islamic banking

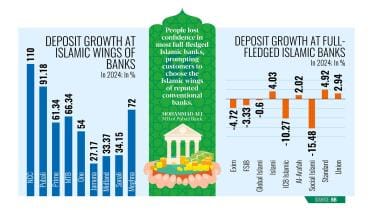

Islamic banks see deposit shift

Islamic wings of conventional banks have become the preferred choice for religiously inclined depositors as many full-fledged Shariah-based banks struggle with a crisis of trust..This shift has emerged after controversies and financial scandals involving Shariah-based banks, many of which

19 March 2025, 15:21 PM

Is Islamic finance facing headwinds?

Rabiul Islam, a practising Muslim who works at a private organisation, refrained from conventional banking services for many years as both paying and receiving interest are against his religious principles.

26 July 2024, 18:00 PM

Half of remittances came thru Islamic banking in Dec

Nearly half of the total remittances in December last year came to Bangladesh through Islamic banking channels, according to the Bangladesh Bank.

3 May 2024, 02:59 AM

Liquidity stress at Islamic banks shows no sign of abating

Liquidity in Shariah-based banks in Bangladesh remains tight due to a dip in deposit collection and the banks’ inability to make the most of the central bank support to overcome the situation, Moody’s Investors Service said in a report.

15 September 2023, 18:00 PM

Islamic banks face liquidity challenges

The Islamic banking sector in Bangladesh continues to face liquidity challenges because of weak governance and regulatory quality, Fitch Ratings said.

13 September 2023, 18:00 PM

Expanding Horizons and Future Prospects

Islamic banking has garnered people’s attention with robust growth over the last decade as a large number of people in Bangladesh prefer the Shariah-based banking system for their financial transactions.

10 June 2023, 18:00 PM

Shaping the future of Islamic Banking in Bangladesh: Insights from banking leaders

In the pursuit of providing modern technology and Islamic Shariah-based banking services to the masses in Bangladesh,

10 June 2023, 18:00 PM

Islamic banking poised to expand

Islamic banking is set to grow from the current level in Bangladesh, which will offer a huge opportunity to banks and financial institutions and accelerate financial inclusion, said Sabbir Ahmed, head of retail banking of Standard Chartered Bangladesh.

3 November 2022, 02:50 AM