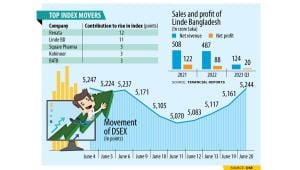

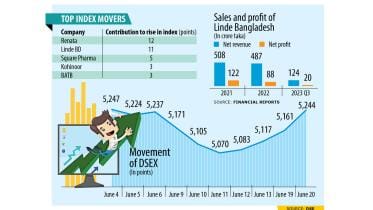

Linde, Renata surge, sending Dhaka stocks to two-month high

Stocks in Bangladesh climbed 1.6 percent yesterday, driven by a surge in the prices of some blue-chip companies such as Renata PLC and Linde Bangladesh.

20 June 2024, 18:00 PM

Both inbound, outbound FDIs drop for Bangladesh

Unctad’s World Investment Report shows

20 June 2024, 16:25 PM

It’s time to correct fiscal stance

The government has not addressed the stability issue through its fiscal policy for two years in a row although the economy is in turmoil owing to both external and internal pressures. A noted economist, however, thinks it can bring the situation under better control through the budget in the next fiscal year beginning on July 1.

2 June 2024, 18:00 PM

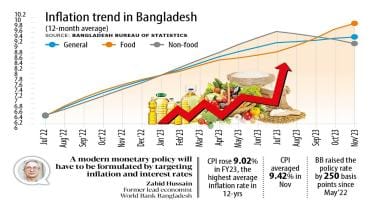

Inflation battle must be at the centre of budget

Fighting raging inflation and putting the economy back on track have not been taken seriously as evidenced from the government’s delayed response, which set the scene for one of the worst economic crises in its history and an unprecedented prolonged period of higher consumer prices, said an economist.

2 June 2024, 18:00 PM

Govt not using full strength to restore macroeconomic stability

The government is not moving at full throttle in bringing discipline to the banking sector, implementing reforms wholeheartedly, taking measures against syndication, and bringing money launderers under the rule of law, said a top economist.

2 June 2024, 18:00 PM

FDI slips but stays above $3b

Foreign direct investments to Bangladesh snapped its rising trend in 2023, highlighting the nervousness outside investors face in pumping money into a country whose foreign exchange regime is experiencing one of its worst periods in recent times

29 May 2024, 03:18 AM

Bangladesh lowers cash incentive for exporters to prepare for post-LDC era

The government has cut the export subsidy for almost all sectors to reduce the pressures on Bangladesh's coffers and bring down the rates gradually

31 January 2024, 01:00 AM

No time to waste as new finance minister inherits wobbly economy

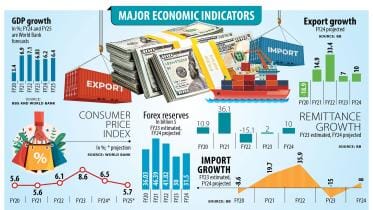

The economy is losing momentum. Inflation remains stubborn. Bangladesh is facing deterioration in external buffers, with official reserves falling to $20.18 billion as of January 10, less than half their historic peak in 2021. The currency shock is lingering.

12 January 2024, 00:30 AM

With election over, economy to take centre stage in 2024

The economy now can take the centre stage with the elections finally done for

8 January 2024, 16:25 PM

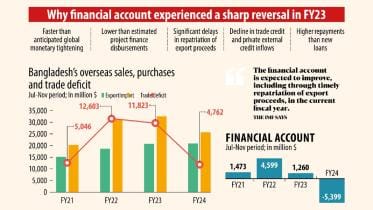

Financial account deficit swells as outflows intensify

Central bank data highlights continuing financial account deficit in the face of international currency outflow

4 January 2024, 17:10 PM

Can Bangladesh put economy back on track in 2024?

The present government started its journey at a time when the global economic environment was conducive to growth and low inflation. Food prices had stabilised after the global food crisis of 2007-08. Interest rates were lowered globally in response to the global economic crisis of 2008.

31 December 2023, 00:56 AM

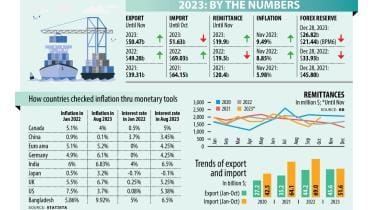

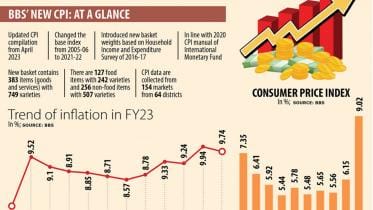

Inflation shock: A weaker taka accounts for half of it

The pass-through of a sharp depreciation of the local currency accounted for half of the inflation surge seen in Bangladesh in the last financial year, according to the International Monetary Fund (IMF)

25 December 2023, 00:00 AM

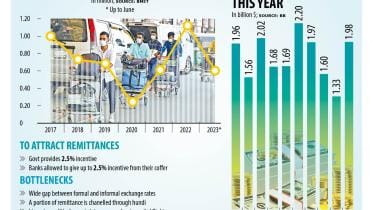

Relaxed incentive rules send remittance to a four-month high

Migrant workers sent home $1.98 billion in October, a four-month high, as banks stepped up efforts to woo more remittance buoyed by a relaxed central bank rule on incentive, a development that is expected to give some relief to a country reeling under the foreign exchange crisis.

1 November 2023, 20:54 PM

Pain deepens as food inflation stays above 12%

Food inflation in Bangladesh stayed above 12 percent for the second consecutive month in September as prices showed no signs of cooling down, hitting the pockets of the consumers who spend most of their incomes to feed their families.

4 October 2023, 01:47 AM

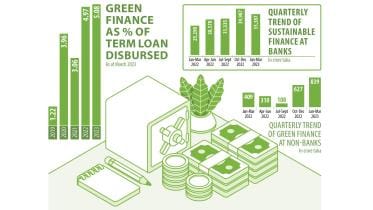

Sustainable finance on the rise

Sustainable finance extended by banks rose nearly 40 percent year-on-year to Tk 35,387 crore in the first quarter of 2023 as lenders keep disbursing a higher volume of loans to eco-friendly businesses and industries, official figures showed.

24 August 2023, 18:00 PM

Banks’ forex balances on the rise

Gross foreign exchange balances held by commercial banks in Bangladesh rose to a 19-month high of $5.53 billion in June, owing to lower imports and higher export and remittance earnings, central bank data showed.

25 July 2023, 00:00 AM

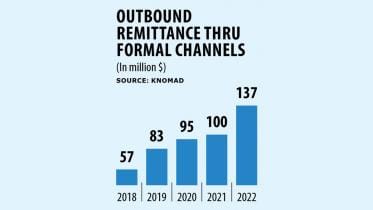

Formal remittance outflow stood at $137m in 2022

Foreigners working in Bangladesh sent home $137 million in 2022, World Bank data showed although analysts believe the exact figure would be much higher since many people from other nations are employed in the country without valid permits.

20 July 2023, 01:00 AM

Channel more financing to SMEs

At least half of all credits disbursed by banks and other financial institutions in Bangladesh should go to small and medium enterprises (SMEs) since a significant of them still don’t have access to the formal credit system despite recent improvements, said a noted economist.

11 July 2023, 18:00 PM

Inflation climbs to 12-year high

Average inflation in Bangladesh surpassed the government’s target for the just-concluded fiscal year by a large margin as higher prices of goods and services continue to linger for the economic crisis at home and abroad.

3 July 2023, 18:00 PM

New fiscal year, old challenges

When a year passes, those who had a good time look forward to continuing the momentum while those who had struggled to keep their head above water might breathe a sigh of relief.

3 July 2023, 00:00 AM