Padma Bank

Depositors gather at Padma Bank's head office to claim their money

Padma Bank Managing Director Kazi Md Talha said the depositors were seeking to recover their funds

15 April 2025, 06:46 AM

Cash-strapped Padma Bank struggling to pay employees

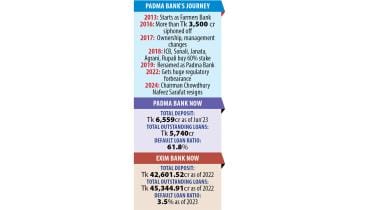

Padma Bank, formerly Farmers Bank, has sunk into such a financial abyss that the lender is struggling to pay its employees’ monthly salaries and has sought a Tk 5,000 crore bailout package from Bangladesh Bank to stay afloat.

2 February 2025, 18:00 PM

EXIM Bank discards plan to merge with Padma Bank

This decision reverses the bank’s earlier plan from March 2024 to merge with Padma Bank

25 December 2024, 07:41 AM

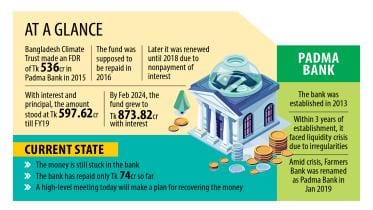

Govt to devise plan to retrieve Tk 873cr climate fund from Padma Bank

The interim government is going to formulate a specific roadmap to recover funds of the Bangladesh Climate Change Trust (BCCT), amounting to Tk 873.82 crore, that have been held up in Padma Bank since 2016.

6 November 2024, 18:00 PM

Banks freeze accounts of Padma Bank former chairman Nafeez Sarafat, family members

Bank accounts of their business entities will also remain frozen for the next 30 days

25 August 2024, 13:30 PM

All that is wrong with the proposed bank mergers

Mergers cannot be based on the arbitrary decisions of authorities. This amounts to an imposition of the liability of poor banks on well performing banks.

21 May 2024, 02:00 AM

Padma Bank MD resigns

NRB Bank appoints him as MD after that

23 April 2024, 12:43 PM

No more bank merger proposals for now: BB

Bangladesh Bank will focus on five merger or amalgamation proposals it has already received and not accept any other proposals for the time.

16 April 2024, 03:22 AM

Merger of banks: Who wins, who loses?

Initially, it is the general stock investors who might be at the receiving end of the process while the loan defaulters, whose misdeeds are largely responsible for Padma Bank’s current misfortunes, might come out victorious.

24 March 2024, 00:45 AM

Hasty bank mergers to bring no good

Both banks are weak as per a Bangladesh Bank health index of banks and it is very difficult to get any positive result by merging two weak banks, said Fahmida Khatun, executive director of the Centre for Policy Dialogue.

24 March 2024, 00:38 AM

Exim-Padma Bank merger to take at least 18 months

The planned merger of Shariah-based Exim Bank and struggling Padma Bank is likely to take between 18 months to two-and-a-half years to complete, according to central bank officials.

18 March 2024, 18:00 PM

Exim Bank, Padma sign MoU for merger

The MoU will open the process of merger

18 March 2024, 05:31 AM

Can mergers heal banking sector’s wounds?

The news that Shariah-based Exim Bank is going to merge with troubled commercial lender Padma Bank has taken the financial sector of Bangladesh by surprise.

17 March 2024, 00:25 AM

Padma Bank to merge with EXIM Bank: official

Padma Bank, which has been struggling with the burden of toxic loans for years, will merge with EXIM Bank. It will be the first bank merger in Bangladesh

14 March 2024, 07:40 AM

Padma Bank Chairman Chowdhury Nafeez Sarafat resigns

Bangladesh Bank today accepted his resignation letter.

31 January 2024, 11:53 AM

Can a defaulter prevail over the government?

Why has no investigation taken place to explore on which grounds and for whose benefit the lion’s share of the climate fund was deposited in the Farmers Bank?

8 October 2023, 02:00 AM

Climate funds perpetually stuck in a scam-ridden bank

How long till Farmers Bank pays back what’s due?

22 September 2023, 11:28 AM

Padma Bank MD resigns

Tarek Reaz Khan, managing director of the embattled Padma Bank, has resigned from his post citing personal reasons.

5 September 2023, 18:00 PM

Padma Bank gets over 2yrs to clear fine of Tk 55cr

Padma Bank, formerly known as Farmers Bank, is going to get over two years, until April 2028, to clear a Tk 55 crore penalty for its failure to maintain the regulator-stipulated cash reserve ratio (CRR) from 2017 to 2019.

22 August 2023, 18:00 PM