BB plans raft of measures to fight economic crisis

The Bangladesh Bank is going to take a raft of policy measures to tackle inflationary pressure, volatility in the foreign exchange market and growing non-performing loans (NPLs) and give a much-needed boost to the forex reserve.

As part of the move, the banking regulator is preparing a policy stance on how to address the four areas.

Three senior officials of the central bank, seeking anonymity, told The Daily Star that the BB has already framed a draft policy and started to take opinions from economists and other stakeholders on it.

Governor Abdur Rouf Talukder and four deputy governors met with noted economist Wahiduddin Mahmud on Thursday.

The central bankers are expected to sit with Sadiq Ahmed, vice-chairman, and Ahsan H Mansur, executive director, of the Policy Research Institute of Bangladesh, this week and chambers, trade bodies and the Economic Reporters Forum, later.

"The policy stance will be finalised after taking opinions from stakeholders. Its implementation will be visible through the next monetary policy but some measures will be implemented soon," said a central banker.

Another official said it would be a sustainable policy aimed at betterment of the financial sector and the central bank will implement it.

On Thursday, Prof Mahmud told The Daily Star that the policy stance to be prepared by the central bank will have to be transparent and credible.

The move from the banking regulator comes at a time when the economy faces multiple challenges, including skyrocketing inflation, volatility in the forex market, depleting forex reserves, and growing NPLs.

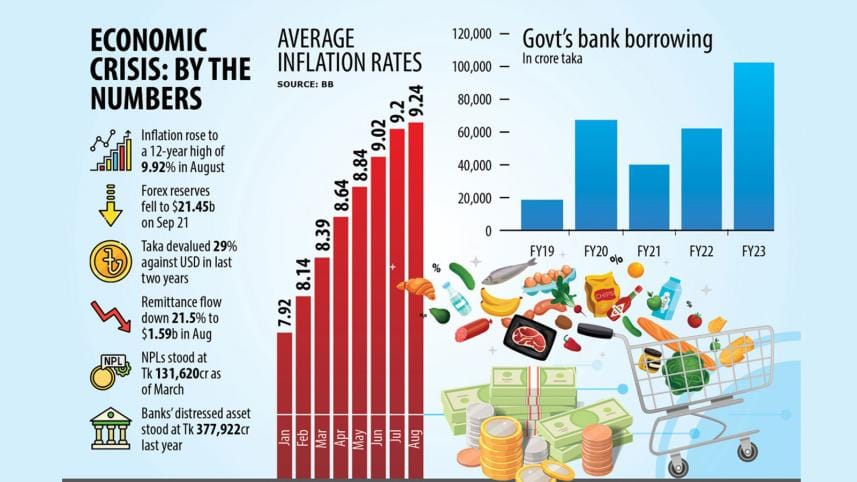

Average inflation rose 23 basis points to a 12-year high of 9.92 percent in August against the government's full fiscal year target of 6 percent. In July, it stood at 9.2 percent. And the inflation shows no sign of abating.

The forex reserves came down to $21.45 billion on September 21, due to higher demand for the US dollar compared to the inflow.

The local currency lost its value by nearly 29 percent against the American greenback in the last two years. The dollar traded at Tk 110 yesterday, which was Tk 85.8 in January last year.

Experts have blamed the central bank's control over the interest rate and the exchange rate for the current economic woes.

In June, the BB finally withdrew the lending cap and introduced a market-based rate to meet conditions attached to the International Monetary Fund's $4.5 billion loan. But market observers say the rate is not fully market-based yet.

Similarly, although the rules governing the forex market have been eased, a fixed exchange rate still prevails.

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, welcomes the BB move.

"It is good that the central bank is taking opinions from stakeholders, including economists."

"But if the recommendations or opinions are not implemented, there is no point of taking the recommendations."

Hussain says the interest rate and the exchange rate are still administered and the rates have not brought any positive results.

"Both rates have to be fully market-based."

The mounting NPL is another concern for the economy.

In March, the NPLs stood at Tk 1,31,620 crore, marking a significant 16.02 percent year-on-year increase. This represented 8.80 percent of the total loans disbursed.

However, the distressed assets in the banking industry amounted to Tk 3,77,922 crore in 2022, according to BB's Financial Stability Report 2022.

Prof Mahmud emphasised accelerating the defaulted loan recovery when he met with the central bankers.

"Credit expansion is not possible without realising the bad loans."

Selim Raihan, executive director of the South Asian Network on Economic Modeling, raises questions about whether the central bank works independently.

"The monetary policy will have to be implemented independently and it will also have to be dynamic. Just formulating a policy is not enough."

The economics professor said in the case of reducing NPLs and bringing governance to the banking sector, especially at public banks, the sole authority should be given to the BB.

But the central bank can't monitor public sector banks properly as they operate under two regulators, namely the BB and the finance ministry.

"The central bank will have to assume the leadership in the banking sector."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments