wilful loan defaulters

How tough can Bangladesh Bank be with wilful defaulters?

Any success of its roadmap will depend on its enforcement

14 March 2024, 07:10 AM

BB outlines tough measures for wilful defaulters

The Bangladesh Bank yesterday introduced strict measures for wilful defaulters as the authorities look to restore people’s confidence in the banking sector in the face of escalating defaulted loans.

12 March 2024, 18:00 PM

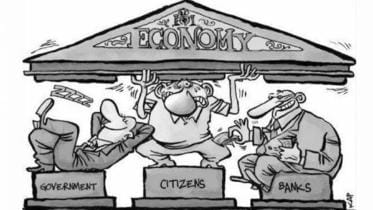

Economists for publishing names of top loan defaulters

Noted economists recommended focusing on macroeconomic stability, publishing the names of top loan defaulters, and forming a review commission on government expenditures.

12 March 2024, 00:51 AM

Expose, punish willful loan defaulters

Business leaders have demanded that the identities of wilful loan defaulters be disclosed for public shaming and for punishing them.

10 March 2024, 18:00 PM

Another disastrous decision for the banking sector

So much for restoring good governance and holding bank ‘looters’ accountable

22 June 2023, 21:04 PM

Can the banking sector be turned around?

Approval of draft Bank Company Act gives hope but enforcement is key

30 March 2023, 03:20 AM