Policy Research Institute of Bangladesh

Raise policy rate to 10% to curb inflation: Ahsan H Mansur

Monetary policy stance should be tight, the economist said in an MCCI-PRI organised post-budget discussion

12 June 2024, 08:02 AM

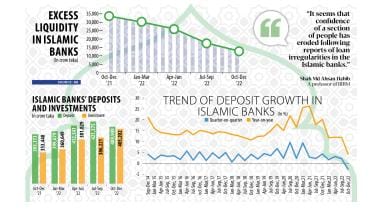

Depositors withdraw Tk 11,426cr from Islamic banks in 3 months

Deposit flow to Islamic banks in Bangladesh registered a fall in the fourth quarter of 2022, the first such decline in eight years, in a sign of erosion of confidence among savers owing to loan irregularities.

24 February 2023, 02:00 AM

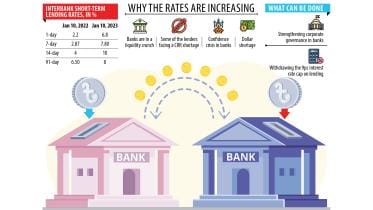

Interbank lending rate goes past 9% cap for liquidity crunch

Cash-strapped banks are borrowing from cash-rich lenders paying more than 9 per cent in interest rate, which is above a cap set by the central bank, as an unprecedented liquidity crunch has hit the banking sector of Bangladesh.

11 January 2023, 02:00 AM