 1,650 crore from Tk 2,016 crore.

Fiscal analysts say Bangladesh is entering a delicate phase where both expenditure composition and revenue mobilisation must be addressed simultaneously.

"We can't do anything about the past," Rahman said. "But going forward, unless we increase our revenue-to-GDP ratio, we'll fall deeper into this debt trap."

"We must also address the problems with inclusion, exclusion, and targeting through reforms and better implementation efficiency," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments