Private wheat imports slump 45%

Wheat imports by the private sector have continued to remain low in Bangladesh than the last fiscal year as businesses are facing persisting difficulties in opening letters of credits owing to the dollar shortage at banks.

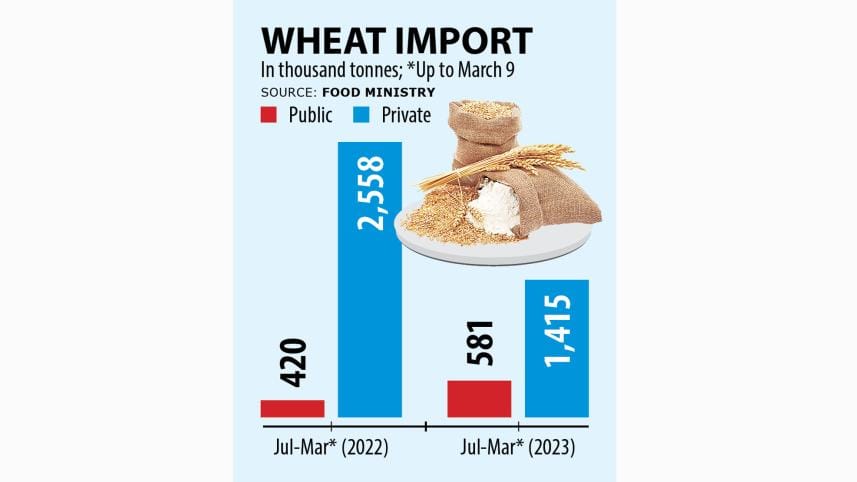

Businesses brought 14.15 lakh tonnes of wheat between July 1 to March 9 in the current fiscal year of 2022-23, down from 25.58 lakh tonnes recorded during the identical period a year ago. On the other hand, public sector imports soared 38 per cent during the period, food ministry data showed.

Despite the surge in the public sector import, overall imports fell 33 per cent year-on-year, affecting the supply of cereal in the domestic market, which is highly dependent on imported grain for the dearth of local production.

"The main reason is the delay in the opening of LCs for the dollar shortage. Even when we can open LCs, we are facing delays in getting confirmation from foreign banks," said Md Aminul Islam, managing director of Nabil Group, an importer of wheat.

"These factors have kept the import of wheat lower. Otherwise, everything is okay. The grain is available in the international market and prices have declined as well."

Wheat prices, which shot up to $492 per tonne in the April-June period of 2022, declined to $369 a tonne in March this year, showed World Bank's commodities price data.

At home, the price of the grain started to rise after April in 2022 impacted by the spike in the prices in the global market amid supply concerns in the wake of Russia's invasion of Ukraine and export restrictions imposed by a number of countries, namely India.

As such, wheat flour prices hit Tk 62.26 per kilogramme, the highest on record, in Dhaka in December 2022, data from the Food and Agriculture Organisation showed.

Prices moderated marginally in the first quarter of 2023, thanks to a grain deal brokered by the United Nations and Turkey. The deal allowed resumption of the movement of the cereal from Ukraine through the Black Sea. Last month, Russia agreed to extend the deal for 60 days.

"Local companies were able to import wheat from Ukraine and Russia after the deal," said Taslim Shahriar, deputy general manager of the Meghna Group of Industries.

He said wheat import suffered a lot in the July-November period because of the supply disruptions in the global market caused by the war and the export restrictions. The problems in LC opening also affected imports.

Amid the US dollar shortage, the central bank has tightened rules to curb imports, particularly those related to non-essential and luxury items, with a view to stopping fast-depletion of the foreign currency reserves, which have been fallen by 30 per cent in the past one year.

"However, wheat imports have increased in the first quarter of 2023," Shahriar added.

The prices of flour edged down marginally in the last one month and the loose flour was selling at Tk 55-58 a kg in the retail markets in Dhaka yesterday, down 4 per cent from a month ago, according to data from the Trading Corporation of Bangladesh.

The prices of flour, the second-most consumed cereal in Bangladesh, however, were up 55 per cent from a year earlier.

"There is a supply crunch in the domestic market because of lower imports," said Islam of Nabil Group.

"Prices will decline by 10-15 per cent if all companies can import properly."

Bangladesh produces around 11 lakh tonnes of wheat against an annual requirement of 75 lakh tonnes.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments