Social protection budget for FY2021 falls short of expectations

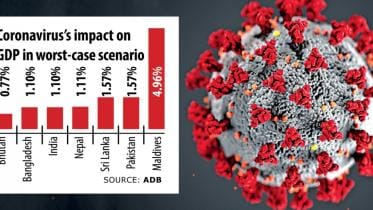

There have been lots of debates and disagreements with regard to the economic cost of Covid-19 in Bangladesh. In particular, the debate concentrated on GDP growth rate in FY2020, which ranged from 1.6 percent (World Bank) to 5.5 percent (Budget Speech FY 2021, Ministry of Finance [MOF]).

27 June 2020, 18:00 PM

In this moment of crisis, the poor and needy must be aided with cash support via MFS

Bangladesh has started dealing with the severe consequences of the global coronavirus pandemic in earnest, with curtailed economic activities manifested in factory closures, cancellation of and/or sharply reduced export orders, falling remittance inflows, and depressed demand for domestically produced goods and services.

3 May 2020, 18:00 PM

Navigating the socioeconomic perils of Covid-19 in Bangladesh

Despite the depressing state of major indicators such as negative export-import growth; large revenue deficit; falling private sector investment; rising non-performing loans recorded in the last quarter of 2019

6 April 2020, 18:00 PM

Budget FY2019-20: Social-sector allocation far from adequate

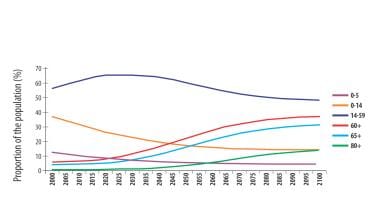

The population structure of any nation provides the country with a window of opportunity to reap economic and social dividends from the structure. In the language of demographers and economists, this is known as first demographic dividend.

17 June 2019, 18:00 PM

Taking care of our senior citizens

HELPAge International, a UK based think tank, produced the 'Global Age Watch Index' which ranks countries according to the social and economic well-being

3 October 2015, 18:00 PM