State banks’ core business in the red

Four state-run commercial banks (SCBs) in Bangladesh are struggling to generate revenue from their core business of lending due to voluminous non-performing loans and the lending rate ceiling.

As a result, they have been forced to bank on the incomes from the investments in bonds and bills to remain afloat.

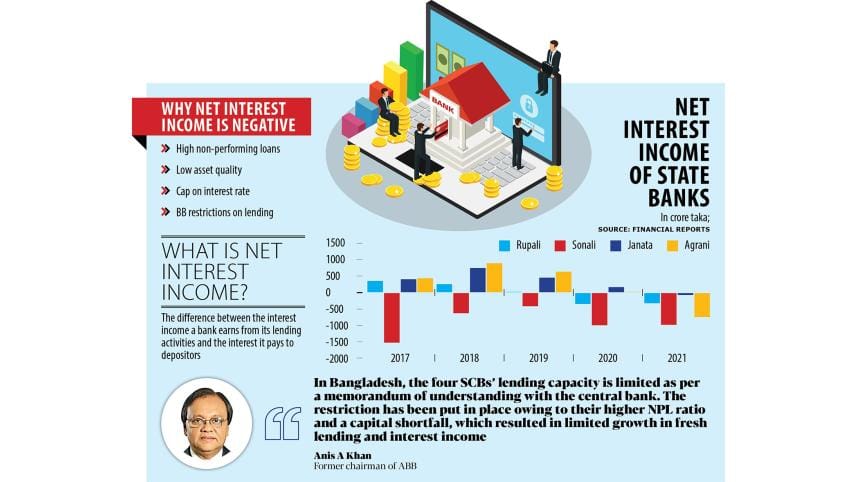

The net interest income is the difference between the earnings made against loans and the interest paid against deposits.

Financial reports showed the net interest income of Sonali Bank, Rupali Bank, and Agrani Bank was negative in 2020 and 2021. Janata Bank's net interest income contracted in 2021.

In Bangladesh, the four SCBs' lending capacity is limited as per a memorandum of understanding with the central bank.

The restriction has been put in place owing to their higher NPL ratio and a capital shortfall, which resulted in limited growth in fresh lending and interest income, said Anis A Khan, a former chairman of the Association of Bankers, Bangladesh, a platform of the managing directors.

Similarly, the state banks have a huge deposit base from the general public and government organisations. And they have to pay a sizeable amount of interest on them. On the other hand, they can't lend at will to generate more revenue.

"The interplay of these two core sides of the balance sheet results in negative interest income," said Khan, also a former managing director of Mutual Trust Bank.

Sonali's net interest income situation was in the worst position as the country's biggest bank has been in red since at least 2017. In 2021, the net interest income reached Tk 979 crore in negative. It was Tk 994 crore in negative in the previous year.

Agrani Bank's interest income was Tk 744 crore in negative in 2021.

The central bank has maintained a 9 per cent interest rate cap on loans, except for credit card loans, since 2020.

On January 15, the BB relaxed the lending rate cap for consumer loans allowing banks to charge up to 12 per cent from 9 per cent.

"Compared to private banks, state-run banks have been more impacted because the latter have not brought down the deposit rate to adjust with the interest rate regime that was introduced in 2020. So, the interest income fell," said Zaid Bakht, chairman of Agrani Bank.

Private lenders also parked funds with state banks, he added.

Despite the negative net interest income, Agrani Bank booked a profit of Tk 209 crore in 2021, on the back of higher revenues from investment earnings from bonds, bills and securities.

Agrani's investment income surged 33 per cent to Tk 2,417 crore in 2021.

Investment in securities also saved the day for Rupali Bank. Its net interest income was Tk 346 crore and Tk 325 crore in negative respectively in 2020 and 2021.

The investment income rose 19 per cent to Tk 1,433 crore in 2021. Rupali Bank made a profit of Tk 50 crore in 2021, way higher than the Tk 20 crore in the previous year.

A state-run bank can invest Tk 81 against a deposit of Tk 100 after keeping the cash reserve requirement (CRR) and statutory liquidity ratio (SLR) and meeting other requirements.

Irrespective of the deposit growths, the state-run banks can't have more than 15 per cent loan growth.

"Under the MoU with the central bank, we are bound to keep the lending growth within 15 per cent," said Md Harunur Rashid, chief financial officer of Rupali Bank.

"The rest of the fund is invested in treasury bills, bonds and other securities though the yield is lower than those of loans."

Md Mezbaul Haque, a spokesperson of the central bank, said NPLs and classified loans of the SCBs were high, so their interest income from lending was small.

"Thus, the net interest income has turned negative."

As of September, the banking industry was sitting on NPLs amounting to a whopping Tk 134,396 crore, accounting for 9.36 per cent of the total outstanding loans in the sector. SCBs had the highest share, at 23.04 per cent.

The BB has put the restriction on the state-run banks on providing a higher volume of loans so that they can't lend excessively and show fictitious income through accrual interest income, Haque said.

The central bank has put an emphasis on improving the loan quality first before extending credits as it found that whenever they make loans, they become classified, he said.

"The improvement in asset quality is more important than making available more loans and showing artificial income."

Janata Bank's net interest income fell into negative territory in 2021, the first time in the last five years. It stood at Tk 71 crore in negative.

The advance deposit ratio of SCBs is 40 per cent to 50 per cent, meaning their lending capacity is low. As a result, the income from the advance and loans is also low, said Md Nurul Alam, chief financial officer of Janata Bank.

"2022 was a better year for Janata Bank and the net interest income will be in positive territory."

Alam agreed that if the net interest income remains negative, it means that banks' profitability and efficiency are not up to the mark.

"As a primary dealer, the state-run banks are bound to buy bills and bonds and ensure the supply of funds to the government, so their advance deposit ratio can't rise."

Niranjan Chandra Debnath, CFO of Sonali Bank, could not be reached for comments.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments