Islami Bank Bangladesh

Islami Bank fires 200, makes 4,771 OSD

Islami Bank has made 4,771 officials OSD (officer on special duty) and terminated another 200 for violating service rules.

29 September 2025, 18:04 PM

Islami Bank’s profit fell 83% in 2024

Islami Bank Bangladesh’s earnings took a heavy hit in 2024 as surging payouts to depositors and higher provision expenses dented its bottom line.

27 August 2025, 18:00 PM

Islami Bank chairman, family members’ bank account details sought

The Bangladesh Financial Intelligence Unit wants the information by July 15

14 July 2025, 13:24 PM

Islami Bank MD sent on forced leave

Md Omar Faruk Khan made acting managing director

6 April 2025, 14:53 PM

Economy can’t go forward without Islami Bank: BB governor

Ahsan H Mansur opens a branch of the bank in Ghatail of Tangail

28 December 2024, 14:21 PM

Islami Bank MD forced out of office

Mohammed Monirul Moula, the managing director of Islami Bank Bangladesh, has not gone to his workplace since December 19 when he was forced to leave by a group of officials.

24 December 2024, 18:10 PM

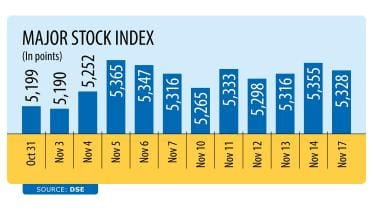

Stocks fall after two-day rise

Major indices of the stock market in Bangladesh fell yesterday, snapping a two-day gaining streak as investors cautiously traded select shares to pocket short-term gains amid price fluctuations resulting from earnings disclosures by listed companies..The DSEX, which reflects the cumulative

17 November 2024, 14:48 PM

Stocks fall on poor performance of large companies

Indexes of the stock market in Bangladesh declined yesterday on rising the day before, largely due to the poor performance of Islami Bank Bangladesh along with the large-cap and blue-chip shares amid sales pressures..Large-cap refers to shares which account for large amounts in market capi

12 November 2024, 18:00 PM

Stocks continue to bleed

Stock markets in Bangladesh maintained a downward trend for a third consecutive day yesterday, with the values of a majority of shares marking a significant drop..The shares of companies like Islami Bank Bangladesh, BRAC Bank, Square Pharmaceuticals, British American Tobacco Bangladesh, Re

8 October 2024, 18:00 PM

Can we change the story of our ailing banks?

Restoring trust in the banking sector is crucially important

9 September 2024, 15:05 PM

The robbing of Islami Bank

How could two state institutions participate in this process?

1 September 2024, 05:00 AM

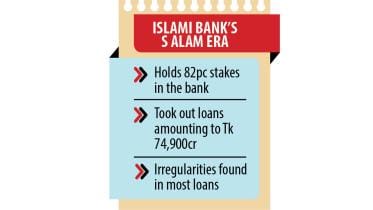

How Islami Bank was taken over ‘at gunpoint’

Islami Bank, the largest private bank by deposits in 2017, was a lucrative target for Sheikh Hasina’s cronies when an influential business group with her blessing occupied it by force – a “perfect robbery” in Bangladesh’s banking history.

31 August 2024, 18:00 PM

Bank accounts of 4 firms linked with S Alam’s personal secretary frozen

The BFIU found Tk 99.7 crore at the accounts of four companies of Md Akiz Uddin, also a former deputy managing director of Islami Bank Bangladesh

26 August 2024, 15:02 PM

Islami Bank finally freed from S Alam Group

After seven years, S Alam Group’s control over Islami Bank ended yesterday after the Bangladesh Bank decided to dissolve the board of the country’s largest private sector bank that was heavily dominated by individuals linked to the conglomerate.

21 August 2024, 18:00 PM

BB to dissolve Islami Bank board, take over shares of S Alam Group

All shares of S Alam Group will be taken over

21 August 2024, 09:43 AM

Islami Bank sacks 8 top officials amidst internal unrest

Islami Bank Bangladesh yesterday terminated its contracts with eight top officials amid unrest in the largest Shariah-based bank in the country following the political changeover.

19 August 2024, 12:36 PM

Unrest in banking sector raises concerns

Unrest has gripped the banking sector at a time when several banks are burdened with huge default loans and are suffering from low asset quality.

11 August 2024, 18:00 PM

Islami Bank plunges into chaos as rival groups clash

The situation worsened when officials and Deputy Managing Director Miftah Uddin tried to enter the headquarters of the bank

11 August 2024, 06:01 AM

Islami Bank rejects cheque seeking to withdraw Tk 548cr

Islami Bank Bangladesh today rejected a cheque of a little-known company seeking to withdraw Tk 548 crore

7 August 2024, 15:52 PM

Islami Bank employees demonstrate in front of bank's HQ

They said they were deprived of official benefits and promotions over the last 15 years

6 August 2024, 07:16 AM