Pubali Bank

Fantastic 5 banks surpassing Tk 2,000 crore in operating profit

In a year marked by financial uncertainty, five banks in Bangladesh have emerged as beacons of resilience and trust. Islami Bank, already a leader in the sector, has been joined by BRAC Bank, City Bank, Pubali Bank, and Dutch-Bangla Bank in reaching the coveted Tk 2,000 crore milestone in operating profit.

29 January 2025, 18:00 PM

Pubali Bank’s profit surges 43% in Jan-Sep

Investment income and increased net interest lift earnings

24 October 2024, 08:29 AM

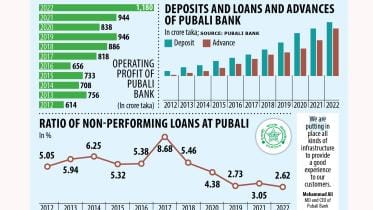

Pubali Bank posts highest ever annual profit in 2023

The bank made Tk 695.12 crore, a 30% rise year-on-year

20 April 2024, 15:15 PM

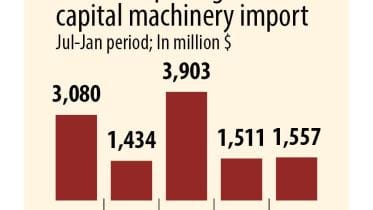

Capital machinery imports on the mend

Capital machinery imports are recovering slowly as concerns over political uncertainty ease and banks show more willingness to facilitate investments amidst increased liquidity in terms of US dollars and stability in the exchange rate. During the July-January period of this fiscal year (FY), LC openings for capital machinery grew three percent year-on-year to $1,557 million, according to Bangladesh Bank data.

22 March 2024, 03:13 AM

StanChart breaks record with Tk 1,655 crore profits

No bank in Bangladesh has ever made so much profit in a year

29 May 2023, 12:27 PM

Pubali Bank aims to be a lifelong partner of clients

Riding on the reputation it has earned over the decades, Pubali Bank Ltd, one of the oldest banks in Bangladesh, is investing to build a robust digital infrastructure with a view to providing all financial services at the fingertips of customers and their doorsteps.

30 April 2023, 03:00 AM

Pubali Bank posts Tk 564 crore profit in 2022

Pubali Bank Limited posted a Tk 564.53 crore profit in the financial year that ended on December 31, up nearly 30 per cent from a year earlier.

16 April 2023, 06:57 AM

Pubali Bank to raise Tk 700 crore through bond

Pubali Bank has got go-ahead to raise Tk 700 crore through its third subordinated bond.

27 December 2022, 12:28 PM

Pubali Bank’s profit surges over 42% in April-June

Pubali Bank Ltd’s profit rose 42.68 per cent year-on-year in the April-June quarter of 2022.

28 July 2022, 07:15 AM

Tk 89.65cr Graft Case: ACC arrests suspect at Dhaka airport

The Anti-Corruption Commission yesterday arrested an accused of a case filed over Tk 89.65 crore misappropriation from Pubali Bank

23 August 2017, 18:00 PM

A banker with extraordinary leadership retires

Helal Ahmed Chowdhury leaves a legacy of 38 years -- from a probationary officer to managing director -- at Pubali Bank

6 December 2014, 18:01 PM