Seven major sectors fell from grace as export dropped

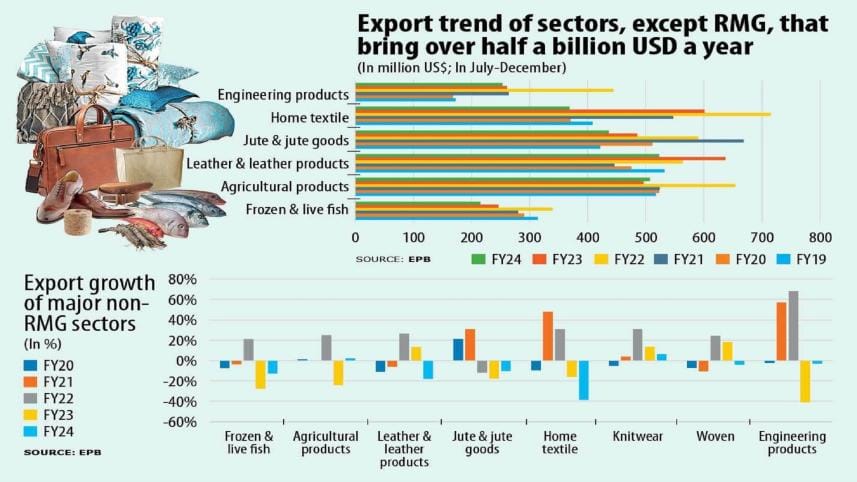

At the end of fiscal year (FY) 2021-22, Bangladesh had eight sectors that recorded over half a billion dollars in overseas sales.

One sector -- frozen and live fish-- slipped from the club the following year, and the downturn of export receipts of the sector continued in the current fiscal year 2023-24.

But the frozen and live fish sector is not alone.

Export of engineering products, including bicycles, which recorded roughly $800 million in FY22, are on the decline for the second consecutive year while the sector for woven garments, the second-largest export earner after knitwear, has also found itself on the list of sectors suffering from falling export earnings.

In fact, except knitwear, export earnings across the other seven major sectors that had registered at least half a billion dollars in annual export receipts in FY 2021-22 each fell in the first half of the current fiscal year 2023-24, showed data released by the Export Promotion Bureau (EPB).

Exporters said demand from buyers in major markets such as Europe and the USA had slowed as consumers cut back on spending amid high inflation, and inventory build-up in the post-Covid-19 period while the Russia-Ukraine war and geopolitical tensions also cut sales.

However, prospects of a quick recovery appear gloomy.

"I do not see any possibility of a sharp rebound soon. Buyers are not placing orders, but rather observing ahead of the general election. We are concerned," said Md Nasir Khan, vice-president of the Leathergoods and Footwear Manufacturers & Exporters Association of Bangladesh (LFMEAB).

The members of the association represent leather products and footwear makers, who fetched roughly $1 billion in export earnings in FY2022-23.

Makers of leather and leather goods, including footwear, saw their overseas sales plummet in the current fiscal year following a recovery from a downturn in the previous two-year period.

During the July-December period of FY24, export proceeds from leather and leather products slumped 18 percent year-on-year to $523 million.

Khan, also managing director of Jennys Shoes Ltd, said high consumer prices had affected export of leather items, but that it was not the only reason.

The leather export also suffered greatly due to a lack of compliance with the requirements of buyers since most local tanneries do not have certification from the Leather Working Group (LWG), a global body for compliance and environmental certification.

As such, Bangladesh's leather goods exporters have to import raw materials to make footwear suitable for export. "We cannot use any leather from Bangladesh to make products for export," Khan said, urging the government to take measures to facilitate export of leather goods.

FY24 is also shaping up to be the third consecutive year of decline in the export earnings of jute goods makers, the third-largest export earners.

In six months to the end of December of FY24, earnings from export of jute and jute goods fell 10 percent year-on-year to $436 million. With this, the cumulative losses in export in the sector stands at 40 percent since FY22.

"We are facing a number of challenges. There is no possibility of improvement soon," said Helal Ahmed, chief operating officer of Janata-Sadat Jute Mills, one of the leading jute exporters.

Export of jute goods, including the main product, jute yarn, declined both in value and volume because of reduced demand in Europe and other markets, including Turkey, a major buyer for jute yarn, he said.

The demand for carpets has fallen in the global market due to high inflation and economic slowdown, he said, adding that factories in Turkey were running at 60 percent capacity.

Prices of jute yarn have fallen to $900-$950 per tonne from $1,200-$1,300 per tonne a year ago, according to Ahmed.

"At present, we are facing severe challenges with regard to freight," he said, citing that shipping operators were charging more as they had to reroute vessels in the wake of the Red Sea impasse.

Ahmed said many small factories have shut down because of reduced export, leaving workers jobless.

For exporters of frozen and live fish, farmed in the southern coastal regions of the nation, FY24 has been the second consecutive year of decline in export.

"There is no demand abroad," said Kazi Belayet Hossain, president of Bangladesh Frozen Foods Exporters Association, fearing that overall export in the sector may decline by 28 percent this year.

Shyamal Das, managing director of MU Sea Foods, a frozen foods exporter, said the major market for frozen fish is Europe and it is suffering from the consequence of high inflation and the Ukraine-Russia war.

"We may see a recovery in the fourth quarter of this fiscal year because of the early harvest of black tiger shrimp and reduced stock at our buyers' end," he said.

Kamruzzaman Kamal, director marketing at PRAN-RFL Group, which export processed food items and bicycles among other products, said sales in the west had improved in the November-December period.

So, orders are going to increase in the coming months, he said, adding that PRAN's export of food products grew in the first six months of the current fiscal year.

Data from the EPB showed that export of agricultural products, which plunged in the fiscal year 2022-23, grew 2 percent to $507 million in the July-December period of FY24.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments