Inside the 3-year plan to fix banks

Bangladesh has committed to a sweeping overhaul of its troubled financial sector, outlining a detailed three-year roadmap as part of its latest agreement with the International Monetary Fund.

The reform plan, also backed by the World Bank and the Asian Development Bank, is built on a package of legislative, supervisory, and institutional changes designed to restore stability, aggressively pursue bad loans, and protect taxpayers from future bank failures.

Under the plan, Bangladesh will establish a government-wide strategy for the banking sector. This will clarify the roles of Bangladesh Bank and the finance ministry in managing crises and define the conditions for any potential state support for ailing lenders.

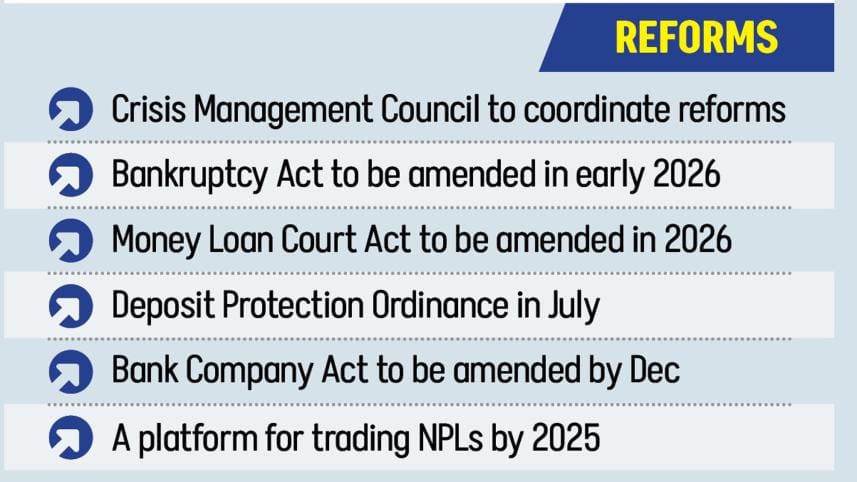

A new Banking Sector Crisis Management Council (BCMC) will be constituted to oversee the process and coordinate responses. The government said the goal is to ensure banks are financially sound and to end the long-standing practice of granting "regulatory forbearance" to weaker institutions.

At the heart of Bangladesh's financial sector reform is a legal overhaul to strengthen recovery mechanisms, modernise insolvency procedures and give regulators the tools needed to intervene decisively in troubled banks.

With non-performing loans and governance lapses weighing on the sector, the reform package represents the strongest policy signal in years. The IMF has linked future disbursements under its $5.5 billion programme to the implementation of these reforms.

LEGAL BLITZ

The government has committed to enacting or amending a series of laws by the first quarter of FY2026, laying the legal foundation for a more resilient financial system:

Bankruptcy Act: A new corporate insolvency framework will be introduced to allow for the early restructuring of viable but distressed companies, aiming to keep them out of lengthy liquidation proceedings and align Bangladesh with international standards.

Money Loan Court Act: The law governing loan recovery will be amended by the first quarter of fiscal 2026 to clear bottlenecks. In the interim, Dhaka has pledged to boost staffing and resources for the courts to tackle case backlogs and enforce verdicts more quickly. The system has long been plagued by understaffing and delays.

Distressed Asset Management Act: This law will create a framework for licensing private asset management companies. This is intended to launch a platform for trading non-performing loans (NPLs), allowing banks to offload bad debts. However, officials have ruled out a state-funded "bad bank", saying they will not use public funds to buy NPLs from private banks.

Bank Resolution Ordinance: Adopted in May 2025, this ordinance grants the central bank powerful tools to resolve failing banks, including special wind-up procedures. It provides a legal shield for regulators, limiting judicial challenges to compensation claims under the principle that no creditor should be worse off than in a liquidation. A resolution handbook has been drafted to make the law operational.

Deposit Protection Ordinance: This law will double the deposit insurance coverage limit to Tk 200,000. It will also allow the new Deposit Protection Fund to provide funding to support bank resolutions, a model known as "Pay Box Plus", backed by an emergency government funding line.

The government is tightening the rules on how banks are run and reversing previous changes that weakened oversight.

As part of the crackdown, Bangladesh Bank has already taken action against 15 poorly-managed private banks since the recent liquidity pressures began. It has replaced the board of directors at 14 banks and completely dissolved the board of another, appointing an administrator to run it. These banks are now under close supervision with new, independent boards.

To increase transparency, the central bank has issued a new rule requiring banks to identify and report who their true owners are. Looking ahead, the government will propose changes to the Bank Company Act by the end of 2025. These changes will ensure that both the real owners and board members of banks are properly qualified and suitable for their roles.

These improvements are not just for private banks. The finance ministry is also strengthening the qualification and selection process for board members at state-owned banks.

Parallel to the legal changes, Bangladesh Bank is directing commercial banks to beef up their own legal departments and adopt new NPL settlement roadmaps. These roadmaps will be updated in FY2026 to reflect revised NPL levels following asset quality reviews.

The government says this legal revamp is essential to maintaining credit discipline and reducing reliance on forbearance or political intervention in loan recovery.

"Strong legal and institutional frameworks for maximising recoveries on distressed loans are essential to maintaining resilient and efficient credit markets," the government said.

ASSET RECOVERY

The government has reconstituted an asset recovery task force led by the central bank, working with the Bangladesh Financial Intelligence Unit, Anti-Corruption Commission and international agencies. The goal is to "freeze, confiscate and recover stolen assets" from banking fraud and corruption, both domestically and globally.

Officials admit the vulnerabilities have "reached macro-relevant proportions, including embezzlement and fraud at banks", and see asset recovery as "a critical part of our broader efforts to promote accountability".

Bangladesh Bank is also establishing an emergency liquidity assistance framework by December 2025. It will include a Shariah-compliant window and protections to ensure any liquidity support is "collateralised and, as appropriate, covered by government indemnities". The authorities pledged to "immediately sterilise any liquidity assistance… to mitigate inflationary pressures."

ASSET QUALITY REVIEWS

The government is undertaking donor-backed asset quality reviews (AQRs) of 18 private banks, representing 35 percent of system assets. The first phase, covering six banks, was completed in May. The remaining 12 are scheduled for review by December 2025. According to the official communication, "the terms of reference have been agreed with the IMF, WB and ADB", and an oversight committee will be in place.

AQRs for state-owned banks are also on the table. The authorities are "considering advising state-owned banks to conduct AQRs by independent consultants by March 2026.

Bangladesh Bank has adopted a risk-based supervision model and completed pilot inspections for 20 banks, covering nearly half of the system assets. It has also instructed banks to revise asset classifications based on a tighter definition of "overdue loans".

A new structure will consolidate the central bank's supervision into single teams per bank by January 2026. Meanwhile, the government has committed to implementing IFRS 9, the global standard for loan loss provisioning, by 2027, with interim prudential buffers in place.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments