Private sector credit growth

Credit growth slowdown: a chance to regain momentum

Credit growth reflects business confidence and investment appetite

3 November 2025, 12:57 PM

Credit growth slowdown: a chance to regain momentum

Credit growth reflects business confidence and investment appetite

3 November 2025, 12:57 PM

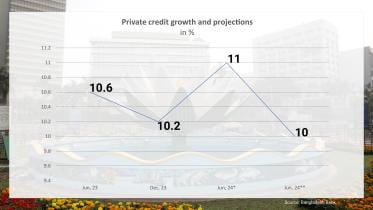

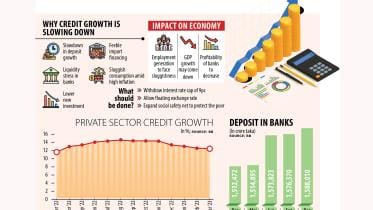

Private credit growth target lowered amid low appetite

Bangladesh Bank (BB) has lowered the target for private sector credit growth in its latest monetary policy, citing a lack of appetite arising from political uncertainties.

31 July 2025, 22:42 PM

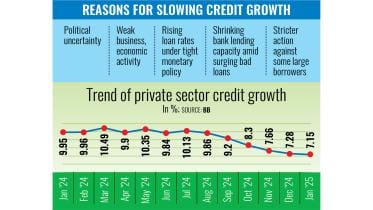

Private sector credit growth hits decade-low

Credit appetite of the local private firms continues to fizzle out as the ongoing battle against inflation makes bank borrowing more expensive amid a volatile political climate after the August political changeover.

9 March 2025, 18:00 PM

Private credit growth slows for contractionary monetary policy

Private sector credit growth slowed in January this year as the lending rate went up due to the central bank’s contractionary monetary policy, according to experts and analysts.

7 March 2024, 16:03 PM

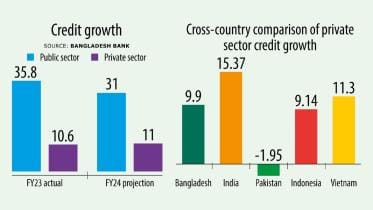

Credit flows to private sector might slow on higher govt borrowing: BB

Higher government borrowing and spike in the benchmark rate might cause credit flow to private sector slow

22 January 2024, 20:00 PM

Private sector credit growth target lowered to 10% from 11%

Bangladesh Bank also raised the benchmark policy rate by 25 basis points to 8 percent

17 January 2024, 09:33 AM

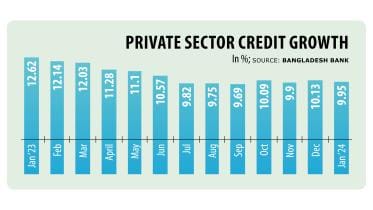

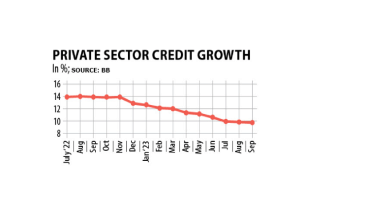

Private credit growth hits 23-month low

Private sector credit growth has slowed in recent months with banks and borrowers adopting a go-slow strategy amidst economic stress and growing apprehensions of a political crisis centring the upcoming parliamentary elections in January.

1 November 2023, 20:54 PM

Private sector credit growth drops to single digit

The private sector credit growth in Bangladesh nosedived to single digit in July as both banks and borrowers face multiple challenges amid lingering economic uncertainty at home and abroad and the growing political crisis centring next year’s national elections.

8 September 2023, 00:00 AM

Islamic banks’ loan surges 9 times their deposits in a year

Investments made by full-fledged Islamic banks in Bangladesh surged nearly nine times their deposits in a span of a year, raising questions as private sector credit growth has slowed in the entire banking sector, official figures showed.

6 June 2023, 01:50 AM

Credit growth slips to 14-month low

Private sector credit growth in Bangladesh dropped to a 14-month low of 11.23 per cent in April owing to weak credit demand amid the current business slowdown, official figures showed.

30 May 2023, 02:00 AM

Demand for loans falls to 12-month low

Private sector credit growth in Bangladesh slipped to a 12-month low of 12.03 per cent in March, a development that may hurt GDP growth and job creation.

1 May 2023, 02:00 AM

2023 will be the year of inflation and financial turpitude

While the government is distracted by elections, the financial economy will suffer

1 January 2023, 02:00 AM