Bond trading in secondary market still negligible

The trading of treasury bonds in the stock exchange of Bangladesh has remained low although eight months have passed since their debut on the secondary market, owing largely to higher transaction costs and a lack of awareness among individual investors.

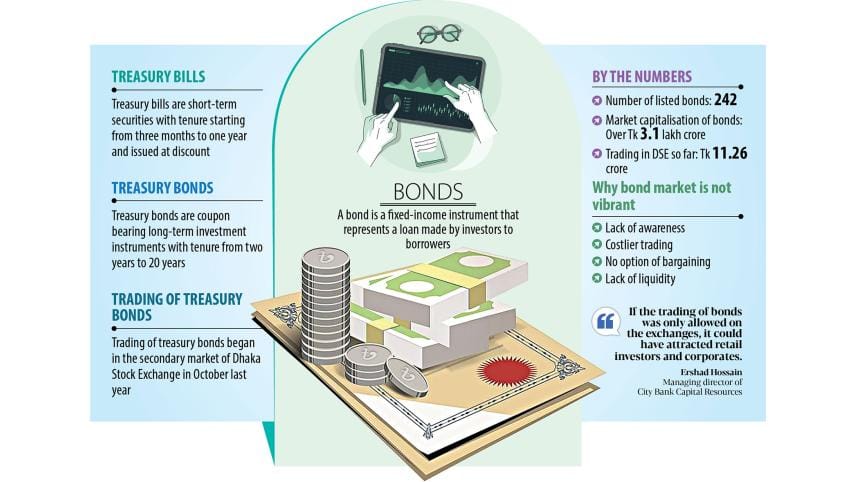

Treasury bonds made their debut on the Dhaka Stock Exchange (DSE) on October 11 of 2022, offering a new product to investors in a market not rich with adequate investment options.

But as of June 21, treasury bonds worth Tk 11.26 crore were traded.

Through the central bank, the government issues treasury bills and bonds to borrow from the market.

Treasury bills are short-term instruments with repayment periods ranging from three months to one year and are issued at a discount. Bonds are coupon-bearing long-term investment instruments, which carry repayment periods of two years to 20 years.

The head of treasury of a bank blamed the higher transaction cost for the lower trading volume.

At present, the commission on selling treasury bonds is 0.1 per cent or Tk 20,000, or whichever is lower, while there is no cost involved when banks trade securities and bonds with each other.

"On the other hand, there is no enough buyers and sellers in the stock exchange," said the banker.

He added that banks can negotiate prices when buying and selling securities on the central bank's trading platform. "That is not possible in the stock exchange."

Ershad Hossain, managing director of City Bank Capital Resources, said bond trading in the secondary market is almost negligible as structural problems have remained unaddressed.

He explained that since the interbank trading of treasury bonds under the infrastructure of the central bank is still operational and this involves no cost, banks prefer to trade using the old system instead of the stock market.

"If the trading of bonds was only allowed on the exchanges, it could have attracted retail investors and corporates."

City Bank Capital Resources is a merchant bank and has worked as the issue manager for many corporate bonds.

Another bottleneck, according to Hossain, is when sellers want to sell bonds through stock exchanges, approval needs to be taken from the Central Depository Bangladesh Limited.

Sellers see this as an extra burden since they require no such approval while trading on the interbank platform, he said.

"As a result, better return-paying bonds are not available on the exchange."

Hossain said the awareness about bonds is still low among individual investors, so all stakeholders should work on it.

"In order to make the bond market vibrant, banks should trade bonds through the new board."

At present, 242 treasury bonds worth more than Tk 3.1 lakh crore are listed on the DSE.

Md Moniruzzaman, managing director of Prime Bank Securities Limited, said the willingness to buy bonds among investors is low.

"Only a few investors have proper knowledge about bonds and can choose lucrative bonds and know when to buy them."

A treasury official of a non-bank financial institution echoed Moniruzzaman.

"Most investors do not know how to buy bonds and what the yield and the underlying interest rate is. It is a completely new product for individuals."

He said when high-net-worth individuals want to buy bonds, they go to fund managers since they can guide them.

"But brokers can't guide them properly."

Shahidul Islam, chief executive officer of VIPB Asset Management, said a parallel secondary market for treasury bonds exists and it has been there for long.

"And we are accustomed to trading using the traditional method."

"In order to make the stock exchange's board more liquid, individual investors' participation needs to increase. If the yield gap between savings certificates and treasury bonds narrows, people will invest in bonds."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments