Made in Bangladesh foods tied to diasporas

Bangladesh has been exporting agro-processed foods for over three decades, but the sector has not grown much and still remains highly concentrated within a few countries where Bangladeshi diasporas are the primary buyers.

Exporters say that food habits and cultural preferences play a key role in food export. They also admit the sector's failure to introduce new items in the export basket, altogether resulting in the stalling of market expansion.

According to Bangladesh Agro-Processors Association (BAPA), the major buyers of Bangladeshi agro-processed foods are the United Arab Emirates, Saudi Arabia, India, the UK, the US, Malaysia, the Philippines, Singapore, Canada, Oman, Qatar, and the Netherlands.

In these countries, Bangladeshi expatriates, as well as Indian and Pakistani citizens, form the primary consumer base for products like spices, dry foods, snacks, puffed rice, fruit juices, noodles, parathas, candy, curry powder and mustard oil.

The BAPA says that 75 percent of the country's processed food exports over the past five fiscal years were concentrated within just 13 countries.

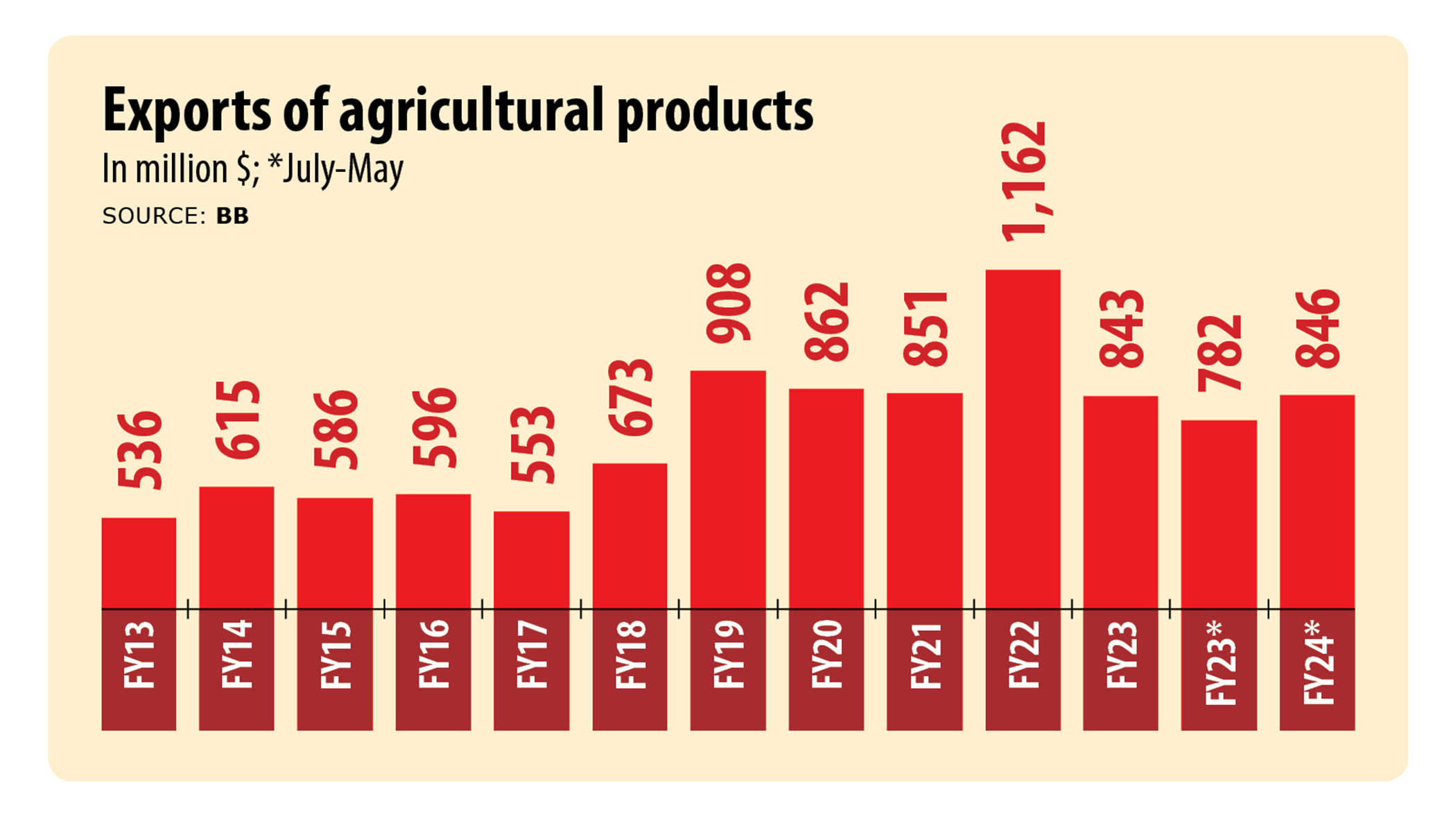

In fiscal year 2023-24, Bangladesh exported $341.73 million worth of agro-processed foods to 100 countries, down from $383.26 million to 103 countries in the previous year.

The UAE accounted for 25.06 percent of the market share, followed by Saudi Arabia (15.54 percent), the UK (6.88 percent), the US (6.36 percent) and Malaysia (4.34 percent).

PRAN-RFL Group, a leading food processor and exporter, ships spices, juices, puffed rice, snacks, and confectionery items to 140-145 foreign markets.

Eleash Mridha, managing director of PRAN Group, said 80 percent of their exports are sold through small individual outlets, while the remaining 20 percent are distributed via superstores.

Mridha said Bangladesh's recent ban on aromatic rice exports and rising costs of sugar and flour have negatively impacted agro-export earnings.

However, he was hopeful about expanding the market to the countries in the Association of Southeast Asian Nations, taking advantage of low freight costs and similar food habits in countries like the Philippines, Thailand, Cambodia, and Vietnam.

"We are focusing on this and expect to improve our position in the next two to three years," he said.

However, Khurshid Ahmad Farhad, general manager for international business and corporate affairs of the Bombay Sweets and Company Limited, was critical of the capacity and sincerity towards market expansion by local players.

"Bangladesh doesn't produce any universal item that could give the country a competitive edge in the global food market," he told The Daily Star.

"The foreign food market is highly dynamic, with rapid improvements in food packaging, machinery and research and development," said Farhad, adding that local exporters have so far shown little interest in keeping up with the fast-changing market.

Bombay Sweets ships 50 items to 41 countries, with the export basket mainly consisting of chips and a savoury snack called "Bombay mix" or "chanachur" in Bangla for the Middle Eastern market.

Parvez Saiful Islam, chief operating officer of Square Food & Beverage Ltd, shared similar views about the highly competitive food market, mentioning that their primary exports include spices, mustard oil, "chanachur" and snacks.

"These products are popular among Bangladeshis but less so in other communities," he said.

Islam said aromatic rice once accounted for 23 percent to 25 percent of the total exports of the company. However, the export ban has largely impacted their performance.

Islam urged the government to reconsider the aromatic rice export ban, arguing that the product, being a premium variety, does not pose a threat to national food security.

Faria Yasmin, chief business officer of the ACI Foods & Commodity Brands, pointed to a reduction in the last budget on cash incentives on exporting agricultural products from 15 percent to 10 percent, negatively impacting their pricing and profitability.

She also called for ensuring punitive measures against incentive misuse.

According to Iqtadul Hoque, general secretary of the BAPA, while new markets are emerging, they have yet to become top export destinations.

"Exporters are actively working to expand their reach," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments