Islamic banking in bangladesh

Islamic banking to be off limits to regular banks

A bank will not be able to do Islamic banking business along with conventional banking at the same time, according to the draft ‘Islami Bank Company Act-2024’, as the central bank looks to level the playing field for Shariah-based banks.

9 November 2024, 18:18 PM

Governor defends liquidity support to cash-strapped Islamic banks

BB's liquidity support to cash-strapped Islamic banks are as per the governor's power, says BB chief Abdur Rouf Talukder

17 January 2024, 15:42 PM

Cash crunch lingers at crisis hit Islamic Banks

Five Shariah-based banks are still experiencing liquidity crisis despite significant support from the central bank

5 December 2023, 00:30 AM

Liquidity stress at Islamic banks shows no sign of abating

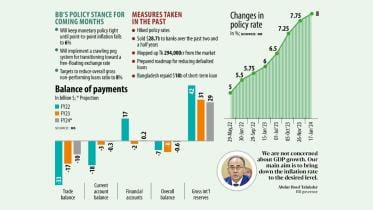

Liquidity in Shariah-based banks in Bangladesh remains tight due to a dip in deposit collection and the banks’ inability to make the most of the central bank support to overcome the situation, Moody’s Investors Service said in a report.

15 September 2023, 18:00 PM

Islamic banks face liquidity challenges

The Islamic banking sector in Bangladesh continues to face liquidity challenges because of weak governance and regulatory quality, Fitch Ratings said.

13 September 2023, 18:00 PM

Islamic banks’ profitability shrinks in 2018

Shariah-based banks’ net profit margin declined to 2.2 percent in 2018 from 3 percent a year earlier at a time when the banking sector’s rose, found a recent study.

The banking sector’s net profit margin improved to 3 percent from 2 percent last year, according to the study titled “Islamic Banking Operation of Banks-2018”.

15 May 2019, 18:00 PM