Budget For Fy25: 53pc rise in allocation for debt servicing

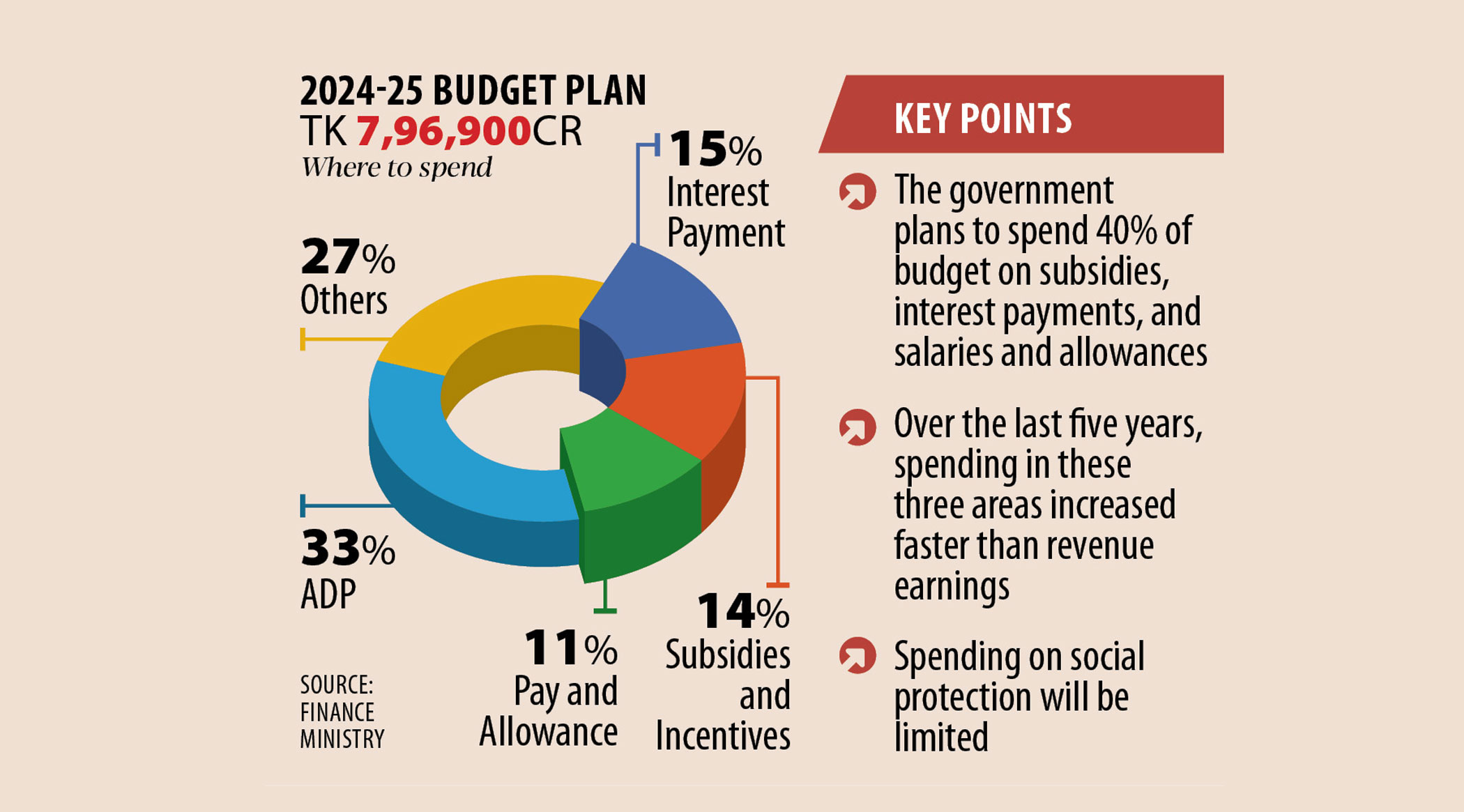

The government's allocation to repay foreign debts may reach Tk 57,000 crore in the next budget, a 53 percent rise from the current year, putting further pressure on the country's dwindling foreign currency reserves.

The interest payments for increasing levels of foreign loans in recent years and the tumbling value of the taka against the US dollar have forced the government to set aside more for debt servicing.

Allocation for foreign debt repayment has been Tk 37,076 crore in the current fiscal year, according to the finance ministry.

The dollar traded at an average of Tk 109.97 in FY24, according to Bangladesh Bureau of Statistics.

Considering this exchange rate, the government has paid $3.36 billion in the current fiscal year and will require $5 billion in the next fiscal year of 2024-2025.

However, an official of the Economic Relations Division (ERD) said the actual amount of the repayment would depend on the exchange rate between the taka and the dollar at the time of repayment.

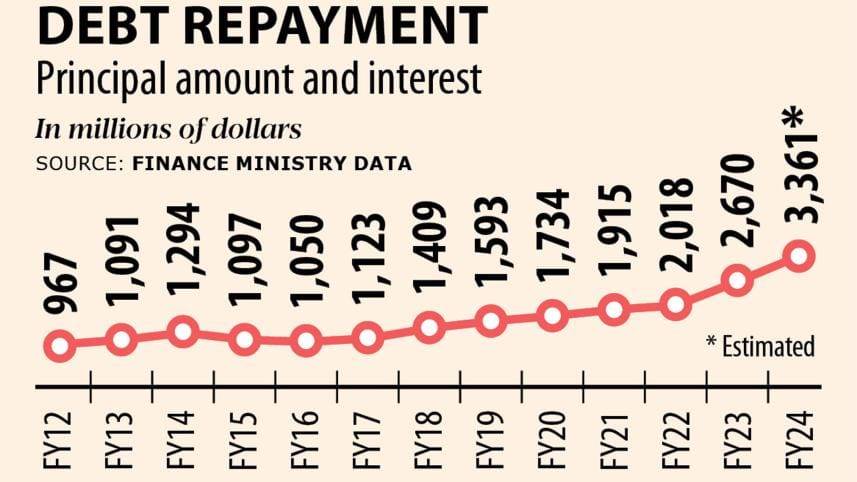

Bangladesh's foreign debt service requirement has increased over the years, with the amount crossing the $1 billion-mark for the first time in 2012-13.

After nine years, in 2021-22, the amount went past $2 billion. The following year, Bangladesh paid $2.67 billion in debt servicing. The amount is going to be over $3 billion in the current fiscal year.

In the first nine months of FY24, debt service repayment in both principal and interest amounted to $2.57 billion, a 49 percent increase year-on-year.

Interest payments alone reached $1.05 billion in July-March. This was the first time the interest payment crossed the $1-billion mark. It was $485 million in the first nine months of FY23.

Prof Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, said spending $2 billion or $3 billion in servicing debts would not be a problem if the forex reserves were $46 billion, which was the case in early 2022.

When the reserves are less than $20 billion, spending $5 billion to repay loans becomes difficult because the payment has to be made in foreign currencies, and for foreign currencies, the country needs the earnings, he said.

On May 21, the reserves stood at $18.61 billion, central bank data showed.

"In the next few years, debt servicing will be a major issue, and we should be careful in managing the debt repayment and try our best to earn more through export and remittance," Prof Mustafizur said.

Besides, the government needs to demonstrate zero tolerance on capital flight, which often takes place through hundi, he said.

The economist said the government should be careful in choosing and implementing projects and ensure the desired outcome of the schemes.

With its rising per capita income, Bangladesh's access to cheap loans is decreasing and foreign borrowing is also becoming costlier.

According to an ERD report, the country now has to borrow at the costlier market-based rates to cover the development spending.

The interest rate risk is high when the debt portfolio is dominated by market-based rates because the volume of the payment is based on the vagaries of the global economy.

The cost of foreign loans has been on the rise as the interest rates have shot up globally. The interest rates for market-based loans have also increased significantly, an ERD official said.

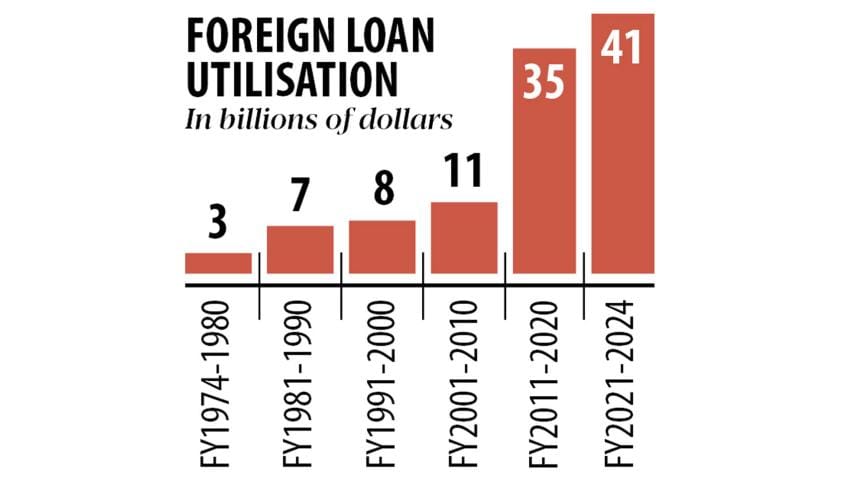

In 2023, the government borrowed about $2.6 billion at the market-based rate, which accounted for 30.7 percent of the total committed loans. In 2022, it was $3.42 billion, representing 43.9 percent of the total.

The ERD official said the funds released for mega projects like the metro rail, the Matarbari power plant, and the Rooppur Nuclear Power Plant have increased in recent times as the physical works are in the final stage.

Besides, Bangladesh received significant budgetary support in the last three years after development partners accelerated lending to help the economy make a turnaround from the impacts of the coronavirus pandemic. This has pushed up the loan repayment.

"Moreover, the grace period of some major loans will come to an end over the next few years," Prof Mustafizur said.

During the grace period, a borrower pays only the interest. After it expires, both interest and principal amounts are paid in instalments.

With Bangladesh set to graduate from the group of least-developed countries, the costs have gone up while the share of concessional loans has come down drastically, he added.

"Also, the country has borrowed large amounts over the last few years."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments