Large-cap stocks plunge as floor prices go

Stocks of British American Tobacco Bangladesh (BATB) dropped at Dhaka Stock Exchange (DSE) following the lifting of its floor price yesterday, just as it had occurred for that of Grameenphone on the day before.

Stocks of the tobacco company fell 7.5 percent to Tk 479.8 while that of Grameenphone around 2 percent to Tk 257 yesterday.

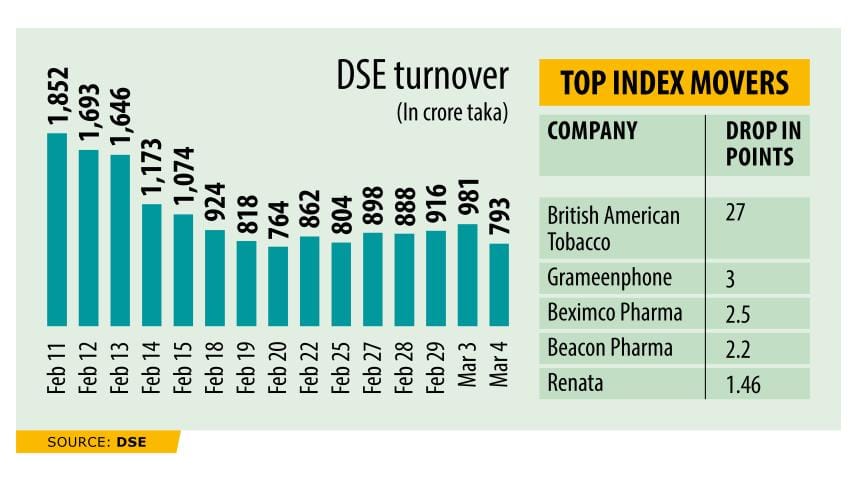

The two companies brought down the DSEX, the key index of the country's prime bourse, by 30 points, of which the BATB accounted for around 26 points, according to LankaBangla Securities.

The DSEX ended the second trading day of the week lower at 6,175 as it slipped 39.94 points, or 0.64 percent, from that on Sunday.

This is the fourth consecutive day of trade that the index has dropped.

The floor price is the lowest price at which a stock can be traded. The Bangladesh Securities and Exchange Commission (BSEC) started to gradually lift floor prices since January on introducing those 18 months ago.

Meanwhile, the DSES, which represents Shariah-compliant companies listed on the country's premier bourse, lost 5.25 points, or 0.38 percent, to stand at 1,344.

Moreover, the DS30, which is comprised of blue-chip firms, went down 19.24 percent to reach 2,108.

Turnover, which indicates the volume of shares traded during the session, slumped 19.14 percent to Tk 793 crore. Block trades accounted for 5.8 percent of the market turnover.

Central Pharmaceuticals was the most traded share with a turnover of Tk 56 crore.

Of the issues that were traded on the DSE, 115 advanced, 214 declined and 67 remained unchanged.

Most of the sectors with large market capitalisation posted negative performances yesterday, said BRAC EPL Stock Brokerage in its market research for the day.

Food and allied experienced the highest loss of 5.49 percent followed by telecommunication (1.10 percent), engineering (0.92 percent), non-bank financial institutions (0.87 percent), fuel and power (0.81 percent) and pharmaceuticals (0.60 percent)

Only the banking sector made a gain of 0.57 percent.

GQ Ball Pen Industries took pole position on the top gainers' list with a rise of nearly 10 percent, followed by SEML Lecture Equity Management Fund (8.43 percent) and Daffodil Computers (7.83 percent).

IT Consultants, AB Bank and Quasem Industries also rose 6.11 percent, 5.60 percent and 4.86 percent whereas SBAC Bank, Agni Systems and Gemini Sea Food 4.58 percent, 4.48 percent and 4.17 percent respectively.

Prime Textile Spinning Mills and Fareast Islami Life Insurance shed the most, losing the identical figure of 10 percent.

The two were followed by New Line Clothings, Active Fine Chemicals and AFC Agro Biotech with 9.82 percent, 9.81 percent and 9.64 percent and Prime Finance & Investment and Bangladesh Industrial Finance Company with 9.37 percent and 9.33 percent respectively.

The Caspi, the broad-based index of Chittagong Stock Exchange, shed 100 points, or 0.56 percent, to 17,740.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments