Cross-platform MFS transfers from Nov

- Bangladesh Bank revives interoperable digital transactions

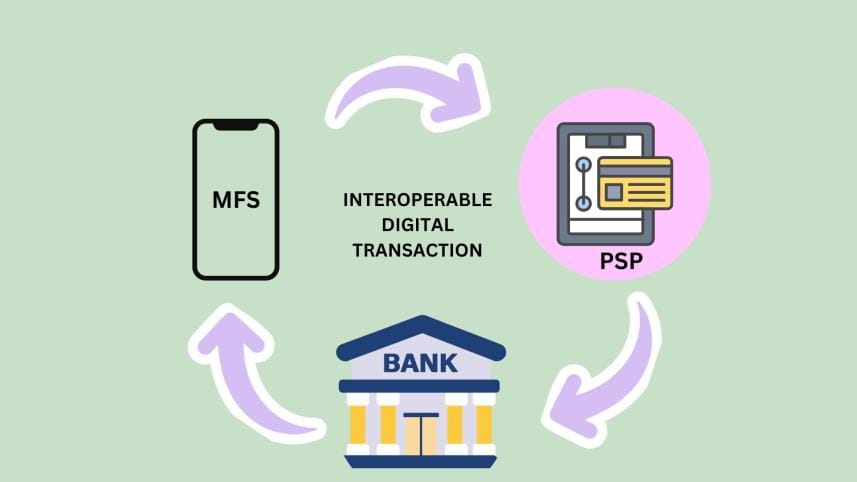

- Transfers allowed across banks, MFS, PSPs

- Transaction fees capped; receivers pay nothing

- New Mojaloop-based platform under development

Transferring money is set to become easier from November as customers will be able to send and withdraw funds between different mobile financial services (MFS) such as bKash, Nagad and Rocket.

They will also be able to transfer money from a mobile financial service account to a bank or a payment service provider (PSP) account.

Regarding this, the Bangladesh Bank (BB) issued a circular yesterday as part of its efforts to promote a cashless economy. The new circular will come into effect from November 1.

According to it, the maximum transaction fees, including value-added tax (VAT), have been fixed at 0.15 percent for banks, 0.20 percent for PSPs, and 0.85 percent for MFS providers.

This means sending Tk 1,000 from an MFS account such as bKash, Rocket or Nagad to another MFS, bank or PSP account will cost Tk 8.50.

A customer sending Tk 1,000 from a bank account to any bank, MFS or PSP will pay Tk 1.50. Transferring the same amount from a PSP account to a bank or MFS will cost Tk 2.

The central bank says service providers must display the applicable charge before a transaction begins, adding that the fee will be collected only from the sender.

According to the circular, no charge can be imposed on the receiver.

The existing transaction limits for each account type will remain unchanged under the new interoperable system.

This latest move by the BB will revive interoperable digital transactions through the National Payment Switch Bangladesh (NPSB), connecting banks, MFS providers and PSPs.

The Bangladesh Bank had first launched such a facility in 2020 through the NPSB, but it was suspended within hours.

Central bank officials said the ICT Division under the previous government ordered the suspension at the time.

Two years later, the ICT Division developed a new interoperable digital platform called "Binimoy" at a cost of Tk 65 crore and instructed the central bank to operate it.

However, the regulator recently scrapped the platform, citing "irregularities and breaches of contract".

"We suspended the services of the platform as we were forced to introduce it," Arief Hossain Khan, executive director and spokesperson of the central bank, told The Daily Star recently.

He said the previous government had handed the Bangladesh Bank a ready-made system and pressed it to sign an agreement without a proper review of its terms.

Industry insiders said Binimoy, which was modelled after India's Unified Payments Interface, failed to attract users due to its poor interface, limited publicity and the reluctance of banks to participate.

Now, despite launching the new interoperable digital transaction system through NPSB from November, the central bank is also preparing to launch a new interoperable digital payment platform.

It is being developed in partnership with Mojaloop, a United States-based open-source initiative supported by the Gates Foundation. Officials said they expect to roll it out later this year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments