NBFI crisis locks up depositors’ savings

With high blood pressure and diabetes, Khalil Ahmed Khan needs regular medical visits and drugs. A Tk 23 lakh fixed deposit receipt was meant to cover those costs. Instead, the 64-year-old now faces despair.

Khan's deposit at Aviva Finance Ltd matured on January 21 this year, yet he has received only Tk 8.98 lakh.

He said he went to the managing director of Aviva Finance to demand the rest. Months later, he still has no repayment and no idea when it might come.

"But I need the amount urgently to pay my dues and other treatment costs this month," Khan told The Daily Star.

Like the elderly citizen, thousands of non-bank depositors are in a similar situation, knocking on doors to recover their savings.

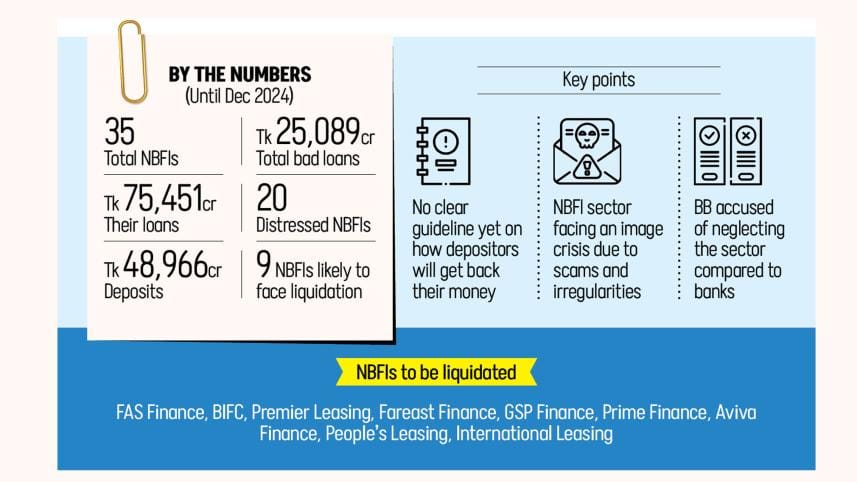

After Bangladesh Bank announced plans to liquidate nine troubled non-bank financial institutions (NBFIs), uncertainty has deepened. Many say they are paying the price for years of wrongdoing they did not commit.

The institutions are FAS Finance, Bangladesh Industrial Finance Company, Premier Leasing, Fareast Finance, GSP Finance, Prime Finance, Aviva Finance, People's Leasing and International Leasing.

Several Aviva depositors expressed their ordeals to The Daily Star.

But they said they were too frightened to speak publicly, fearing it could ruin any chance of getting their money back.

One retired private-sector employee said he has Tk 80 lakh with Aviva. With heart problems and other age-related ailments, the 65-year-old wants to cash out for medical costs, but cannot because of the company's crisis.

The Daily Star sought comment from Mohammad Modasser Hasan, managing director and chief executive of Aviva Finance, by phone and text. But he was not available.

Demanding the return of their savings, depositors of Peoples Leasing held a press conference at the Jatiya Press Club in Dhaka last week.

They said many retirees depend on the funds to run their households, pay for treatment and cover their children's education.

They said at least 35 depositors have died so far while waiting for their money.

Ahsan H Mansur, governor of the central bank, recently told The Daily Star that the nine NBFIs would be liquidated and that the government has given its approval in principle. The process, to be carried out under the Finance Company Act 2023, may begin soon.

However, the Bangladesh Bank (BB) has yet to issue guidelines on how the liquidations will proceed or how depositors will be reimbursed.

A central bank document shows that Tk 15,370 crore of deposits from individuals and institutions are locked in those nine NBFIs.

Of it, Tk 3,525 crore belongs to individuals and Tk 11,845 crore to banks and corporate depositors.

Among individuals, the largest sum, Tk 1,405 crore, is stuck with People's Leasing, followed by Tk 809 crore at Aviva Finance, Tk 645 crore at International Leasing, Tk 328 crore at Prime Finance and Tk 105 crore at FAS Finance, as per BB data.

Industry people say the NBFI sector has long been mired in scams and irregularities. They blame lax oversight, noting that the central bank did not supervise non-banks as closely as banks.

As of March this year, non-performing loans at 35 NBFIs stood at Tk 27,189 crore, or 35.32 percent of total outstanding loans of Tk 76,987 crore, according to central bank data.

Meanwhile, other NBFIs say that the liquidation move is eroding confidence across the sector.

"We are facing serious difficulties due to the decision to liquidate several NBFIs, because our clients are now losing trust in us," said Mustafizur Rahman, managing director of Midas Finance.

"Before taking such decisions, there should have been discussions with all stakeholders in the sector."

He said the sector wants some form of cash or liquidity support.

"Right now, our three major sources -- depositors, bank borrowings, and our own collections -- are all severely affected. Among these, bank borrowings have completely stopped, and depositors have lost confidence as well.

"Given the current market situation, even our large clients are struggling to make repayments properly, which has pushed us into a liquidity crisis," added the MD.

He said, "Therefore, we believe that the central bank should provide us with some form of liquidity support, based on our position and cash flow. This support could be similar to the financing or funding we used to get from banks, something like term lending. We are willing to repay it over the long term, along with interest."

Anis A Khan, former managing director of Mutual Trust Bank and former chairman of the Association of Bankers, Bangladesh, told The Daily Star that apart from a handful, most non-bank financial institutions are in trouble.

He said vested interests were using these companies, and insider lending was one of the main reasons for their decline.

"There is a need for dialogue on the sector, where stakeholders, industry representatives, central bankers, and senior commercial bankers should be present," Khan said.

He believes recommendations from such talks could help rescue the sector.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments