liquidity crunch

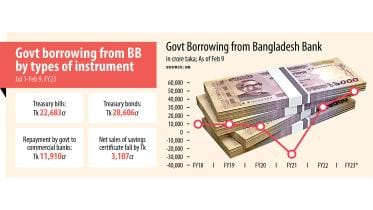

Govt’s higher borrowing from BB stokes inflation risk

The government has kept borrowing from the Bangladesh Bank as commercial banks can’t come up with much-needed funds owing to the liquidity crunch.

15 February 2023, 02:00 AM

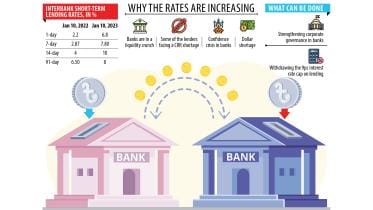

Interbank lending rate goes past 9% cap for liquidity crunch

Cash-strapped banks are borrowing from cash-rich lenders paying more than 9 per cent in interest rate, which is above a cap set by the central bank, as an unprecedented liquidity crunch has hit the banking sector of Bangladesh.

11 January 2023, 02:00 AM

Govt keeps borrowing heavily from BB

The government continues to borrow from Bangladesh Bank on a large scale as commercial banks are now unable to finance the state due to liquidity crunch.

6 January 2023, 01:30 AM

Resolving liquidity crunch in our financial sector

Restoring equilibrium in both money market and forex market should be the central bank’s singular goal.

7 December 2022, 14:36 PM

Banking sector now orphan: CPD

The Centre for Policy Dialogue yesterday came down hard on the finance ministry for the host of moves it made earlier this month to

17 April 2018, 18:00 PM

Why liquidity crunch in banks?

The liquidity crunch that has hit the private sector has its roots in the Farmers Bank debacle. It went down under primarily because the bank management went for giving out wholesale credit without maintaining two fundamentals.

21 March 2018, 18:00 PM