Forced bank mergers may be counterproductive: World Bank

The World Bank today said forced bank mergers may be counterproductive without a thorough assessment of asset quality.

"A consolidation process will require careful assessment and prudent implementation of procedures to avoid weakening good banks acquiring bad banks. An assessment of the asset quality of weak banks will be required," it said in its Bangladesh Development Update launched at a press briefing at its Dhaka office.

WB Country Director for Bangladesh and Bhutan Abdoulaye Seck, its Chief Economist for South Asia Region Franziska Ohnsorge, and its Senior Economists Bernard James Haven and Rangeet Ghosh spoke at the occasion.

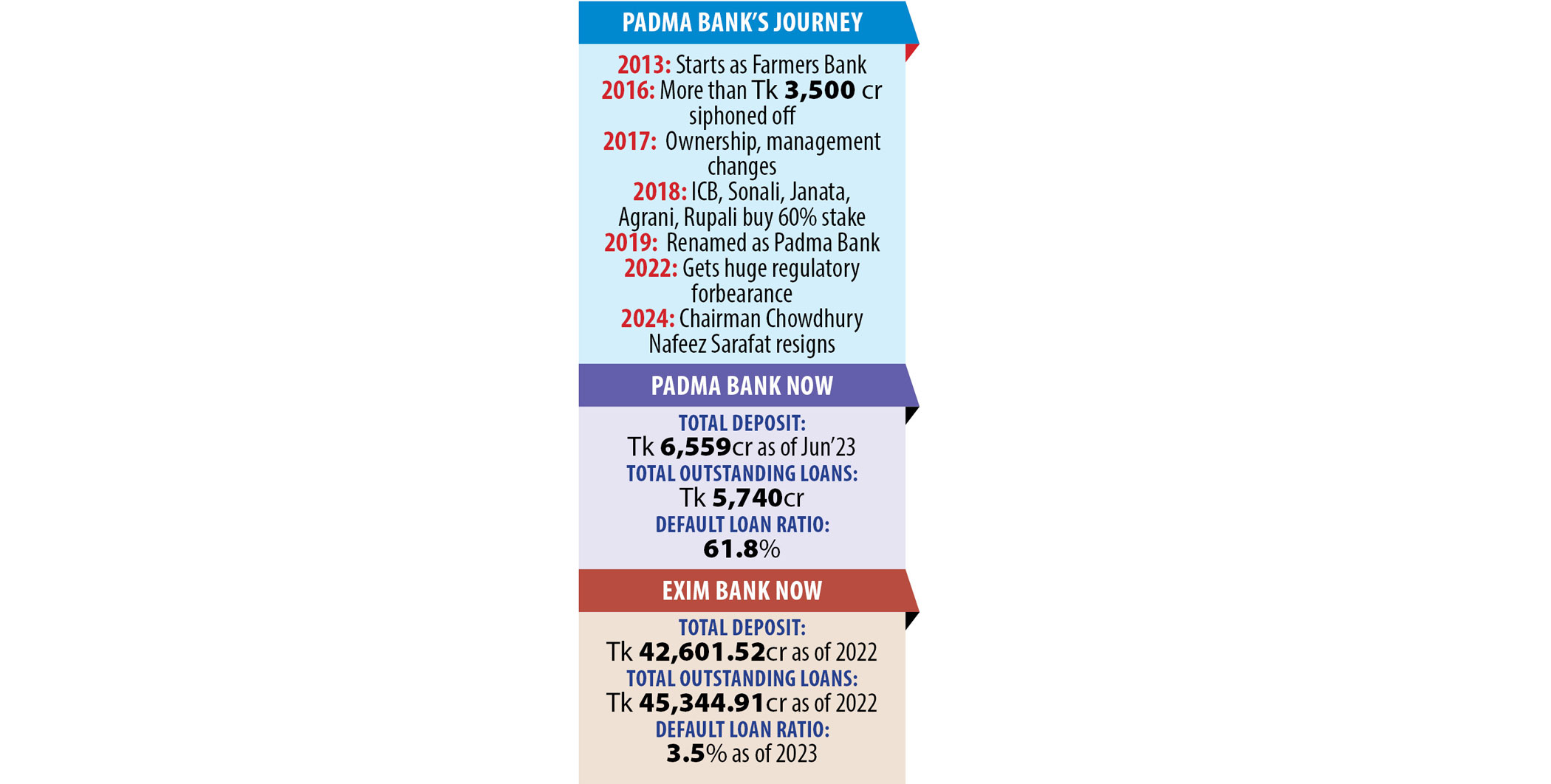

The observation comes weeks after Shariah-based Exim Bank agreed to take over the struggling Padma Bank as part of the Bangladesh Bank's plan to rein in the runaway defaulted loans to a reasonable level and bring good governance to the banking sector.

The WB said before initiating any merger processes, detailed guidelines on mergers and acquisitions need to be issued, allowing banks a clear idea about the process involved.

Such guidelines can be based on international best practices and provide alternative merger mechanisms for banks to choose from depending on the status of the banks/non-bank financial institutions deciding to merge.

Bank mergers will also require an evaluation of internal systems, branch networks, staffing levels, adequacy of management arrangements, impacts on banks' cross-border business, and international risk ratings.

"Given the high prevalence of NPLs and undercapitalised banks, additional tools will likely be required to address vulnerabilities, including strengthening corporate governance, and introducing stronger financial safety nets such as modern least cost resolution tools for insolvent banks, and stronger deposit insurance," the WB said.

"Rapidly implementing bank mergers before addressing these issues may further undermine confidence in the sector, deterring intermediation capacity."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments