Scams crippling banking sector

A little-known firm named SB Exim allegedly swindled Tk 200 crore from Bangladesh Commerce Bank Ltd (BCBL) using forged documents in the name of exporting terracotta tiles in 2018.

The firm laundered the fund since it did not bring back the export proceeds as happen in the case of genuine exporters.

BCBL was later forced to create a loan against the payments made to the borrower as it had not received the money from foreign banks.

Subsequently, the loan defaulted and BCBL rescheduled it in November last year without informing the central bank.

In a shocking move, the Bangladesh Bank allowed BCBL to reschedule the defaulted loan in violation of its own rules since banks can't regularise bad loans that have been secured through forgery.

In Bangladesh, such financial scams in the banking sector are not rare. In fact, they seem to take place every now and then amid a lack of governance and inaction from regulators.

As a result, the public, who are the main sources of funds for lenders, are losing trust in the banking sector, whose job is to support the economy.

The crisis in the banking sector has reached a point where even the top court of the country has had to make observations about the anomalies facing it.

Yesterday, a High Court bench, during the hearing of a petition filed in a loan related corruption case, observed that serious crimes are being committed in the banking sector.

"If the offences continue to be committed, how will the country progress?" questioned the bench of Justice Md Nazrul Islam Talukder and Justice Khizir Hayat asked.

This is not the first time the High Court has made such an observation.

In January 2021, the HC said a section of Bangladesh Bank officials, tasked with monitoring the activities of banks and financial institutions, are harbouring financial thugs for personal gains.

Still, the financial crimes in the banking industry show no signs of slowing down.

This is because the government has not taken any strict measure to rein in irregularities. And, there is an unholy nexus among politicians, bankers and business magnets to swindle funds from banks, according to experts.

In a disappointing sign, both the government and the central bank took several measures such as relaxing the rules on loan classifications and rescheduling, helping the industry camouflage the scams and thus paint a rosy picture.

Although several earth-shaking financial felonies took place in the sector, most of the main accusers are yet to face any music, encouraging the wrong-doers to get bolder and helping the culture of impunity to take root.

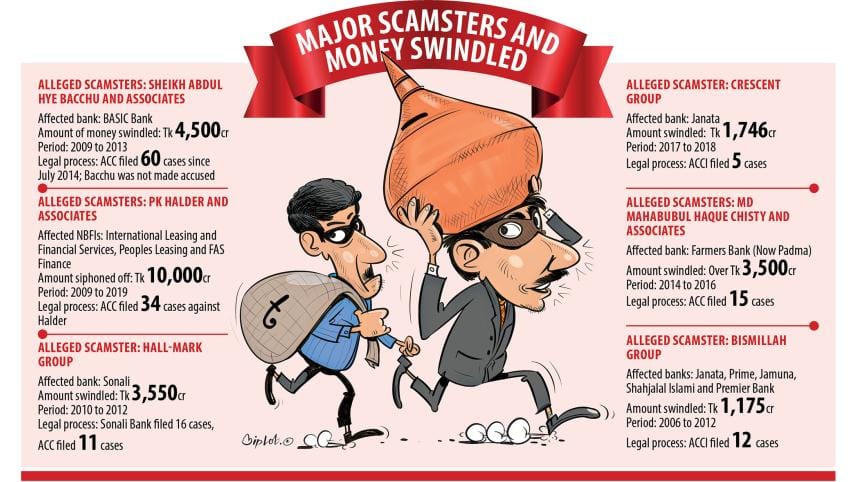

For instance, BASIC Bank, which was once one of the top-rated banks until Sheikh Abdul Hye Bacchu was appointed board chairman in 2009, has been facing a reputation crisis following the scams that took place between 2009 and 2014.

In December 2009, the state-run lender's soured loans accounted for only 4.81 per cent of its total loans. In March, default loans made up 55 per cent of the total outstanding loans.

The Anti-Corruption Commission (ACC) has so far filed 60 cases in connection with the scam, but ironically Bacchu was not accused in the lawsuits.

Earlier, a little-known Hall-Mark Group put Sonali Bank, another state lender, in spotlight after its erstwhile Ruposhi Bangla Hotel branch lent the company and five other firms Tk 3,547 crore between 2010 and 2012 based on fake documents.

Both the then board and the management of Sonali Bank were largely responsible for the scam. The bank has hardly recovered the swindled fund from the scammers.

Another scamster, Prashanta Kumar Halder, allegedly jeopardised the financial health of four non-banks after he and his cohorts laundered more than Tk 2,500 crore. Fugitive for about two years, he was arrested in India on May 14.

Muinul Islam, an economics professor at the University of Chittagong, says the government has not taken any exemplary action against delinquent borrowers.

"What is even more alarming is that the central bank has relaxed policies to help banks show a lower amount non-performing loans compared to the actual amount."

"A vested quarter is laundering money from the country, but the government has hardly taken any measure to stop them."

Scammers mainly launder the fund in the form of under-invoicing and over-invoicing in the name of exports and imports.

Had the laundering been tackled, Bangladesh's foreign exchange reserves would have been in a much better shape today, according to the economist.

"This means we would have been able to avoid the ongoing volatility in the foreign exchange market to a large extent."

Bad loans totalled Tk 113,441 crore in March this year, just shy of the highest-ever of Tk 116,288 crore recorded in September 2019.

ABM Mirza Azizul Islam, a former finance adviser to a caretaker government, says that there is an unholy nexus between politicians, bankers and business magnets to embezzle funds from banks.

"The central bank has taken decisions one after another favouring delinquent borrowers, which is pathetic," he said, urging the government to take firm actions to restore discipline in the banking sector.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, blames the culture of impunity that encourage scamsters to steal money from banks on a regular basis.

And the authorities have not carried out investigations to trace the whereabouts of the funds in most cases, she said.

ACC's chief counsel Khurshid Alam Khan said that the main cause for the repeated loan scams at banks is the negligence and lack of competence of Bangladesh Bank.

The monitoring of the central bank on local banks' functions is not up to the mark, he said.

Khan does not see any weaknesses in the laws related to preventing financial irregularities.

Muinul Islam describes the legal process to recover swindled funds as lengthy.

"This is not good for ensuring good governance in the banking sector."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments