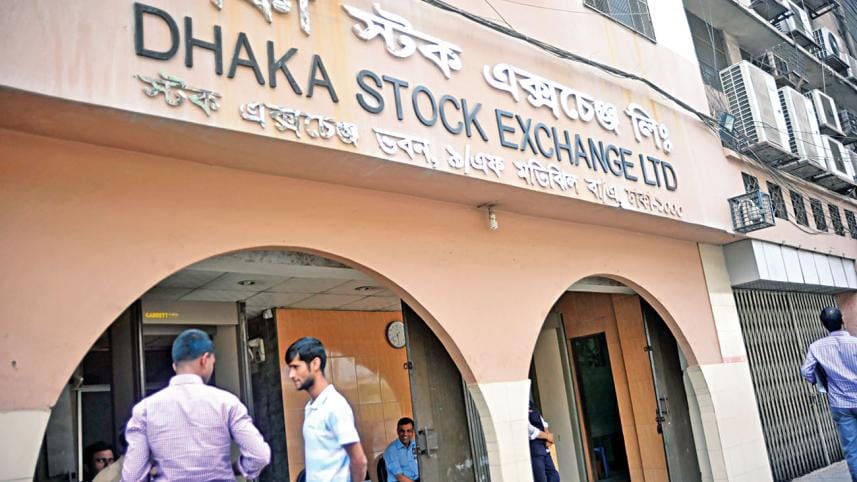

Stocks rebound at last

Stocks rallied the best in six-and-a-half months yesterday after sinking for more than three weeks. The bounce back was due to the central bank and the capital market regulator teaming up to prop up the flagging market.

DSEX, the benchmark index of the Dhaka Stock Exchange, closed at 5,077 points after soaring 111 points, or 2.24 percent -- the biggest single day leap since January 8.

Between June 28 and July 22, the index had lost 463.6 points and investors’ Tk 27,500 crore were wiped out.

The rebound comes as the Bangladesh Bank on Monday verbally asked banks and non-banks financial institutions that have the capacity to invest to support the market.

As per its information, 19 lenders have the scope to park Tk 2,000 crore in the market.

Similarly, the Bangladesh Securities and Exchange Commission asked the DSE to order all stock brokers to ensure due authorisation from their clients for sell orders before placing them into the system.

In other words, investors would have to physically go to the brokerage house to place the sell order instead of just picking up a phone.

Both the actions arrested the free fall of the index.

“Such a massive bounce back is only possible with intervention of the regulators,” said Mizanur Rahman, professor of the Dhaka University’s accounting and information systems department.

The regulators drummed up support from the institutional investors to make retail investors feel less nervous. At the same time, they tried to reduce the sell pressure.

“So, it can be termed as an artificial rise,” he added.

Ali Xahangir, chief executive officer of Amarstock, a website that provides technical analysis on the market movements, sounded even more pessimistic.

“The investment from the financial institutions is an eye-wash. They will not be able to support the market for long as they are suffering from liquidity crisis.”

The technical analysis shows the rise is a dead cat bounce, Xahangir added.

Dead cat bounce means a temporary recovery from a prolonged decline or a bear market that is followed by the continuation of the downtrend.

Were the index and turnover both higher yesterday in comparison with the previous day the rally would have been considered a genuine one.

But the turnover slid 31.7 percent to Tk 317 crore yesterday.

AB Mirza Azizul Islam, a former chairman of the BSEC, however, was more appreciative of the regulators’ interventions.

“Since the market has been falling for a long time, it was expected that the regulator would take some steps to boost the investors’ confidence. This is a positive move,” he added.

The institutional investors were ordered to provide as much support as possible to the market in order to stop the free fall, said Mostaque Ahmed Sadeque, a former president of the DSE Brokers’ Association.

“And their activities were monitored. So, some institutions poured money into the market,” he added.

If the index does not soar for the next 7 or 8 days at least, investors’ confidence will once again sap, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments