foreign currency reserves in Bangladesh

Record budget support helps govt meet IMF’s reserve condition for first time

Bangladesh is going to fulfil the International Monetary Fund’s condition on foreign exchange reserves in June on the back of record budget assistance from global creditors, the first time since the IMF approved its $4.7 billion loan programme more than a year ago.

29 June 2024, 18:00 PM

IMF flags nine risks for Bangladesh

The International Monetary Fund (IMF) has suggested greater exchange rate flexibility to preserve reserve adequacy, warning failure to do so may create further imbalances in the currency market.

26 June 2024, 18:00 PM

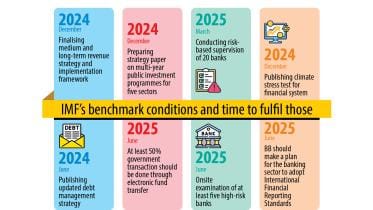

IMF sets 33 conditions for next two loan instalments

Bangladesh will have to comply with 33 new conditions by June next year in order to receive the next two instalments under the International Monetary Fund’s $4.7 billion loan programme.

25 June 2024, 18:00 PM

IMF approves 3rd tranche of $1.15b loans

The International Monetary Fund yesterday approved the third tranche of $1.15 billion loans in a boost to Bangladesh’s foreign exchange reserves.

24 June 2024, 18:00 PM

IMF’s $1.15b 3rd tranche likely in late June

Bangladesh may receive $1.15 billion in the third instalment of the International Monetary Fund’s (IMF) loan in the last week of June, which will give a much-needed relief to the country’s dwindling foreign exchange reserves.

29 May 2024, 18:30 PM

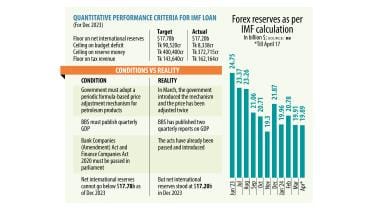

Forex reserve target for IMF loans may be revised down to $18b

The latest proposal was made to the IMF’s visiting mission yesterday during a joint meeting with officials of the finance division and central bank at the finance ministry in Dhaka.

7 May 2024, 00:16 AM

IMF Loan: Govt may miss two key targets set for fourth tranche

The government is likely to ask the International Monetary Fund (IMF) to revise down two key targets related to Net International Reserves (NIR) and tax revenue collection, set for June this year for the release of the fourth tranche of its $4.7 billion loan, finance ministry officials said.

29 April 2024, 18:00 PM

IMF’s 3rd loan tranche on track despite repeated failure to hit reserve goal

The minimum net international reserves (NIR) will also remain below the threshold when an IMF mission visits Dhaka next week to review the progress of the programme before releasing around $681 million in the third tranche in May.

19 April 2024, 00:54 AM