BB to step in if banks don’t merge voluntarily by Dec

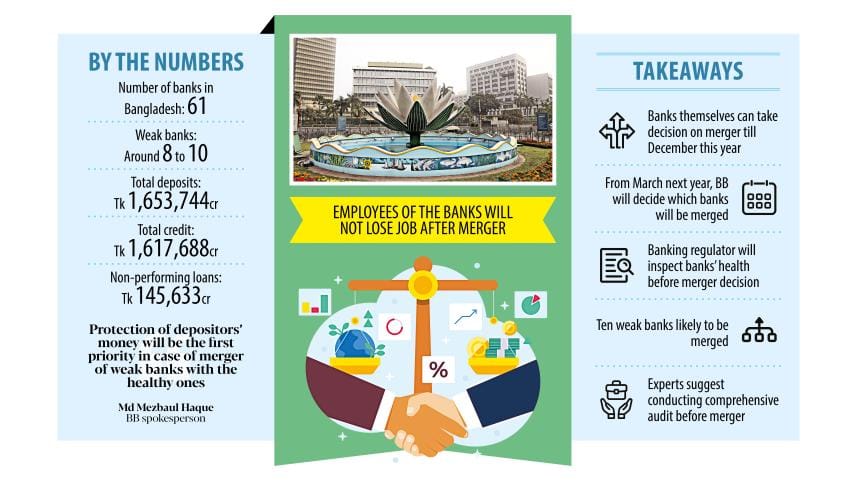

Bangladesh Bank yesterday said it would take the initiative for the mergers and acquisition of banks from March 2025 if they fail to do so voluntarily by December this year.

"The central bank will assess the scenario after December and take steps accordingly," BB Executive Director and Spokesperson Md Mezbaul Haque told reporters at the central bank headquarters.

In December, the BB issued a guideline, known as the Prompt Corrective Action (PCA) framework, to give a procedural direction for mergers and acquisitions amidst the deteriorating financial condition of some banks and financial institutions.

The move has stoked concerns among many, including savers.

However, Haque said: "The protection of depositors' money will be the first priority in the case of mergers and acquisitions of weak banks with sound ones. The protection of strong banks will also be a priority."

The central bank will issue a detailed guideline on mergers and acquisitions, he said.

"The mergers will be carried out as per laws and employees will not lose their jobs."

Both weak and strong banks will be evaluated by audit firms before the BB takes any decision on their mergers.

"There are many examples of mergers and acquisitions in the world. We are trying to learn from their experiences," Haque said.

The spokesperson said weak banks are already being evaluated by the stock market and it is evidenced by the low prices of their shares.

When his attention was drawn to the recent media reports on the list of banks belonging to the red, yellow and green zones, Haque said this is not the proper method to analyse the health of lenders.

"The list is an evaluation of a department of the central bank -- this is not the overall assessment of the central bank."

He said the list was prepared for research purposes and not for publishing in the media.

A week ago, central bank governor Abdur Rouf Talukder formally informed the owners of banks that weak lenders will be merged with stronger ones within a year and the banking regulator has got down to working towards it.

He also assured them that the mergers would help both strong and weak banks.

According to an official of the BB, around 40 out of a total of 61 banks in the country were performing well. The remaining were weak and of them, 10 would be merged.

Talukder has also asked managing directors of banks to discuss how to combine the balance sheets of weak banks with sound lenders.

Merger is an accepted practice globally.

"It is possible in our country. At the same time, it is also difficult in our political economy," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, recently.

Before mergers, the central bank should restructure the board and management of some weak banks and conduct a comprehensive audit, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments