loan

Data-driven lending solution for Bangladeshi banks

The process of securing a loan from most banks and non-bank financial institutions (NBFIs) feels like a maze.

18 May 2025, 09:30 AM

Bar non-compliant banks from giving new loans

Citing BB data, he said there were 16 banks where the NPL ratio exceeded 10 percent and 9 banks where the NPL ratio exceeded 20 percent as of June 2023.

15 May 2024, 01:52 AM

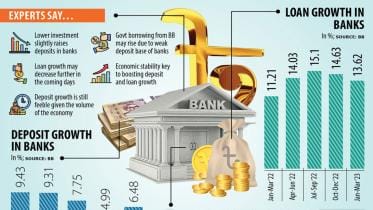

Deposit growth rises, loan growth falls

The deposit growth in the banking sector of Bangladesh rose in the first quarter of 2023 from a quarter ago as businesses prefer to park funds with lenders instead of making investments amid the ongoing economic slowdown and uncertainty.

14 June 2023, 02:10 AM

IMF’s conditions on governance and corruption - rhetoric or reality?

The key to the ACC’s effectiveness in delivering its mandate is independence, especially when setting the example that, in handling allegations of corruption, it is guided by equality before law, and not by the status or identity of the individual depending on their political, governmental, or other connections.

18 February 2023, 16:00 PM

Private sector’s foreign debt down by over $1b

The private sector’s foreign debt decreased by 4.3 per cent, or more than $1 billion, in the second quarter of the current fiscal year following Bangladesh Bank’s strict measures to control imports.

13 February 2023, 02:00 AM

WB to give $6.05b over next 3 years

The World Bank Group is scaling up its lending to Bangladesh in non-concessional terms by as much as three times to prepare the country for its impending LDC graduation, which would close the doors to low-cost funds.

21 August 2022, 02:30 AM

UK to lend $450m in five years

British International Investment (BII) has embarked on an ambitious plan of lending $450 million to Bangladesh over the next five years, finding that the country has a stable government and policy support for private sector development.

31 May 2022, 05:00 AM

Here’s what the 2022-23 budget must address

The national budget for the next fiscal year will be the third since the start of the Covid-19 crisis in March 2020. Can we expect it to address the current realities, contexts and challenges of Bangladesh?

6 May 2022, 18:00 PM

Bangladesh Bank revises post import financing policy

The Bangladesh Bank today revised its policy for post import financing (PIF) in order to give clarification to banks as importers have faced complexities to get fund properly.

26 April 2022, 14:03 PM

IMF says talks on Sri Lanka's loan request 'fruitful'; World Bank preparing aid package

The International Monetary Fund said on Saturday it held "fruitful technical discussions" with Sri Lanka on its loan request, while the World Bank said it was preparing an emergency aid package for the crisis-stricken country.

24 April 2022, 08:24 AM

Refugee Crisis: WB offers $400m, Japan gives $3m

Bangladesh can avail as much as $400 million from the World Bank as grants if it rolls out programmes exclusively for the Rohingya

27 September 2017, 18:00 PM

Bank bends rules for its directors

In a gross violation of the banking rules, the United Commercial Bank has allegedly waived a director-related loan for less than one-fifth of the principal amount without Bangladesh Bank's approval.

8 September 2017, 18:00 PM

Combating Natural Disasters: World Bank offers $250m soft loan

The World Bank has offered a low-cost loan of $250 million to Bangladesh for tackling natural disasters.

25 August 2017, 18:00 PM

Football: Palace take Liverpool's Sakho on loan

Crystal Palace have signed Liverpool defender Mamadou Sakho on loan until the end of season, the London club said on Wednesday.

1 February 2017, 06:51 AM

Football: Arsenal's Wilshere joins Bournemouth on loan

Arsenal's England midfielder Jack Wilshere, who has suffered a string of injuries, joins Bournemouth on a season-long loan.

1 September 2016, 08:51 AM

Hart joins Torino

Manchester City goalkeeper Joe Hart has joined Serie A side Torino on loan until the end of the season.

30 August 2016, 18:00 PM

ADB to give Tk 13,115cr for Trans-Asia rail corridor

The Asian Development Bank will provide Tk 13,115 crore loan for implementing a rail route project which will connect Bangladesh to the east and west.

19 April 2016, 09:12 AM

ADB extends loan for Bangladesh water project

The Asian Development Bank (ADB) extends fresh loan to Bangladesh to expand a water project in south-west area.

6 October 2015, 08:46 AM

Radamel Falcao: Chelsea sign Monaco striker on loan

Chelsea sign Monaco striker Radamel Falcao on a season-long loan deal, with the option to make the deal permanent.

3 July 2015, 15:57 PM

Interest rebate for good borrowers

Bangladesh Bank will offer incentives to good borrowers, as there has been an allegation that the central bank always stands by defaulters.

19 March 2015, 10:48 AM