Islamic Banks

The case for an Islamic digital bank in Bangladesh

It has the potential to fundamentally reshape savings, deposits, and investments.

20 November 2025, 06:00 AM

Three banks agree to merge, two oppose

Among the five Shariah-based banks slated for merger by the central bank, three have agreed to the regulator’s plan, while two have opposed it during separate meetings in the last three days..Those that agreed are First Security Islami Bank PLC (FSIB), Global Islami Bank PLC (GIB), and Uni

4 September 2025, 16:30 PM

Why five Islamic banks should not be merged

The prospect of five Islamic banks in Bangladesh being merged into one “New Bank” has raised a general concern over whether such a move is the most effective solution to their problems. Merger memories exist in our banking history. My central argument is that restructuring each bank individually offers a more sustainable path forward.

3 August 2025, 18:00 PM

Islamic banks fall behind in remittance race

Conventional banks dominate remittance inflow as Islamic lenders face trust deficit

28 July 2025, 18:00 PM

Is merger of Islamic banks a viable solution?

Ahsan H Mansur stated that the country's Islamic banking sector would be completely restructured as most of the existing Islamic banks are currently in trouble.

26 April 2025, 18:00 PM

BB gives two Islamic banks Tk 2,500cr more in emergency support

The Bangladesh Bank (BB) yesterday extended an additional Tk 2,500 crore in emergency liquidity support to Social Islami Bank and First Security Islami Bank without any security to help them address financial crises.

13 March 2025, 18:58 PM

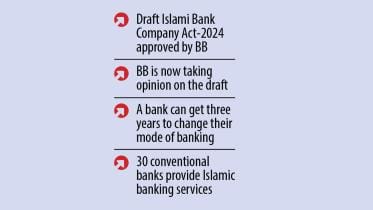

Islamic banking to be off limits to regular banks

A bank will not be able to do Islamic banking business along with conventional banking at the same time, according to the draft ‘Islami Bank Company Act-2024’, as the central bank looks to level the playing field for Shariah-based banks.

9 November 2024, 18:18 PM

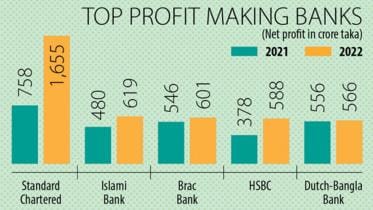

Traditional lenders fall behind Islamic banks in profit growth

Conventional lenders in Bangladesh fell behind shariah-based banks in 2022 in terms of profit growth mainly due to the lower interest rate regime.

30 May 2023, 02:30 AM

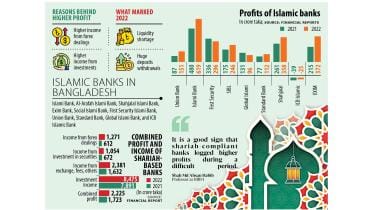

Islamic banks post higher profit despite troubles

Most of the Shariah-compliant banks in Bangladesh clocked higher profits in 2022 despite a fall in deposits and the unprecedented fund withdrawal by customers and liquidity crunch.

15 May 2023, 02:00 AM

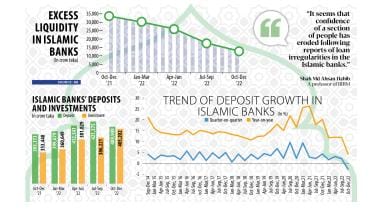

Depositors withdraw Tk 11,426cr from Islamic banks in 3 months

Deposit flow to Islamic banks in Bangladesh registered a fall in the fourth quarter of 2022, the first such decline in eight years, in a sign of erosion of confidence among savers owing to loan irregularities.

24 February 2023, 02:00 AM

Four more Islamic banks take BB emergency loans

Four more shariah-based banks have been found to have taken emergency funds, which are usually taken during extraordinary circumstances, in an attempt at dressing up their balance sheet for last year.

3 January 2023, 02:00 AM