Budget to get bigger by 21pc

The forthcoming budget, set to be announced today, is going to be an increase of 21.65 percent over the current year owing to the new pay scale for government staff and increased development expenditure.

The projected revenue stream upon which the enlarged budget has been prepared is optimistic, said an official of the finance division.

“We are not worried, as neither the expenditure projection nor the revenue projection will turn out to be true at the end of the year.”

Every year, at the time of preparing the budget, the finance division invariably finds itself in a tight spot, trying to meet the demands from various ministries and divisions.

“New viable sources of revenue collection are hard to find compared to the expenditure demand.”

But, at the end of the fiscal year, a large part of the target set by the government typically remains unimplemented, he added.

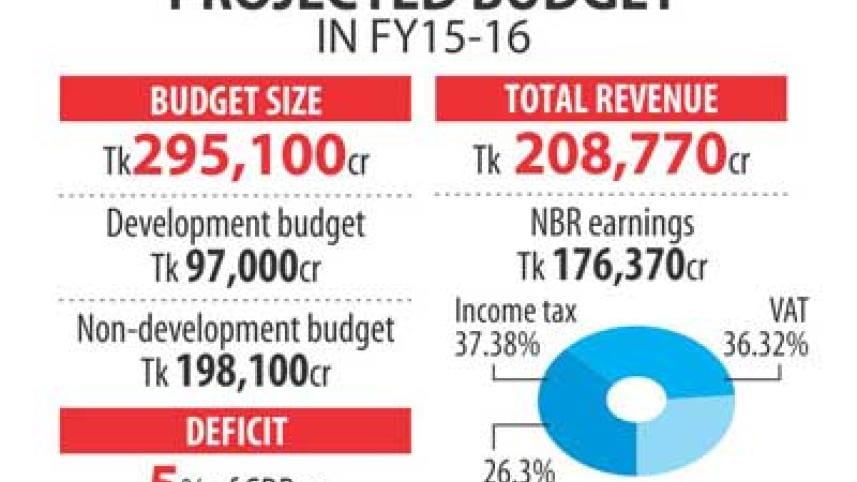

The size of the budget, which will be the country's 44th, is likely to be Tk 295,100 crore.

Some Tk 97,000 crore has been earmarked for development expenditure, which is an increase of 29 percent over the current year.

At least another Tk 16,000 crore will be required to implement the new pay scale for government staff, due to take effect from July.

Debt servicing may increase by Tk 3,000 crore to Tk 4,000 crore in fiscal 2015-16 from the current year's Tk 31,034 crore.

To meet the expenditure, 27.78 percent revenue growth has been estimated despite the current fiscal year's poor performance in revenue collection.

Around 85 percent of the total revenue comes from the National Board of Revenue, and they have been tasked with boosting their collection by 31 percent over the current year.

To facilitate the increased collections, the scope of value-added tax will be widened and some innovative measures imposed, the finance division official said.

On the income tax side, besides increasing the number of taxpayers, initiatives will be taken to collect more taxes through reform measures.

Another big source of funds for the government is non-tax revenue, whose target has been increased about 14 percent year-on-year.

The budget deficit has been kept within five percent of the gross domestic product, which is in keeping with international practices.

A big portion of the deficit will be met through high-cost internal borrowing, which is around Tk 55,880 crore. Of the amount, Tk 38,380 crore will be borrowed from the banking system and the remaining from savings instruments.

The reason for financing a bigger chunk of the deficit by bank borrowings is that the cost of funds is much lower than savings instrument at present, said the official.

Furthermore, the banks are flush with liquidity due to the sluggish investment situation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments