Double blow to SMEs: Tight financing and sluggish sales

The ongoing economic and political uncertainty, spiralling bad loans, and eroding trust are depriving many cottage, micro, small, and medium enterprises (CMSMEs) of necessary loans, as they face weaker sales amid high inflation.

Banks are cautious about issuing large loans under the current scenario, while CMSME owners say they are struggling to get the required capital to sustain and grow their businesses, which has led to falling sales.

Bangladesh Bank data show that year-on-year, SME loan disbursement fell to Tk 47,821 crore during the first three months of this year from Tk 53,107 crore in 2024.

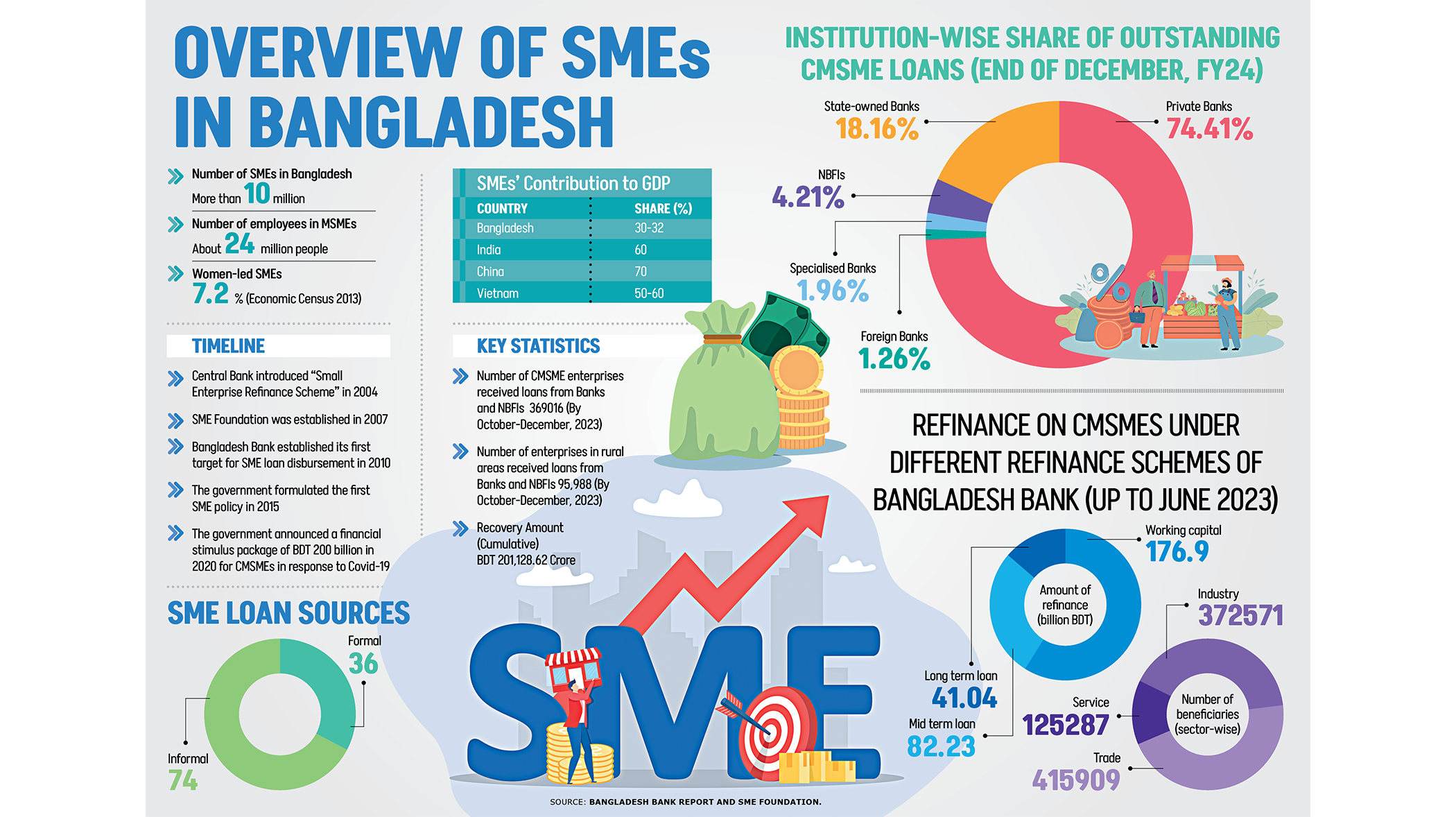

Often described as the backbone of the economy, the country's 78 lakh CMSMEs contribute one-fourth of the gross domestic product.

A 2019 Planning Division report found that small and medium-sized enterprises account for 69.9 percent of total manufacturing value-addition. But without capital backing, industry insiders say, growth is losing momentum.

"Recently, I approached several private commercial banks for a loan of Tk 50 lakh, but they offered only Tk 20-25 lakh," said an entrepreneur

"I'm not getting the amount of financing I require," said Ripon Majumder, a cricket bat and accessories producer from Jashore's Narendrapur.

"Recently, I approached several private commercial banks for a loan of Tk 50 lakh, but they offered only Tk 20-25 lakh," he said, adding that without adequate financing, small loans bring little benefit.

Noting that political instability and inflation have already slashed his sales, Majumder said, "Suppose I sold products worth Tk 100 a month, my current monthly sales would be Tk 60 on average."

"The unstable political climate has also reduced the number of events, a key driver of demand for my products. As a result, my regular buyers have cut back on their orders," he said.

Majumder, who has been in business for 26 years, said uncertainty is making banks hesitant to lend, as they fear repayment delays.

According to the Bangladesh Bureau of Statistics, inflation stood at 8.29 percent in August, down from 8.55 percent a month earlier.

Saleha Begum, a Manipuri saree producer from Sreemangal, described a similar situation. "Recently, I tried to get a loan of just Tk 1 lakh from a private bank, but I haven't received it yet."

She noted that the struggle for finance comes as high inflation is eating away at consumer spending. "I supply sarees to different showrooms, but orders have dropped sharply. Earlier, I sold products worth Tk 2 lakh a month, but now that has fallen to Tk 50,000-60,000."

Banks say the political shift last August has added pressure on the sector as a mammoth amount of toxic loans was uncovered, revealing its fragility.

According to central bank data, Bangladesh's non-performing loan (NPL) amount stands at Tk 4.80 lakh crore. The country has the highest bad loan ratio in Asia, with defaults surging to 20.2 percent of total loans in 2024, according to a recent Asian Development Bank report.

"Many politically influential individuals were connected to CMSMEs, while many buyers left the country or went into hiding after August 5 last year," said Sanjib Kumar Dey, head of SME at Mutual Trust Bank PLC.

"Slower public sector development has also hurt contractors and the entire supply chain, including rod, cement, sand, hardware and paint," he noted.

Private sector consumption has dropped too, Dey added. "Previously, people with undeclared income invested in real estate, but that segment has shrunk, affecting CMSMEs linked to the sector."

He said rising NPLs are also making banks more cautious. "Trust is eroding, forcing banks to heighten scrutiny and adopt conservative lending practices."

Mahbubur Rahman Palash, head of MSME at Dhaka Bank PLC, noted that his bank is not rationing loans arbitrarily. "If a borrower's business performance is weak or their ability to repay is in doubt, loan amounts may be adjusted in line with internal policy."

In the past few months, Dhaka Bank has taken on new CMSME clients across different regions, with credit limits from Tk 5 crore to Tk 30 crore, he said.

Syed Abdul Momen, head of SME banking at BRAC Bank, said, "If a borrower requests Tk 5 lakh, but their financial state doesn't support it, the bank will not approve the loan. It's not arbitrary."

He added that many good clients are avoiding loans altogether in the current uncertain climate. "It's not that we are denying them, but that the demand itself has fallen significantly."

Trade bodies say banks should adopt a more CMSME-friendly approach.

"Many entrepreneurs face barriers in securing loans that match their business realities. The banking system must adopt a more SME-friendly approach, with simplified procedures, collateral-free options, and tailored credit products," he said.

"Strengthening financial inclusion and supporting CMSMEs will not only unlock their growth potential but also create jobs, foster innovation, and ensure sustainable economic progress for Bangladesh," he added.

Melita Mehjabeen, professor at the Institute of Business Administration, University of Dhaka, said CMSMEs face a twofold problem.

"On one hand, banks are reluctant to extend credit, with CMSMEs receiving at most 20 percent of bank loans and just 9 percent of trade finance," she said.

"On the other hand, weak sales and reduced production have made CMSMEs even more vulnerable. Only 28 out of 100 CMSMEs currently have access to formal credit, leaving a financing gap of about $2.8 billion," she added.

The risk-averse stance of banks has left many viable businesses deprived of the support they need. "Unless these financing barriers are addressed, CMSMEs will remain unable to recover and contribute fully to the economy."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments