Grey handset market booms as taxes, currency shock push prices up

eroding official sales and hurting local manufacturers

When the official market is constrained, the grey market thrives, and that is precisely what has happened in the mobile phone sector of Bangladesh.

High taxes on official handsets, severe dollar shortages disrupting imports, and the taka's tumble to record lows have made legal devices far more expensive. As a result, the grey market has become the norm, aided by the fact that enforcement agencies seldom visit malls to check whether shops sell genuine products.

But how widespread is the sale of unauthorised handsets?

A few months ago, a secretary of a ministry visited Bashundhara City Shopping Complex to buy a flagship phone. The official seller, a relative of the bureaucrat, advised him not to purchase it from the shop.

Instead, he was directed to another retailer, where he bought the device for Tk 112,000 -- half the Tk 220,000 price it would have cost in the official store, the secretary told The Daily Star, requesting anonymity.

He is far from alone.

Estimates show that 93 percent of premium phones of one brand in use in Bangladesh last year came from the grey market. For mid-range models, the figure was around 69 percent.

Traders say they source these devices through luggage carried by returning travellers.

Now, as the government is set to introduce a centralised system to block new unofficial sets, protests by such traders erupt.

They say documentation and processes required to sell official handsets are not feasible for small retailers. Besides, many consumers would not be able to afford them as they cost up to 35 percent more in taxes.

HIGHEST TAX ON IMPORT

Bangladesh now imposes some of the world's highest taxes on officially imported smartphones, with cumulative duties between 57 and 59 percent. This pushes consumers to the grey market, where handsets can be purchased far cheaper.

High taxes inflate official retail prices 30 percent to 50 percent above international benchmarks in the US, UAE, Malaysia, Indonesia, Vietnam and China. Grey-market devices, which avoid all duties, undercut legal distributors and undermine the viability of official channels.

In November last year, Jungmin Jung, managing director of Samsung Electronics Bangladesh, pointed to the issue at a Foreign Investors' Chamber of Commerce & Industry session.

He showed how the grey market has captured a growing share of sales, driven almost entirely by large price gaps. Samsung data showed that grey-market phones were 30-48 percent cheaper than official models.

For example, a Model A handset priced at Tk 244,000 officially could be bought for roughly Tk 124,000 through unofficial channels. Premium models were the hardest hit, with 93 percent of units circulating in Bangladesh estimated as grey-market imports, while mid-range devices accounted for around 69 percent.

CURRENCY VOLATILITY HURTS LOCAL PRODUCTION

Taxes on locally manufactured phones have also increased. Pakistan imposes around 20 percent duty on mobile production, while Bangladesh's rate has reached 35 percent.

When local assembly began in 2017, raw materials faced only 12 percent import duty, and there was no value-added tax (VAT) on manufacturing or sales.

By 2019, multiple layers of VAT were introduced, and a further 5 percent sales-stage VAT came in 2022, bringing total taxes to 35 percent.

That same year, taka was heavily devalued, opening letters of credit became difficult, and grey handsets grew more attractive, said an official of the Mobile Phone Industry Owners' Association of Bangladesh.

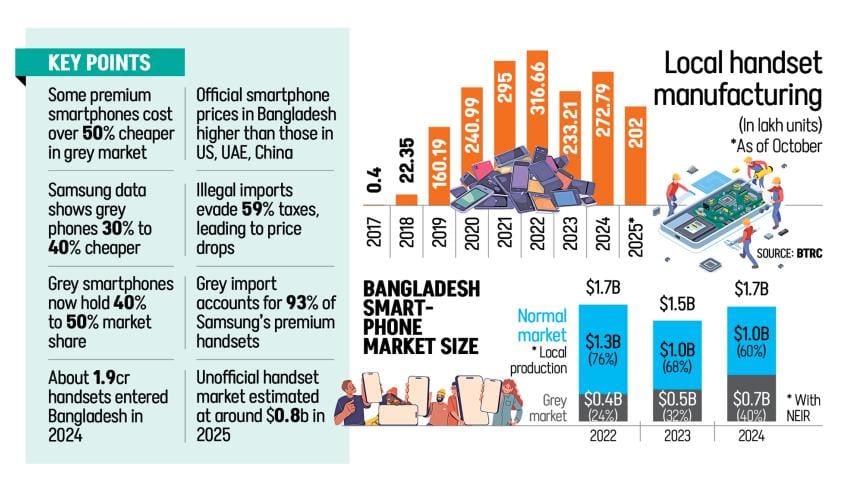

Handset production in 2023 fell for the first time since assembly began, dropping 26 percent year-on-year. This came after a rapid rise from 40,000 units assembled by Walton in 2017 to 3.16 crore in 2022.

In 2024, production rebounded 17 percent, but weak sales and large grey imports continued to challenge manufacturers.

According to the Mobile Phone Industry Owners' Association and Bangladesh Telecommunication Regulatory Commission (BTRC) data, grey smartphones now account for 40 percent to 50 percent of the market.

Meanwhile, Samsung's figures show grey-market imports rose from 24 percent in 2022 to 40 percent in 2024. The overall market is valued at $1.7 billion, with over $0.7 billion captured by unofficial devices.

According to industry insiders, the grey market alone is estimated at around $0.8 billion in 2025.

TRADERS RESIST NEIR

BTRC data show 4.6 crore handsets were added to the network last year. Of these, 2.7 crore were locally manufactured, one-third of them smartphones, while around 1.9 crore entered through unofficial channels.

However, the breakdown of how many handsets were bought by Bangladeshi expatriates and how many by grey-market traders remains unclear.

Shamim Mollah, acting president of the Mobile Business Community Bangladesh, whose members protested against the NEIR system, denied claims that traders bring in phones illegally.

He said devices are sourced from foreign travellers, bypassing official procedures. NEIR and high taxes, he argued, disproportionately threaten small traders, while local assemblers benefit.

"NEIR needs restructuring. We want to pay tax, but the regulator must remove barriers to legal imports," he said.

Meanwhile, BTRC Chairman Major General (Retd) Md Emdad ul Bari said the commission is working to simplify import and vendor-enlistment processes.

He said certificates will require fewer documents and faster approval, and unsold devices in the market will be regularised. Inter-ministerial discussions are ongoing.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments