Falling stocks worry regulator

Dhaka stocks continued their losing streak for the fifth consecutive session yesterday in a worry for the market regulator.

The DSEX, the benchmark index of the Dhaka Stock Exchange, lost 18.5 points, or 0.31 percent, to end the day at 5,869.

Turnover, however, was up more than 20 percent at Tk 440 crore from the previous session.

The continuous fall coincided with a meeting at the finance ministry yesterday. The ministry sat with the representatives of the Bangladesh Bank and the Bangladesh Securities and Exchange Commission (BSEC) to take stock of the market.

However, no instruction came forth from the meeting, said a senior executive of the BSEC.

Eunusur Rahman, senior secretary of the financial institutions division, said they had an informal meeting with the BB and the BSEC. "We were trying to know what is happening with the stock markets," Rahman said.

Maybe, he said, the market has been affected by the recently-announced monetary policy and the BB's strong position.

On January 30, the central bank lowered conventional banks' loan-deposit ratio by 1.5 percentage points to 83.5 percent and Islamic banks' by 1 percentage point to 89 percent to tighten the money supply. The BSEC has kept its eyes open to know whether there is any aggressive selling by institutional investors, said Saifur Rahman, executive director of BSEC.

“We are worried about the current downfall,” said Rahman.

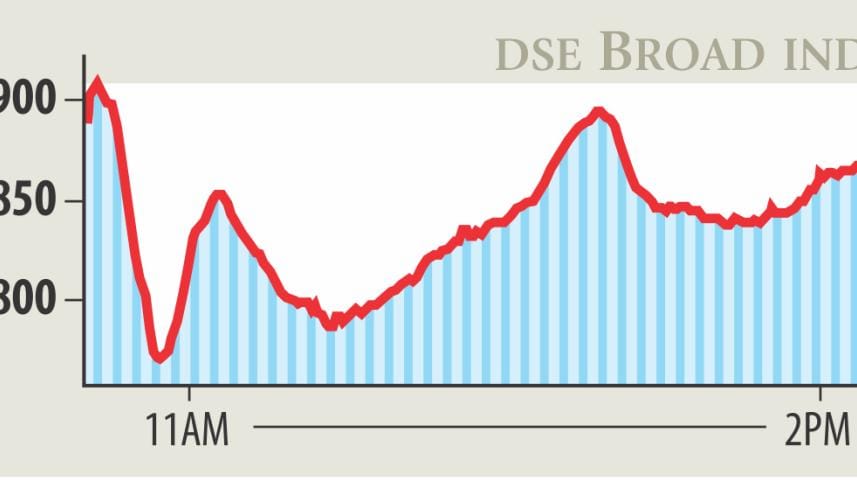

The prime index dipped more than 130 points in the first half of the trading session and came even below 5,800 points.

But in the second half, the index recovered as opportunists took a fresh position to buy shares at lower prices, said market insiders. On Sunday, the premier bourse saw its biggest fall of 133.15 points in four and a half years as political unease looms large on investors' minds.

“The market exhibited roller-coaster pattern with the intra-day volatility of 138.3 points in the broad index yesterday amidst active presence from both pessimistic as well as opportunity-hunter investors,” said EBL Securities in its daily market analysis.

The steady bearish streak in the market along with liquidity crisis and political uncertainty kept the investors worried, while another group of investors opted to take the fresh position in stocks that witnessed heavy price fall in the recent period, said the analysis.

Selling pressure was spurred on stocks from banks, food and allied and textile sectors, according to the analysis.

Among the major large-cap sectors, non-bank financial institutions, pharmaceuticals and fuel and power registered positive movements with 0.46 percent, 0.44 percent, and 0.23 percent gains respectively. On the DSE, 111 securities gained, 186 declined and 38 remained unchanged.

Beximco Pharmaceuticals topped the turnover list, followed by Square Pharmaceuticals, LankaBangla Finance, GP, and Brac Bank. The port city bourse, the Chittagong Stock Exchange, also ended in the red. The CSCX and the CASPI fell 53.19 and 88.96 points respectively.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments