Shariah bank merger gains momentum

- Government tables ordinances to overhaul banking

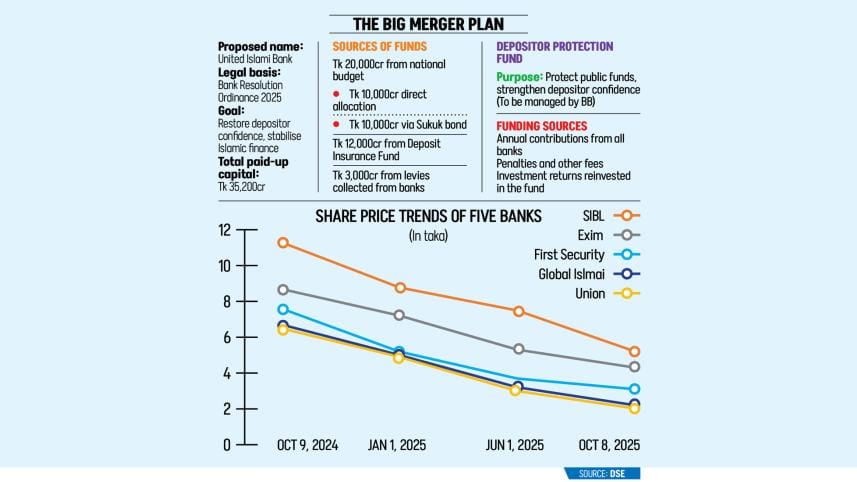

- Five shariah banks merging into United

- Tk 35,200cr capital set for entity

- Depositor fund ensures Tk 2 lakh

The government is set to table two draft ordinances related to overhauling the country's troubled banking sector at the advisory council meeting today.

One draft ordinance is about the merger of five struggling shariah-based lenders into a single entity, to be called United Islami Bank, while the other seeks to set up a Depositor Insurance Authority to protect public funds.

According to finance ministry officials, the paid-up capital of the proposed new shariah bank has been set at Tk 35,200 crore.

Of this, Tk 20,000 crore will come from the national exchequer, with Tk 10,000 crore drawn from the current fiscal year's allocation and the remainder raised through Sukuk bonds.

The remaining capital will come from the Deposit Insurance Fund, contributing Tk 12,000 crore, while levies collected from banks will add another Tk 3,000 crore.

The five banks identified for the merger are First Security Islami Bank, Union Bank, Global Islami Bank, Social Islami Bank, and Exim Bank.

"This is the most ambitious banking sector reform in the country's history," said a senior finance ministry official, requesting anonymity.

"It is designed to avoid the cost and consequences of liquidation and to restore depositor confidence in Islamic finance," added the official.

Depositors of the merged banks will be allowed to withdraw up to Tk 2 lakh if they choose to close their accounts.

Larger individual deposits will be repaid in phases, while institutional depositors will be reimbursed through a separate mechanism, the official added.

If approved, United Islami Bank will proceed with licensing and operational formalities. Officials said the proposed name may be revised based on discussions at today's meeting, to be chaired by Chief Adviser Prof Muhammad Yunus.

The merger is being carried out under the newly enacted Bank Resolution Ordinance 2025, which grants broad powers to restructure weak banks.

The move follows forensic audits conducted earlier this year by international accounting firms, which found alarming levels of financial distress in the five banks.

The audits showed that non-performing loans (NPLs) accounted for 96.37 percent of total loans at First Security Islami Bank. Union Bank followed with 97.8 percent, Global Islami Bank 95 percent, while Social Islami Bank and Exim Bank recorded 62.3 percent and 48.2 percent, respectively.

As of May this year, combined deposits at these banks stood at over Tk 1.36 lakh crore, according to the Bangladesh Bank.

After the political changeover in August last year, the central bank dissolved the boards of these banks and formed new ones. The forensic audit findings prompted the interim government to move ahead with the merger plan.

In a parallel move, the draft of the Depositor Protection Ordinance will be presented before today's advisory council meeting.

The draft law proposes the creation of a Depositor Protection Fund to be managed through a designated account at the Bangladesh Bank.

All banks will contribute annually through risk-based and special premiums. The fund will also receive money from penalties and other sources, with investment earnings reinvested into the scheme.

From the fund, the draft act proposes an initial protection ceiling of Tk 2 lakh per depositor, subject to review every three years by a board led by the central bank governor.

Officials said a separate managing board will oversee the fund.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments