Exports slip after 13 months

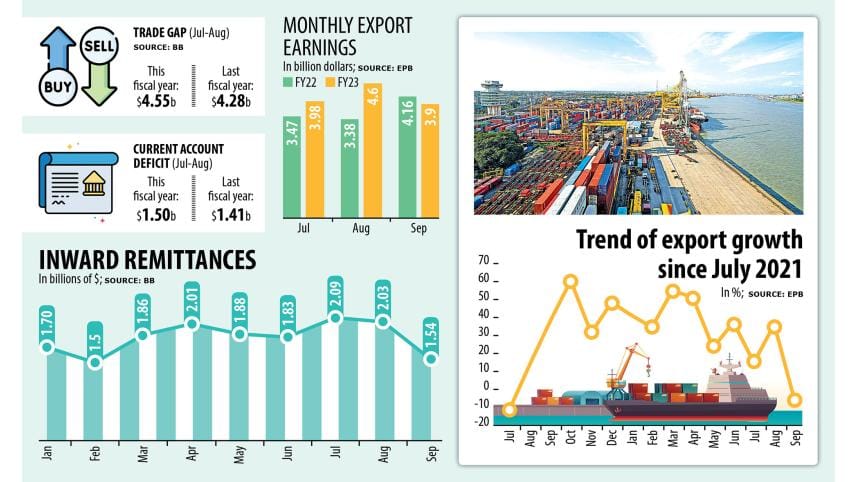

Export earnings dropped 6.25 per cent year-on-year to $3.9 billion in September, the first fall in 14 months, as the cost-of-living crisis in the western countries took its toll on Bangladesh's main foreign currency earning sector.

The decline came as the garment shipment, which accounts for about 85 per cent of national exports, went down by 7.52 per cent to $3.16 billion in the month, according to data from the Export Promotion Bureau (EPB).

In September, woven exports slipped 5.66 per cent to $1.43 billion while knitwear shipments dipped 9 per cent to $1.73 billion.

The contraction in export earnings came as European and American buyers continue to struggle amid higher consumer prices.

Inflation in the 19-member eurozone surged to 10 per cent in September, the highest on records, owing to the soaring electricity and natural gas prices. In the US, the Consumer-Price Index rose 8.3 per cent in August from the same month a year ago.

And exporters warned that the negative growth may continue for another one or two months because of the double-digit inflation in Europe and higher consumer prices in the US and the growing threat of the world falling into recession.

Overall earnings in the July-September quarter were, however, up 13.38 per cent at $12.49 billion.

Similarly, garment shipment rose 13.41 per cent to $10.27 billion during the three-month period. Of the amount, $5.64 billion came from the knitwear sector and $4.62 billion from the woven segment, up 9.40 per cent and 18.73 per cent respectively from the identical quarter a year earlier.

The shipment of woven garment items has been displaying a strong rebound because of the improvement in the coronavirus pandemic situation as the people have returned to offices and are going out and attending social events.

"We expect that the earnings from the garment sector will rebound strongly from December as international retailers and brands are confirming previously stalled orders," said Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

International retailers and brands have put on hold the orders because of the price escalation of the raw materials and higher inflation caused by higher prices of essentials and energy costs for the Russia-Ukraine war.

"However, the situation is improving thanks to a fall in the prices of petroleum products and cotton in international markets," Hassan said.

Cotton prices fell to 80 to 84 US cents per pound last week from $1-$1.05. This led retailers and brands to begin confirming the orders. Moreover, a lot of orders are shifting from China to Bangladesh due to the dragging tension between China and the US.

Hassan, however, said factories need simplified business processes and there has to be adequate supply of gas to cater for the work orders.

In the quarter, the earnings from the jute and jute goods export increased by 15.71 per cent to $245.65 million, EPB data showed. Leather and leather goods export grew 20.87 per cent to $327.97 million.

"The earnings from jute and jute goods have been rising because of the growing export of diversified and value-added goods," said Md Abul Hossain, president of the Bangladesh Jute Mills Association.

Recently, local jute mills have started producing fine yarn, which has higher demand in the international markets, he said.

Syed Nasim Manzur, president of the Leathergoods and Footwear Manufacturers and Exporters Association of Bangladesh, expects the earnings from the sector to cross $3 billion in the next three years and $5 billion in the next five years from $1.5 billion in the last fiscal year.

Home textile exports grew 26.59 per cent to $353.48 million between July and September, and the shipment of non-leather footwear grew by 35.31 per cent to $125.34 million.

However, frozen and live fish, agricultural products, pharmaceuticals, carpets, terry towels and furniture could not perform strongly in the quarter.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments