Foreign banks top profits, trail in social spending

- Foreign banks profit most, spend least

- Shariah-based lenders lead CSR allocations

- Private banks second, state banks lag

- Experts urge BB to mandate spending

Multinational banks operating in Bangladesh posted the highest profits in 2023 but spent the least from it for social responsibility purposes the following year, according to Bangladesh Bank (BB) data.

In comparison, shariah-based banks led in corporate social responsibility (CSR) spending in 2024, directing funds to education, healthcare, the environment, disaster relief, women's empowerment and financial inclusion.

Local private banks ranked second, followed by state-owned lenders.

Foreign banks argued that their smaller allocations reported by the BB do not indicate a lack of commitment to social or environmental causes. They said their approach focuses on impact rather than volume of spending.

Banking experts, however, believe the central bank should urge foreign lenders to increase CSR contributions, especially as they continue to make large profits annually.

CSR refers to banks using part of their profits to support initiatives that align with national priorities such as poverty reduction, climate action and the Sustainable Development Goals (SDGs). It combines charitable giving with structured development work.

According to the central bank's CSR guidelines, banks are encouraged, not mandated, to engage in social spending. But there is no minimum threshold for it. Still, the commercial lenders are required to report their spending in a prescribed format to the BB.

WHO SPENT HOW MUCH

Foreign banks collectively made Tk 4,453 crore in profit in 2023 but spent only Tk 25 crore, or 0.56 percent, on CSR next year.

In contrast, despite financial troubles, shariah-based banks spent about 9 percent of their Tk 2,658 crore profit on CSR. Local private banks contributed 4.2 percent, while state-run lenders spent 0.59 percent, according to the central bank.

Nine banks spent nothing on CSR in 2024. Most of them are long-term loss-makers, while one new bank had no profits to spend.

Agrani Bank's CSR spending was the lowest at 0.08 percent of its profit, followed by Woori Bank at 0.13 percent, Commercial Bank of Ceylon at 0.16 percent and State Bank of India at 0.18 percent. Citi Bank NA spent 0.19 percent.

In contrast, Mercantile Bank allocated 21 percent of its profits, Jamuna Bank 15.3 percent, and EXIM Bank 15.2 percent.

In monetary terms, EXIM Bank spent the most at Tk 49 crore, followed by Premier Bank at Tk 47 crore. Islami Bank and Mercantile Bank each spent Tk 42 crore.

In the first half of 2025, Islami Bank, EXIM Bank, AB Bank, First Security Islami Bank and Social Islami Bank spent over Tk 16 crore combined, even as some struggled to repay depositors.

Toufic Ahmad Choudhury, former director general of the Bangladesh Institute of Bank Management (BIBM), said banks in financial trouble should focus on protecting depositors before spending on CSR.

On meagre CSR spending by foreign banks, he said, multinational banks are making hefty profits every year in Bangladesh, so they should spend much more on CSR.

Globally, India became the first country to make CSR spending mandatory in 2014, requiring eligible companies to allocate 2 percent of their average net profits.

Similar rules apply in Indonesia, Mauritius and Denmark, while in the UK and Spain, CSR forms part of corporate governance.

Referring to those global practices, Choudhury said the BB should follow international examples and hold multinational banks accountable for their low CSR spending.

FOREIGN BANKS CLAIM GREATER CONTRIBUTIONS

Standard Chartered Bangladesh (SCB) was the most profitable bank in 2023, but one of the lowest CSR spenders next year. It earned Tk 2,335 crore in profit that year but spent less than Tk 20 crore on CSR, or about 0.85 percent, in 2024.

In 2024, SCB's profit rose to Tk 3,300 crore. The foreign lenders said it plans to spend Tk 33 crore on CSR this year. By mid-2025, the bank had spent Tk 5.6 crore.

"It is important to note here that the Bank has also spent more than Tk 47 crore across 2023 and 2024 in the agricultural sector and reported to a separate department of the Bangladesh Bank," SCB said in a written response to The Daily Star

The foreign lender said its CSR spending difference with other banks is not due to "reduced commitment", but the result of their "strategic allocation approach". It was "guided by several principles, such as impact over expenditure, strategic allocation over volume, holistic value creation, and transparency, accountability, and compliance."

HSBC Bangladesh, the second-highest profit maker with Tk 999 crore in 2023, spent only Tk 2.86 crore, or 0.29 percent, on CSR last year. It plans to spend Tk 1.89 crore in 2025 and has already disbursed Tk 1.54 crore in the first six months.

HSBC said it also funds projects through global programmes, such as the HSBC Water Programme, which spent Tk 45 crore in Bangladesh between 2012 and 2019, and the "English and Digital for Girls Education" initiative, which received $0.35 million.

Another $0.35 million went to a financial literacy project for cottage and micro-enterprises. The bank is now working with the Apparel Impact Institute to help decarbonise the garment sector and is funding a Tk 30 crore agriculture project launched in 2023.

"These are not included in the Bangladesh Bank report," HSBC said.

Even accounting for such initiatives, analysts say foreign banks' total social spending is low relative to their profits.

Citi Bangladesh said, "Citi Foundation and Citi Bangladesh jointly contribute significantly to CSR initiatives in the country; however, the local CSR spend is only reflected in Bangladesh Bank CSR Reports."

Since 1999, Citi Foundation has contributed more than $5 million to NGOs in Bangladesh. It disbursed Tk 10.7 crore for food security projects in 2023, Tk 5.75 crore in 2024 for homelessness initiatives, and Tk 1.15 crore to help flood victims in August 2024.

"Although there is no specific regulatory mandate on the profit percentage contribution for CSR, Citi Bangladesh is committed to increasing the CSR budget and ensuring proper utilisation," it said.

Commercial Bank of Ceylon said it doubled its CSR budget in 2023, increased it by 40 percent in 2024 and by over 103 percent in 2025 for a special cause. It said it also makes special contributions to humanitarian and national causes.

OVERALL CSR SPENDING KEEPS FALLING

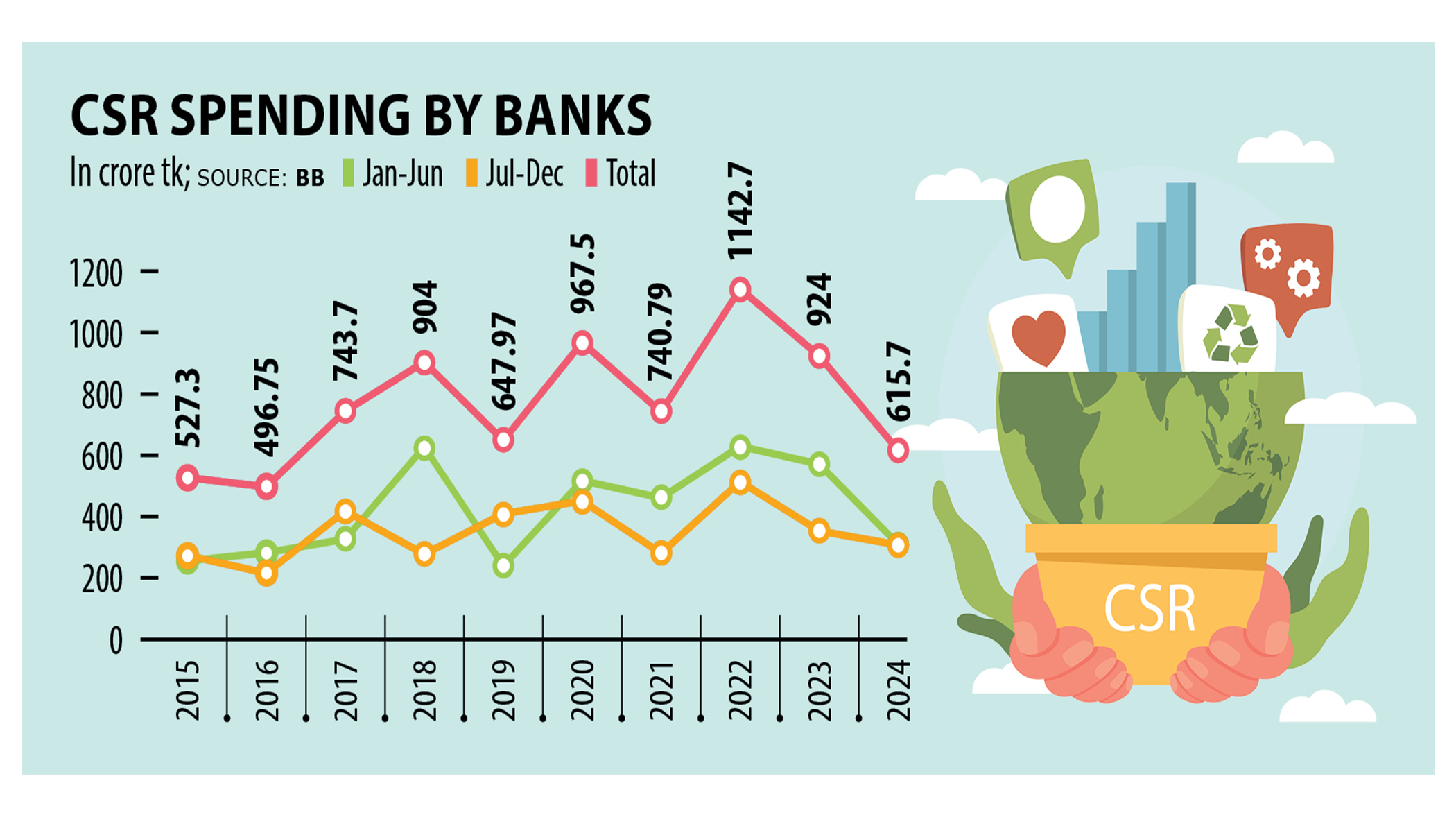

Last year, the overall CSR spending by banks fell to an eight-year low. Total spending dropped by 33 percent year-on-year to Tk 615 crore, marking the second consecutive annual decline since a record Tk 1,142 crore in 2022.

Almost half of the total was used for disaster management, including winter relief and flood aid.

Banks also donated heavily to various foundations and the Prime Minister's Relief and Welfare Fund under the previous government.

Some bankers said these contributions were made under "political pressure".

Setting aside those issues, former BIBM director general Choudhury said questions remain over how local banks select CSR projects.

"Their spending should be inclusive. Many banks fund causes linked to the localities of their board members. But CSR should have a lasting impact on education, healthcare and the environment," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments