Stop injecting fresh money into economy

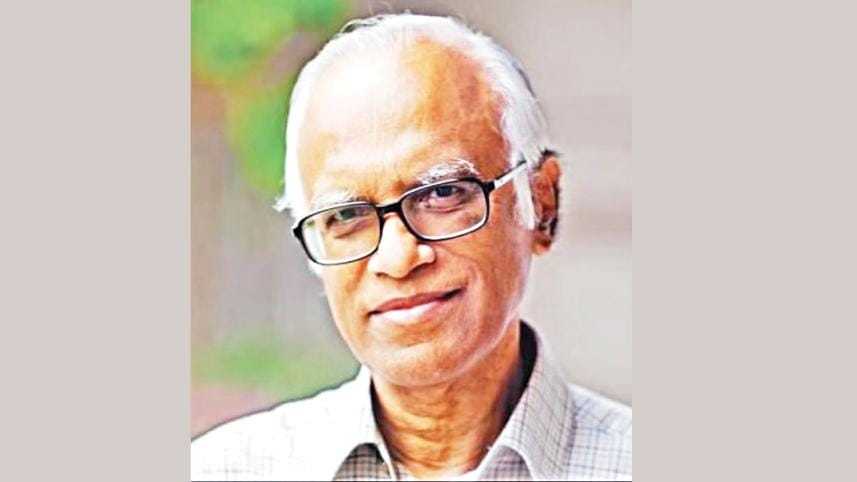

Noted economist Wahiduddin Mahmud yesterday urged the Bangladesh Bank to stop pumping fresh money into the economy in order to rein in runaway inflation and tackle the current economic crisis.

He made the suggestion during a meeting with the central bank governor Abdur Rouf Talukder as the banking regulator started to take opinions from the economists and other stakeholders to ride out the crisis.

Deputy governors Kazi Sayedur Rahman, AKM Sajedur Rahman Khan, Abu Farah Md Nasser and Nurun Nahar, as well as Fatima Yasmin, senior secretary of the Finance Division, and Sheikh Mohammad Salim Ullah, secretary of the Financial Institutions Division, were present in the meeting.

BB Chief Economist Md Habibur Rahman presented a paper about the current situation of the economy.

In the last fiscal year that ended in June, the government took a record Tk 98,000 crore in loans from the Bangladesh Bank to run its operations.

But a significant injection of such funds, known as high-powered money, contributes to stoking inflationary pressure and Bangladesh is already witnessing record inflation because of that.

Average inflation rose 23 basis points to a 12-year high of 9.92 percent in August against the government's full fiscal year target of 6 percent. In July, it stood at 9.2 percent.

"I suggested they stop printing new money because it fuels inflation," Prof Mahmud told The Daily Star last night.

"They informed me that the central bank has stopped printing fresh money."

Instead of taking new loans, the government repaid Tk 3,283 crore to the banking sector in the first two months of the current fiscal year, central bank data showed.

Mahmud, a former adviser to the caretaker government, said the central bank has formulated the monetary policy to contain the rising inflation, facilitate the exchange rate and foreign exchange currency management, and reduce non-performing loans and credit expansion.

"I appreciated the policy stance and commented on some areas. But the policy will have to be transparent and credible. None can be trusted without a credible policy."

According to the former economics professor, cash circulation may increase and there may be additional cash in the hands of people since this is an election year.

"The central bank should mop up the cash if needed."

Prof Mahmud emphasised accelerating the defaulted loan recovery because credit expansion is not possible without realising the bad loans.

He said since the exchange rate is closer to the real exchange rate, it would not be wise to leave the exchange rate completely in the hands of the market.

"This is because if the rate goes up further, it will be difficult to bring it down."

"I suggested the central bank not to look at the kerb market because it is small given the size of the economy. You will have to be strict on the real exchange rate."

"There are more scopes for the taka to depreciate but it will have to be done step by step."

Prof Mahmud told the central bankers that loans given to the businesspeople from the foreign exchange reserves were a big mistake.

"The same mistake can't be repeated in the future."

Prof Mahmud described the external balance as not good, saying it reached near to the average position due to import curbs.

Earlier, after the meeting, BB Spokesperson Md Mezbaul Haque told reporters: "We informed Prof Mahmud about the current economic situation, including inflation, the exchange rate volatility and the growing non-performing loans, and the central bank's policy stance on addressing the challenges."

"Prof Mahmud also discussed inflation management and the governor assured him that if needed, measures will be taken in the upcoming monetary policy."

Apart from economists, the central bank will take opinions from chambers, trade bodies and the Economic Reporters Forum.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments