Local government and economic empowerment

The need for local government is stimulated by the rationale for transferring the authority, responsibility and resources from the national government to its field units, to enable them in decision-making, planning and management. Central planning and management have resulted in unsatisfactory results and deficiencies in delivery of public services, which ultimately led to decentralisation and the emergence of local government institutions (LGIs) in many countries. Decentralised development planning and building administrative capacity of the LGIs are essential not only for delivering services to remote and poor rural regions but also to improve effectiveness of the national government and performance of local administrative units. Democratic LGIs in Bangladesh, if sufficiently empowered, would be more effective in meeting local needs, promote equitable distribution of benefits of development to different segments of the population, improve access to administrative agencies, provide opportunities for greater speed and flexibility of decision-making by reducing level of central direction and control, and enhance civic consciousness and active citizenship.

The Government of Bangladesh has introduced commendable laws at all tiers of democratic local government. Among the five tiers of LGIs, Union Parishads (UPs) have been functioning for long with uninterrupted practice of democracy. The other tiers, viz., municipal council (Paurasabha), City Corporation, and Upazila Parishad (UZP) have been practising democratic decision-making but there are instances of disruption and discontinuation of democratic practices. Elections were held in Zila Parishads in the last year that opened up a new era of democratic practices in this important tier, the scope of civic engagement in its decision-making and balancing citizens' power with the administration at the district level. However, the main drawback of these laws is their implementation to the fullest extent, which leads to ineffectiveness of devolution of power to the LGIs up to their potential and citizens' satisfaction in terms of quality services.

Effective decentralisation through inclusive and sensitive inter-governmental transfers, sensible resource sharing and ability to generate resources locally is the key to strengthening democratic LGIs in Bangladesh. It is widely perceived that all the LGI tiers have been suffering from resource deficiency that hinders delivering quality services. The Seventh Five Year Plan 2016-2020, like its predecessor, does not have tangible commitment on resource transfer to LGIs based on a comprehensive nationwide assessment. In order to address the resource gap, there is a need for comprehensive understanding of the financial relations between national level and LGIs. It would include the pattern of allocation, identifying the channels of vertical resource flow, revealing horizontal disparity, and making out the ways and means for further enhancement of availability of funds at LGIs vis-à-vis predicaments of implementation of the laws for greater effectiveness of the LGIs.

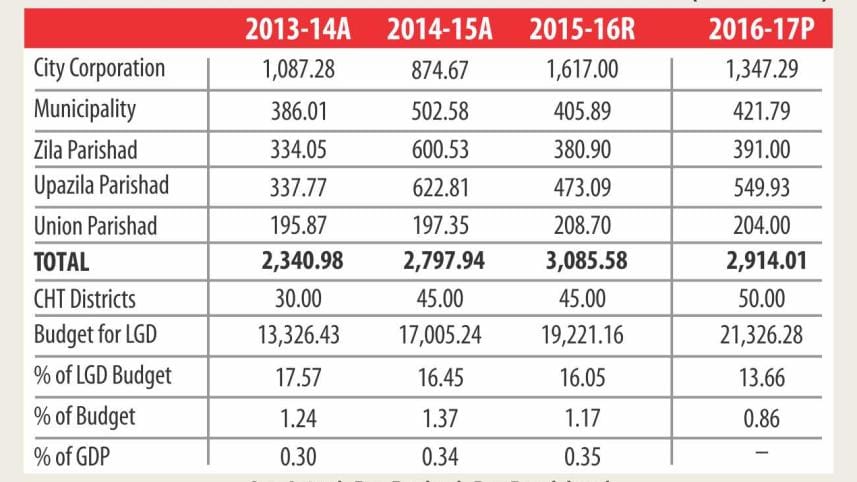

Financing LGIs does not show any particular pattern over the last eight fiscal years. There are frequent fluctuations in direct transfer of funds in all the LGIs from the national in terms of both amount and rate of change. Rural LGIs, viz., UPs, UZPs and Zila Parishads, are experiencing more swinging in resource transfers than the other type of LGIs. The aggregate direct allocation to the LGIs also demonstrates frequent fluctuation of fund transfer. Compared to other tiers of LGIs, the UPs receive a more stable and constantly increasing unconditional block allocation along with a more stable annual change over the years. The allocation to UZPs shows a typically fluctuating pattern. The block allocation for Zila Parishad shows an overall positive trend. The Medium Term Budgetary Framework (MTBF) is expected to provide a reasonable projection of the direction of fund transfer to LGIs for enabling them in participatory development planning and budgeting sensitive to the local needs. However, while direct real allocation to City Corporations shows an unsustainable nature, the annual change of allocation exhibits fluctuations even in the periods of MTBF projection. Paurasabhas experience a pattern of allocation almost similar to that of Zila Parishads.

Besides direct unconditional block allocation for LGIs, the government also has significant developmental support to all the units except for CHT Regional Council. Local Governance Support Project (LGSP) has been receiving significant amounts of allocation for UPs. However, the share of allocations in

Local Government Division's (LGD) allocation, no matter whether direct, developmental assistance and total, shows a general downward trend.

The existing laws provide the areas where the LGIs are sharing resources generated locally with the national government. Thus, revenue coming from the local level is supposed to be generally predictable and sustainable. However, there is paucity of data of revenue coming from LGIs to the national government. Even though MTBF should provide both the revenue and expenditure data by ministry and operational units, it only details out expenditure data by units. The amount of revenue generated from LGD is notable but it demonstrates a declining trend.

The two major streams of fund flow from the government to City Corporations are LGD, and other ministries, divisions and agencies (MDAs). The government has funding arrangement through "block allocation for development assistance to city corporations" in which city corporations get development funds. Alongside this, there is an option of discretionary fund in the name of "special grant" from the government, the amount of which is determined by special (read political) considerations, as per City Corporation officials and elected representatives. The city corporations also get a portion of land transfer tax within their perimeters as defined by their respective laws. The amount of this tax received by City Corporations varies significantly between corporations in amount and ratio of direct transfer from the government. However, the share of land transfer tax in direct transfer from the government varies greatly, from as high as two-thirds of Dhaka North to only about two percent in Khulna City Corporation. On the other hand, direct transfer from the government is quite high in only Khulna and very low in three other City Corporations. They also get a small amount of budget for operational unit.

According to the latest available information, Dhaka North and Narayanganj City Corporations have been found to be financially highly solvent. Only about 13 percent of total revenue of Dhaka North City Corporation came from the government's grant in FY2015-16. Conversely, Narayanganj City Corporation has demonstrated its capacity to become quite solvent in financing development projects since about twothirds of the funds are coming from foreign sources only, which has also been exceptional among the studied city corporations. However, development projects financing through public-private partnership (PPP) is only seen in Dhaka North.

Among the different categories, the A-category municipalities are in a better financial position due to strong basis of internal resource mobilisation from own assets, better tax base and higher special grants from the government. They also get a range of development projects and funds. The municipalities in B and C categories remain in weak financial position — they are unable to even pay salary and allowances to their employees regularly. Most of the municipalities including ones of A-category depend heavily on the development receipts from the government and donor projects to their total expenses. No particular pattern is revealed in direct development allocation by the government which includes regular and special grant. Government grant ranges from Tk 0.75 to 16 crore, which depends on, as per the opinion of the interviewees, the size of special grant due to political influence and discretion.

From the latest budget information of 29 Zila Parishads spread over all the administrative divisions, it is revealed that a Zila Parishad received on average Tk 27 crore as revenue, in which about 41 percent is their own fund. Among the divisions, the average revenue received by a Zila Parishad also varies significantly in the categories of own funds, government grants, income from various sources and total revenue.

Unlike the other tiers of the LGIs, the flow from and to upazilas is quite complicated. This is because there are three types of institutions that function on a parallel basis at upazilas, viz., UZP having revenue and development expenditures, 17 transferred departments, and about 17 additional non-transferred departments that

operate in upazilas that earn revenue from and spend at upazilas. The transferred departments have been found to be spending more in non-ADP developmental areas than revenue spending. UZPs spend quite a small amount compared to the transferred departments. All parishads, including UZP, UP and Paurasabha, jointly spend a very small amount of money in an upazila compared to transferred and non-transferred departments.

Despite many innovations and practices along with legal bindings of performance-based allocation mechanism, UPs are still heavily dependent on the government support directly from the national level and other tiers of local government, viz. upazila. With very few exceptions, government support is overwhelming majority of total revenue in most of the UPs despite the fact that the law has empowered the UPs to generate revenue from many local sources including holding tax, marketplaces and open water bodies, and even renting out a part of its own complex.

Overall, the share of resource transfer for LGIs as the proportion of LGD's budget has been declining from 17.57 percent of FY2013-14 to 13.66 percent of 2016-17, which indicates gradually weakening state of resources for them. The share further goes down in the MTBF projection up to FY2018-19 (only 5 percent of LGD's budget). Thus, there seems to be a contradiction between the pledges on local government made in the Perspective Plan 2010-2021, which was formulated in line with 'Vision 2021' and the indicative allocation for LGIs from the government.

The above discussion reveals that there is a serious need for reforming the current pattern of LGI financing in order to promote their economic empowerment. First, medium-term financing requirement for all LGIs should be analysed before the upcoming budget 2017-18 and it should then be adjusted with the resource planning for implementing the Seventh Five Year Plan 2016-2020. The budgetary projections for LGIs in the MTBF seem to be ineffective quite notably. Also, indication for financing LGIs is absent in the process of medium-term national development planning. Unless there is no commitment for allocation in the Five Year Plan, the MTBF documents cannot translate it into financial allocation and projections for the medium term. MTBF will also convert it into the specific project-based and operational fund requirement for each of the LG tiers and conduct projection for the medium term. This will work as a primary basis for realising sustainable and predictable basis for financing LGIs.

Introducing index-based financing mechanism for LGIs is required. Currently, there is no financial distribution policy of the LGIs in Bangladesh, which leads to 'special' and discretionary allocation. Coupled with uneven distribution of shared immovable property transfer tax, it again results in acute horizontal inequality of financing local government bodies. However, introducing such a policy would require time and can be materialised in the medium term, and the immediate task should be to introduce an index-based funding mechanism for distributing fund among the LGIs. It would work as a scientific foundation for developing financial distribution policy of the LGIs in the country.

Finally, the government should consider constituting an independent Local Government Planning and Financing Commission. It would comprise of technical experts on local government, planning and public financing. It would develop a window for the parliament, civil society organisations, universities, think tanks, and donor community working on local governance to formulate the basis of predictable, sensible and sustainable financing for LGIs. It can regularly hold participatory consultation with LGIs and other stakeholders, and help prepare planning documents for different LG tiers. Such a commission can provide indicatives for MTBF through the Five Year Plan, Ministry Business Strategy and multi-year public investment programmes that have relevance for LGIs. With such a comprehensive approach of resource transfer, the government can materially improve the performance and effectiveness of local government in Bangladesh.

The writer is Acting Research Director, Bangladesh Institute of International and Strategic Studies (BIISS). E-mail: mahfuzkabir@yahoo.com

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments