Foreign investors returning to stock market

After a long time, foreign investors are showing renewed interest in buying shares of listed companies in Bangladesh as they hope good governance will return to the local stock market following the recent political changeover.

This is because the interim government has implemented various measures, such as punitive action against stock manipulators, to make the market more attractive since taking office on August 8.

Besides, foreign investors hope the exchange rate volatility in the country will stabilise and that floor prices or any other market intervention mechanism will not return following the preceding government's ouster on August 5.

Another reason for their buying mood is that interest rates in US banks have dropped while the share values of many listed companies in Bangladesh have reached a lucrative level, according to market analysts.

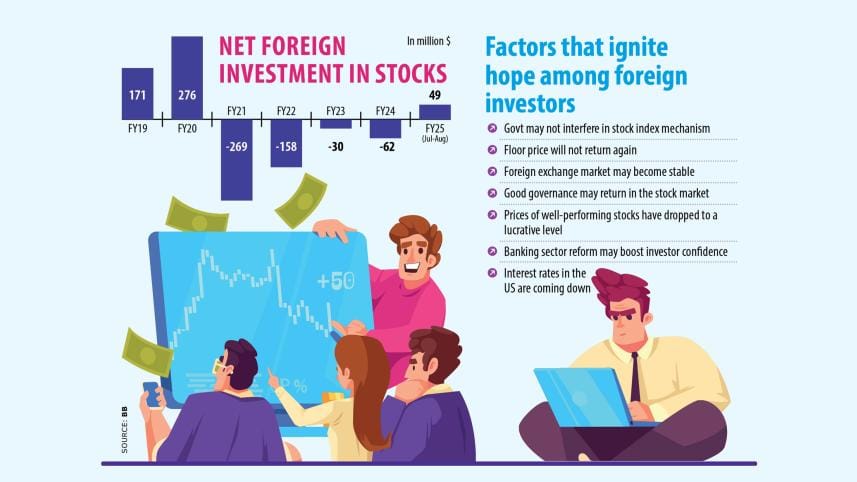

Bangladesh Bank data shows that the net portfolio investment of foreign investors soared to $49 million in the July-August period of fiscal year (FY) 2024-25 while it was $3 million at the same time the previous year.

"The main priority of foreign investors is good governance and they hope it will return to the market," said Mohammed Rahmat Pasha, managing director and CEO of UCB Stock Brokerage.

"They are very positive about the punitive action being taken against manipulators."

He went on to say that the second priority for foreign investors is their returns.

If the forex market is unstable, then their investment value deteriorates with the depreciation of the local currency, Pasha said. "So, they are hoping recent reform activities will ensure stability in the forex market."

Central bank data shows that the taka has depreciated by more than 40 percent against the US dollar over the past four years.

The net portfolio investment of foreign investors was in the negative for the past four fiscal years, standing at $62 million in the negative in FY24 and $30 million in the negative in FY23.

Foreign investors began selling shares en masse in FY21, when their net sales amounted to $269 million, before dropping to $158 million in FY22, shows central bank data.

Pasha said foreign investors prefer the same well-performing companies that they had poured investment into in the past. Aside from assured returns, this is because they have no other options considering that no new good stocks have been listed in the past four years.

UCB Stock Brokerage reported increased buying orders from foreign investors, mainly for well-performing stocks with lucrative prices, since July.

"The lucrative price of good stocks is the main reason for the higher participation of foreign investors," said Ershad Hossain, managing director and CEO of City Bank Capital.

Meanwhile, bank interest rates in the US are declining, so funds are moving out of the country to emerging markets, with Bangladesh also getting in on the action, he added.

The US central bank lowered its interest rates last month for the first time in more than four years, according to a BBC report. The Federal Reserve reduced the target for its key lending rate by 0.5 percentage points to the range of 4.75 percent to 5 percent.

Moreover, the fall of the autocratic Awami League government has raised confidence of foreign investors in Bangladesh's stock market, Hossain said.

"As such, many of them [foreign investors] are now even considering the potential of investing in non-listed firms," he said.

Furthermore, the interim government has already started many reform activities across all economic sectors to boost confidence in the market.

Under the previous government, the Bangladesh Securities and Exchange Commission had taken many steps, such as setting floor prices, that heavily impacted the stock market.

The foreign investors hope that these types of policies will not be implemented in the future and instead huge reforms will be implemented to bring good governance back to the stock market.

"At the same time, stock manipulation will be reduced. So, they have started investing funds in the market," Hossain added.

FTSE Russell, one of the world's leading market analytic and index providers, resumed its review of local stocks from last month to identify eligible index constituents from the Dhaka bourse.

It stopped reviewing the Dhaka Stock Exchange in February of 2023 following the implementation of the floor price mechanism.

Usually, foreign investors follow several indices to identify good stocks, including the FTSE index, where 25 Bangladeshi stocks were included.

Both Pasha and Hossain emphasised the need to ensure good governance and list good stocks to attract more foreign funds to the market. They also said market-friendly policies should be ensured and they should not be changed frequently.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments