loan defaulters

Legal loopholes allow defaulters to stay in race

If loan defaulters continue to receive such advantages in all areas, it will have negative consequences, especially in a national election, said experts and analysts.

6 January 2026, 18:00 PM

Govt moves to expedite Tk 38,000cr bad loan cases

The interim government has moved to expedite long-pending lawsuits filed by 10 institutions, including state-owned banks and a non-bank financial institution (NBFI), against loan defaulters, in a bid to speed up the recovery of defaulted loans

4 September 2025, 18:00 PM

Govt preparing list of loan defaulters: finance minister

The government is preparing a list of all the top loan defaulters in the individual and organisational categories, Finance Minister Abul Hassan Mahmood Ali today told parliament

24 June 2024, 12:14 PM

Cash-strapped Islami Bank lends to AnonTex

Distressed Islami Bank has approved a Tk 700 crore loan to a concern of AnonTex Group, one of the five large borrowers of Janata Bank that has been enjoying undue facilities despite making negligible repayment in 13 years.

16 September 2023, 18:00 PM

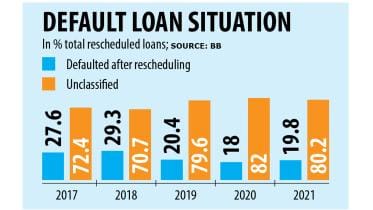

Rescheduled loans too turning bad

The Bangladesh Bank’s policy that allows defaulters longer repayment tenures and easy terms and access to fresh funds has appeared to have failed to make major inroad in bringing down bad debts as rescheduled loans are even turning sour.

20 October 2022, 02:10 AM

Tk 1,26,369 crore loans defaulted as of March this year: Finance Minister

Finance Minister AHM Mustafa Kamal today told the parliament that as of March this year, the amount of defaulted loans in the country was Tk 126,369 crore.

22 June 2022, 16:18 PM

BB asked to form committee to find out loopholes in lending, loans recovery

The High Court (HC) has ordered Bangladesh Bank to form a nine-member committee with experts of the banking sector to find out loopholes in lending and recovery of loans.

3 November 2019, 11:46 AM

11 Large Borrowers: BB paves way for fresh rescheduling

In a reversal of its stance, Bangladesh Bank yesterday paved the way for 11 large business groups to reschedule their loans even though they restructured their loans four years ago on condition of regular repayments.

27 August 2019, 18:00 PM

Good punished, bad rewarded

Borrowing large amounts from banks, some people set up industries in the country with a portion and launder the rest to other countries, the High Court observed yesterday, adding that those people consider the countries to be their second home.

24 June 2019, 18:00 PM

Defaulters have the last laugh

Insanity is doing the same thing over and over again and expecting different results, the influen-tial physicist Albert Einstein once said. And this quote comes to mind when one glances through the Bangladesh Bank’s latest policy for defaulters. Issued on May 16, the notice is an extended

18 May 2019, 18:00 PM

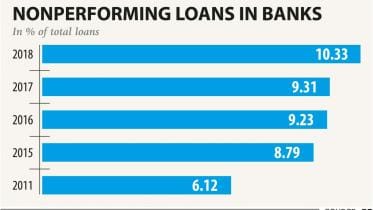

Saving our ailing banking sector

Bangladesh's banking sector faces a number of major challenges including rising nonperforming loans, credit concentrations, poor

26 March 2019, 18:00 PM

Loan Defaulters: Top 20 named in parliament

As of December last year, there were 2,66,118 loan defaulters in the country, Finance Minister AHM Mustafa Kamal informed parliament yesterday.

28 February 2019, 18:00 PM

Govt may unmask loan defaulters thru' media

The government will consider unmasking bank loan defaulters through the media, said Finance Minister AMA Muhith yesterday in

11 April 2018, 18:00 PM

Borrow money, never pay back

It was a time when politics played havoc with the economy.

7 April 2018, 18:00 PM