Too many stockbrokers, asset managers approved during Hasina’s regime

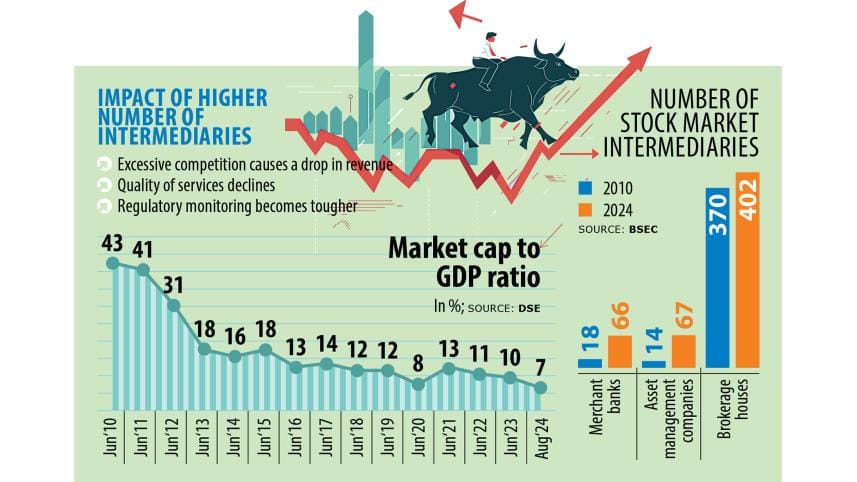

Over the past 15 years, investors have fled the market, initial public offerings (IPOs) have been scarce and capital market growth has fallen short of expectations. Despite this dry market, the number of stock intermediaries entering the market increased steadily.

The stock regulator's puzzling approval of these intermediaries has led to several adverse outcomes -- broadly a decline in the quality of market services offered to investors.

In the past 15 years of the Awami League regime, the number of asset management companies has risen to 67 from 14 while merchant banks have increased to 66 from 18. Similarly, stock brokerage firms have grown to 402 at present from 370 in 2010.

"These licences were issued on political grounds," said Saiful Islam, president of the DSE Brokers Association of Bangladesh. "But licences for stock intermediaries should have been granted based on the market size."

Subsequent excessive competition, according to Islam, has forced intermediaries to cut prices and compromise quality, leaving many barely surviving now.

Despite offering portfolio management services, only a few merchant banks have must-have research wings, he said, citing this is "almost rare in foreign countries".

"When the stock market was struggling, the regulator granted licences to as many as 60 new brokerage firms. I don't understand the basis for these approvals," Islam added.

Ultimately, more than a dozen of these new intermediaries have yet to start any operations, whether as stock brokerage firms, asset management companies or merchant banks.

Central Depository Bangladesh Ltd data shows that despite the increasing number of stock brokerage firms in the past 15 years, the number of beneficiary owner accounts has nearly halved -- from 3.4 million to 1.67 million.

Meanwhile, Asif Khan, president of the CFA Society Bangladesh, said a surge in intermediaries always makes regulatory monitoring more challenging.

The Bangladesh Securities and Exchange Commission (BSEC), for this case, must now monitor around 600 intermediaries and listed companies in addition to the secondary market.

"With such limited manpower, how is it possible to properly monitor them?" Khan questioned.

He said the BSEC has allowed exemptions from maintaining provisions for negative equity on margin loans for the past 14 years to keep the market afloat. Some intermediaries have become insolvent but have been allowed to continue operations, making the entire system risky.

Regarding the higher number of merchant banks, Khan said it is difficult to attract good companies to the market if the environment remains unfavourable.

Although the number of merchant banks has tripled to 68, IPO approvals have declined steadily in recent years, with a total of 127 companies listed in the past 15 years, according to the BSEC.

For discouraging companies from market listing, he blamed the current IPO pricing method, lack of tax rate differences, easy bank loans and tax evasion culture.

Meanwhile, investors have a fragile trust in mutual funds, leading to a nascent sector despite the increase in asset managers. Total assets under management are only Tk 14,860 crore, which is less than 2 percent of total market capitalisation, according to IDLC data.

By giving licences to many institutions, the number of eligible investors has increased, and many of them have engaged solely in IPO applications and enjoyed quotas, said Shekh Mohammad Rashedul Hasan, managing director and CEO of UCB Asset Management.

"These investors often participate in syndication and disrupt the market."

Regarding the reasons for the nascent mutual fund industry, Hasan cited lower investor literacy, frequent policy changes and an unfriendly tax policy.

On Mutual Fund economics, he said open-end mutual fund investors are still exposed to dividend tax which is an uncommon practice globally.

Due to the large number of intermediaries, competition has turned fierce. So, some merchant banks had to surrender their licences, said Mazeda Khatun, president of the Bangladesh Merchant Bankers Association.

"I doubt whether the regulator conducted any research to assess the necessity of these licences for the economy," she added.

Without ensuring good governance in the market and introducing attractive policies, simply having a large number of merchant banks will do nothing in attracting quality companies. This is also true for other intermediaries, Khatun added.

Compared to its neighbouring countries and other similar-size economies and nations, Bangladesh has a higher concentration of market intermediaries.

Bangladesh also leads in terms of stockbrokerage firms, with 402 brokers serving investors through the Dhaka Stock Exchange (DSE) and the Chittagong Stock Exchange (CSE).

In India, there are 314 brokerage firms, while the numbers are 67 in Nepal, 89 in Vietnam, 204 in Pakistan, 26 in Sri Lanka, 36 in Thailand and 183 in Nigeria.

With 68 merchant banks, Bangladesh ranks second among the eight countries, following India, which has 200 merchant banks. Nepal has 28 merchant banks, while the numbers are 17 in Vietnam, 54 in Pakistan, 21 in Sri Lanka, 50 in Thailand and 32 in Nigeria.

Indian merchant banks managed initial public offerings for 2,183 companies between 2018 and 2022, compared to 50 companies in Bangladesh.

The number of asset management companies is also higher in Bangladesh. The country has 67 asset management companies while India has 44.

DSE Brokers Association President Saiful Islam recommended merging some intermediaries and consolidating the two stock exchanges.

He said the DSE could focus on bond and equity markets while the CSE could specialise in commodity exchanges.

"This will be a win-win situation for both exchanges as the CSE's turnover is very low," he added.

The Daily Star approached former BSEC chairman M Khairul Hossain for comment, but he did not respond to phone calls.

Prof Shibli Rubayat-Ul Islam, the other chairman who led the BSEC during the latter part of the 15-year Awami League regime, was also found unavailable for comment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments