Dollar holds gains in thin trading as markets await Fed minutes, US GDP

17 February 2026, 12:46 PM

Business

Oil in spotlight as Trump's Iran warning rattles sleepy markets

17 February 2026, 12:41 PM

Business

Thailand economic growth slows year-on-year: govt data

16 February 2026, 16:49 PM

Business

Japan's GDP falls short of expectations

16 February 2026, 16:37 PM

Business

India forced to defend US trade deal as doubts mount

16 February 2026, 12:12 PM

Business

ECB to extend euro backstop to boost currency's global role

15 February 2026, 12:14 PM

Business

The World Trade Organization is on life support. Will Trump’s new rules finish it off?

14 February 2026, 14:18 PM

Business

WTO chief urges China to shift on trade surplus

14 February 2026, 13:51 PM

Business

US consumer inflation eases more than expected to lowest since May

14 February 2026, 12:38 PM

Business

US waives Venezuela oil sanctions as Trump says expects to visit

14 February 2026, 12:35 PM

Business

Dollar holds gains in thin trading as markets await Fed minutes, US GDP

The dollar index , which measures the greenback against a basket of currencies, inched up to 97.12 after a 0.2 percent gain in the previous session

17 February 2026, 12:46 PM

Oil in spotlight as Trump's Iran warning rattles sleepy markets

West Texas Intermediate was up more than one percent, nearing $64 per barrel

17 February 2026, 12:41 PM

Thailand economic growth slows year-on-year: govt data

Exports rose 11.9 percent compared to 4.4 percent in 2024, despite global uncertainty amid a slew of US tariff announcements last year

16 February 2026, 16:49 PM

Japan's GDP falls short of expectations

GDP in the world's fourth-biggest economy expanded by just 0.1 percent in the fourth quarter

16 February 2026, 16:37 PM

India forced to defend US trade deal as doubts mount

The deal announced this month has rattled India's powerful farmers' unions

16 February 2026, 12:12 PM

ECB to extend euro backstop to boost currency's global role

The new facility will extend this to central banks worldwide, as long as they fulfil certain criteria

15 February 2026, 12:14 PM

The World Trade Organization is on life support. Will Trump’s new rules finish it off?

Largely designed to serve its strategic and corporate interests, the US now sees the WTO as a liability

14 February 2026, 14:18 PM

WTO chief urges China to shift on trade surplus

China's trade surplus hit a record $1.2 trillion last year

14 February 2026, 13:51 PM

US consumer inflation eases more than expected to lowest since May

The consumer price index (CPI) rose 2.4 percent year-on-year

14 February 2026, 12:38 PM

US waives Venezuela oil sanctions as Trump says expects to visit

The oil industry has expressed interest in the petroleum-rich country, while cautioning that the timeframe for investment depended on having clear rules after expropriations by earlier governments

14 February 2026, 12:35 PM

Google turns to century-long debt to build AI

The Silicon Valley internet giant reportedly aims to raise about $20 billion overall, a chunk of it by issuing bonds that mature in February of 2126

11 February 2026, 13:45 PM

US retail sales flat in December as consumers pull back

Overall sales were flat on a month-on-month basis at $735 billion

11 February 2026, 12:22 PM

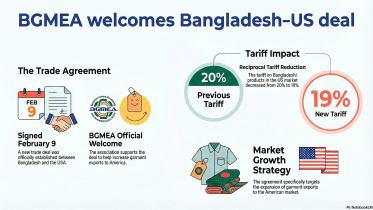

BGMEA welcomes Bangladesh-US trade deal

The association will convene an urgent meeting to determine the next course of action regarding the deal

10 February 2026, 19:19 PM

Oil drifts lower as traders weigh supply risks amid US–Iran tensions

Brent crude oil futures were down 18 cents, or 0.26 percent, at $68.85 a barrel by 0353 GMT

10 February 2026, 11:51 AM

US to lower tariff for Bangladesh from 20% to 19%

The two countries signed a deal moments ago

9 February 2026, 22:53 PM

Forex reserves cross $29 billion this month as per IMF method

It hit $29.47 billion today

9 February 2026, 20:34 PM

Taiwan says 'impossible' to move 40 percent chip capacity to US

Taiwan is a powerhouse in producing chips -- a critical component in the global economy

9 February 2026, 12:41 PM

Gold, silver extend gains on softer dollar

Spot gold rose 1.1 percent to $5,012.76 per ounce by 0502 GMT

9 February 2026, 12:00 PM

Indian refiners avoid Russian oil in push for US trade deal

Indian Oil, Bharat Petroleum and Reliance Industries are not accepting offers from traders for Russian oil loading in March and April

8 February 2026, 14:48 PM

US consumer sentiment rises to six-month high in early Februaryv

The third straight monthly improvement in sentiment reported by the University of Michigan's Surveys of Consumers on FridayThe third straight monthly improvement in sentiment reported by the University of Michigan's Surveys of Consumers on Friday

8 February 2026, 12:54 PM