Cross-platform MFS rollout misses deadline

The eagerly anticipated interoperable digital transaction facility among mobile financial service (MFS) providers has not launched on schedule, despite an announcement by the central bank that it would go live on November 1.

Industry insiders told The Daily Star that the service could not go live as key MFS operators are not yet ready, while Nagad, one of the country's largest providers, has not been permitted to participate.

In mid-October, Bangladesh Bank issued a circular stating that from November 1, customers would be able to send and withdraw funds between different MFS providers, banks, and payment service providers via the National Payment Switch Bangladesh (NPSB).

NO MAJOR MFS READY

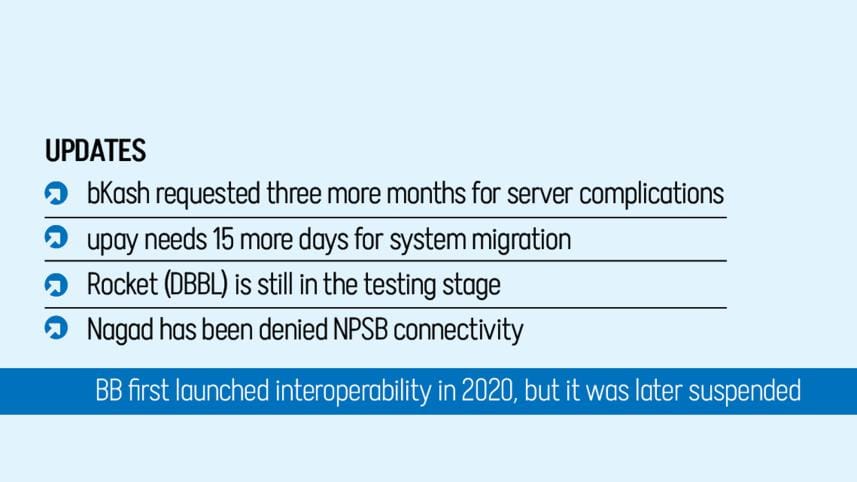

As of yesterday, no major MFS providers were fully prepared to launch the service. Both bKash, the largest MFS provider in the country, and upay, the digital financial service of UCB Fintech Company owned by United Commercial Bank, have sought more time to launch the service. Rocket, Dutch-Bangla Bank Ltd's (DBBL) mobile banking service, is still in the testing phase.

upay has asked Bangladesh Bank (BB) for an additional two weeks.

"We need another 15 days to launch the service due to system migration," said Md Abdullah Al Mamoon, director of UCB Fintech. "We will inform the central bank about our delay soon."

bKash, on the other hand, has requested three more months as it is facing server-related complications, according to a senior official of BB's Payment Systems Department.

Shamsuddin Haider Dalim, bKash's head of corporate communications and PR, said the provider is working with BB to adopt the latest version of the interoperability framework.

"We are emphasising strong authentication and layered security features to enable seamless transactions and handle disputes, if any," he said, adding that the company hopes customers will be able to use the service in full "soon."

Meanwhile, DBBL's Rocket is waiting for the regulator's nod. "We started live testing but are waiting for the central bank's green signal for customer-end use," said a senior official of the bank, seeking anonymity.

Nagad officials said they remain unable to join the interoperable platform as they have not been connected to the NPSB.

To enhance customer service, Nagad applied to the regulatory authority for approval to launch interoperability facilities a couple of months ago, said Muhammad Zahidul Islam, head of Media and Communication at Nagad.

"However, no response has been received yet. As a result, despite being fully prepared, Nagad has not been able to launch the interoperability service."

Another official, seeking anonymity, said, "We are being kept out of this facility for no apparent reason." They questioned how interoperability could be launched while excluding "the second most popular MFS."

BB Executive Director Areif Hossain Khan told The Daily Star that Nagad is excluded because it still does not have an MFS licence.

The BB spokesperson also confirmed that some MFS providers, including bKash, requested the central bank for more time to open the service. But the regulator has "not yet approved the time extension to launch the service."

This is not the first time such a service has failed to launch. BB first launched such a facility in 2020 through the NPSB, but it was suspended within hours. Central bank officials said the ICT Division under the previous government ordered the suspension at the time.

Two years later, the ICT Division developed a new interoperable digital platform called "Binimoy" at a cost of Tk 65 crore and instructed the central bank to operate it. However, the regulator recently scrapped the platform, citing "irregularities and breaches of contract."

Expressing frustration over the latest delay, Rakibul Hasan, an MFS user, said, "We have been hearing since 2020 that this service would be launched, but it still hasn't happened. If the MFS providers are not even ready, then what's the point of making such announcements?"

According to BB's October circular on launching the interoperable service, the maximum transaction fee, including VAT, has been set at 0.15 percent for banks, 0.20 percent for payment service providers (PSPs), and 0.85 percent for MFS providers.

For example, a customer sending Tk 1,000 from an MFS account to another MFS/bank/PSP account would be charged Tk 8.50; a bank account to any bank/MFS/PSP would cost Tk 1.50; and a PSP-to-bank/MFS transfer would cost Tk 2.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments