True extent of bad loans emerges

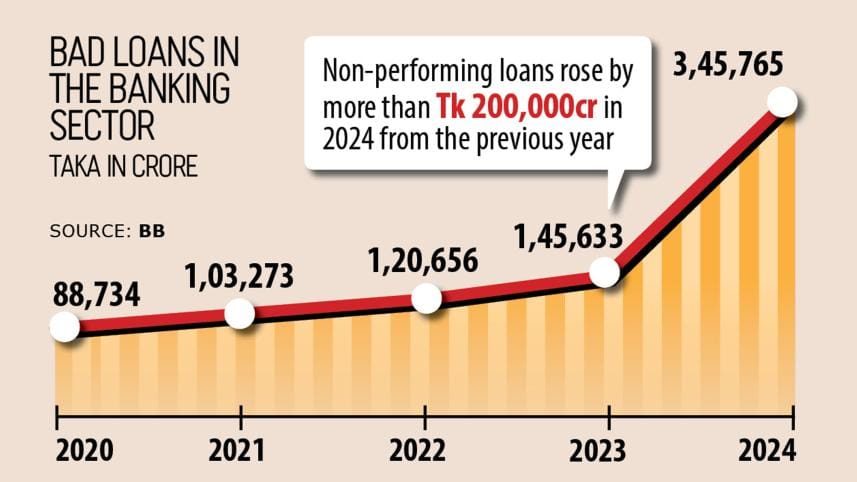

Defaulted loans in the country's banking sector reached a record Tk 3,45,765 crore at the end of 2024 as toxic loans increased sharply following the political changeover in August last year.

At the end of last year, total outstanding loans stood at Tk 17,11,402 crore, 20.20 percent of which have turned sour, according to the latest data from the Bangladesh Bank, which was released through a press conference for the first time.

However, distressed assets -- which include written-off loans, rescheduled loans and loans tied up in the Money Loan Court -- stood at Tk 6,68,598 crore.

At the end of September last year, bad loans stood at Tk 2,82,977 crore. In the following three months, the tally increased by Tk 60,788 crore.

This means defaulted loans increased by a staggering Tk 2,00,132 crore in 2024.

Defaulted loans have increased sharply since the political changeover, as the true picture of the sector, concealed during the Awami League government's 16-year regime, has now come to light, The Daily Star has learnt from bankers.

In a statement, the central bank said that defaulted loans increased due to a decline in new loan disbursements and loan renewals, as well as the rescheduling of the maturity period of term loans by the central bank.

Some loans became defaulted following central bank inspections and the vacating of court-issued stay orders related to loan classification.

Bad loans also increased due to the reclassification of rescheduled loans after non-payment of instalments, the statement added.

The growing trend of bad loans could not be arrested as those loans were concealed under the previous regime but have now come to light, said BB Governor Ahsan H Mansur at the press conference yesterday.

Mansur was appointed the central bank governor on August 13 last year.

Some large borrowers, including S Alam Group and Beximco Group, defaulted heavily after the Awami League's fall, pushing the total to an unprecedented level.

The defaulted loan ratio of state-run banks stood at 42.83 percent, while that of private sector banks was 15.60 percent, BB data showed.

Bad loans have increased sharply in some Shariah-based banks controlled by the controversial business conglomerate S Alam Group and in some other banks where Awami League-affiliated businesses had influence, said central bank officials.

Janata had the highest volume of bad loans in the banking sector at the end of last year: as much as 66.8 percent of the bank's total outstanding loans have turned bad.

Of the Tk 67,300 crore of Janata's defaulted loans, about Tk 23,000 crore is of Beximco's, which were classified in the last quarter of 2024.

S Alam Group is another major defaulter, with its defaulted loans at Janata Bank reaching Tk 10,200 crore. It was followed by AnonTex Group (Tk 7,800 crore) and Crescent Group (Tk 3,800 crore).

Not only have bad loans increased, but loan disbursements also rose sharply during the previous regime.

The focus should now be on recovering the money by selling collateral, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

"We have to learn from previous mistakes and avoid repeating them. There must be a willingness to fix the banking sector as intention is the key factor. For that to happen, long-term reforms are needed," he added.

Ensuring proper loan sanctioning, enforcing single borrower exposure limits, halting loan rescheduling and appointing administrators at troubled banks are necessary for the ailing sector, said Fahmida Khatun, executive director of the Centre for Policy Dialogue, at a recent event.

She also emphasised protecting central bank independence, ending bank bailouts through recapitalisation and a licence freeze for new banks.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments