Govt’s borrowing goes up amid falling revenue

The government's dependence on borrowing to finance national budgets has increased over the past decade as revenue collection has failed to keep pace with the ballooning public expenditure.

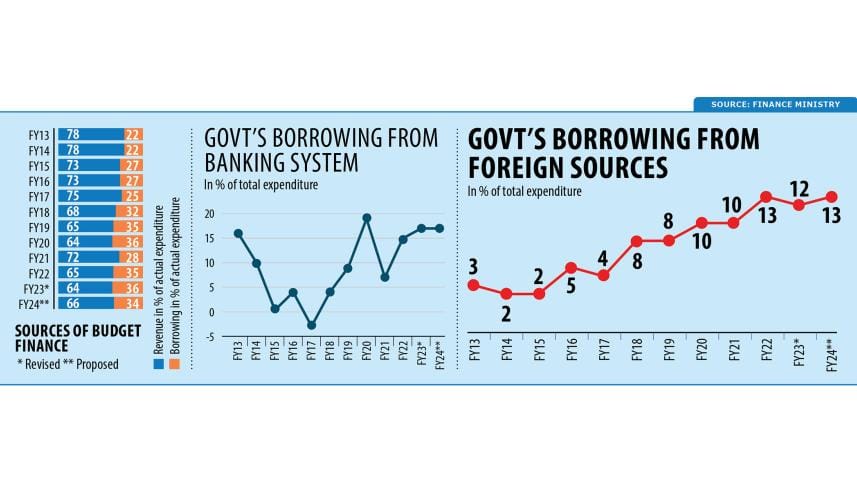

Finance ministry data showed that taxes raised by the National Board of Revenue (NBR) and other public agencies could fund 74 per cent of the government's total expenditure of Tk 174,013 crore in the fiscal year of 2012-13.

The rest of the expenditure was met through debts from the domestic source and foreign loans and grants, which accounted for 22 per cent and 4 per cent, respectively.

A decade later, in 2021-22, the contribution of revenue generation to actual expenditure declined to 65 per cent. On the other hand, the share of borrowing from internal and foreign sources rose to 35 per cent. The trend continued in the subsequent years as well.

The government plans to meet 34 per cent of its expenses set for 2023-24 on the back of borrowing, mainly from the domestic banking system.

Sadiq Ahmed, vice-chairman of the Policy Research Institute of Bangladesh, said by and large, fiscal deficits have been kept at below 5 per cent of gross domestic product.

"However, the inability to mobilise adequate revenues despite securing rapid GDP growth has weakened the quality of fiscal management. This issue has become important over the past several years as the tax-to-GDP ratio continues to fall, whereas fiscal deficit, public debt and interest cost as shares of GDP are rising."

The fiscal deficit increased from 3.7 per cent of GDP in FY19 to 5.1 per cent in FY22.

Total revenues are expected to remain at 8.5 per cent of GDP in FY23. Although revenues are expected to gradually increase, this ratio remains among the lowest in the world.

According to Ahmed, a matter of immediate concern is the ongoing macroeconomic instability reflected in a persistently high inflation rate and pressure on the balance of payments.

"In this environment, the government needs to reduce aggregate demand pressure to reduce inflation and contain the pressure on the balance of payments."

The new budget proposes to keep the fiscal deficit at 5.1 per cent of GDP.

But Ahmed thinks the actual fiscal deficit for the next fiscal year could be higher since the lofty target of increasing tax revenues is not likely to be achieved.

Revenue growth averaged 10 per cent annually between FY2017 and FY2023 and the NBR has not been able to reach its revenue generation goal in the past one decade.

"This approach to fiscal policy management is clearly inconsistent with the task of restoring macroeconomic stability. Growing fiscal deficit and the use of bank financing will both put additional pressure on aggregate demand and on the balance of payments," said Ahmed.

"The correct policy stance should be to reduce the fiscal deficit to around 4 per cent of GDP by cutting subsidies and rephasing spending on large infrastructure projects."

Selim Raihan, executive director of the South Asian Network on Economic Modeling, said the government should borrow judiciously. "There is no alternative to generating more revenues."

The government is increasingly depending on borrowing from either banks or foreign sources, which has some implications, said Raihan.

When the government considers taking loans from the banking sector, it can borrow from commercial banks or the central bank. When it takes up funds more from commercial banks, it affects the private sector's credit growth since the availability of loans for businesses narrows.

The private sector credit growth target has been set at 11 per cent in FY24 against the public sector's 30 per cent.

"If the government continues to borrow from commercial banks, it will create a big implication," said Raihan, also a professor of economics at the University of Dhaka.

In FY24, the government has planned to borrow Tk 132,395 crore from the banking sector and Tk 102,490 crore from external sources.

If the government borrows from the central bank, it means an injection of fresh money into the economy. Then it may quicken inflation, which is already running at a decade high.

In the last few years, the government has taken some mega projects, which prompted the country to turn to the external sector for funds.

Prof Raihan said the government is moving towards short-term bilateral loans and longer-term multilateral loans.

"This is a matter of concern as the government may face higher debt servicing and interest repayments, especially for bilateral loans since they usually remain high."

The pressure stemming from higher debt repayments may deepen in the coming years, he said.

The economist urged the government to scrutinise foreign loans and initiate projects carefully after carrying out proper feasibility studies.

"If projects are undertaken through proper assessment, it may cut cost- and time overruns and give some relief to the government."

Towfiqul Islam Khan, a senior research fellow of the Centre for Policy Dialogue, said the apparent quick rise of GDP, partly due to rebasing, has allowed the deficit to grow as the size of the budget deficit relative to GDP in considered more often.

Khan thinks the more concerning part of the budget deficit is the composition of financing.

"Foreign aid is increasingly coming from more stringent and expensive sources while the domestic borrowing's share and the debt servicing liability are growing. Indeed, Bangladesh has lost track of its set pathway to some extent," he said, referring to the medium-term debt strategy.

Since higher borrowing from the central bank is expected to continue in FY24, it will undoubtedly increase the money supply and lead to inflationary pressure, he said.

"If administered interest rates are maintained, the situation is likely to worsen day by day."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments